Did you know that you could face a hefty 10% penalty for withdrawing money from your retirement account before you reach age 59.5? It’s true, but there’s a way to avoid this financial setback. The 72t rule is a little-known IRS provision that allows for early withdrawals without penalties, under certain conditions.

If you’re over 50 and want to explore this option, we’ll explain the 72t rule so you can make the best decision for your retirement.

Read More

Do you want to retire at age 55? Early retirement isn’t for everyone, but it can be a great fit for those wanting a change of pace. The reality is, the many financial products and services that are now available in the marketplace are allowing more people to do this.

In this article, we will go over steps to take when you are retiring at age 55. Let’s look at how much money you might need for retirement at 55, what some optimal retirement options are, what you should know about your accounts at 55, and much more. Read on for some practical tips on how to retire efficiently at 55 or in that time bracket.

Read More

Many people choose to continue working after retirement. For some, it’s to help with monthly income and budgeting. As for others, it’s partially to enjoy staying productive in their chosen fields.

However, earning income from work after you have retired and started receiving benefits can significantly impact your Social Security, tax liabilities, Medicare coverage, and other areas of financial concern.

Due to these critical implications, it’s wise to understand the basics of how extra income earned after retirement can affect your financial planning.

Read More

If protection and growth are important for you in retirement, you may want to look at your options for a “secure guaranteed retirement account.” Fueled by retirement annuities, this sort of financial strategy can give you a guaranteed income that lasts for the rest of your life. As the defined benefit pension has disappeared, we have all been forced to think more about alternatives for guaranteed retirement income.

A secure guaranteed retirement account can be an important part of your overall retirement strategy. It can counterbalance certain kinds of risk in other retirement investments. An annuity’s stream of income can cover periods when you need extra income, such as the period between your retirement and your eligibility for Social Security or Medicare.

The predictable nature of an annuity’s income stream can allow you to take a bit more risk or creativity in your other retirement investments. In other words, a retirement annuity can give you security and flexibility.

Read More

The SafeMoney.com Spotlight Series highlights financial professionals who are part of our tight-knit community of financial professionals across the country. Our community of financial professionals has appeared on major outlets including CNBC, U.S. News Money, Fox Business, CNN, and others reaching 84+ million households nationally.

We celebrate them as independent business owners, friends, neighbors, educators, advocates, and people who are doing good work in their corners of the world. What stands out about financial professionals on SafeMoney.com from countless others in the industry is their commitment to financial security, wellness, and peace of mind for people from all walks of life.

We celebrate them as independent business owners, friends, neighbors, educators, advocates, and people who are doing good work in their corners of the world. What stands out about financial professionals on SafeMoney.com from countless others in the industry is their commitment to financial security, wellness, and peace of mind for people from all walks of life.

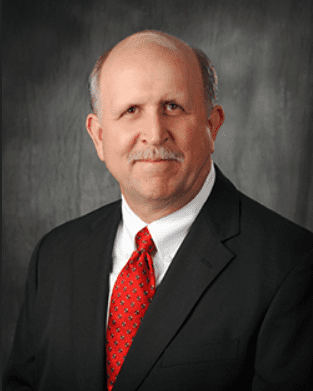

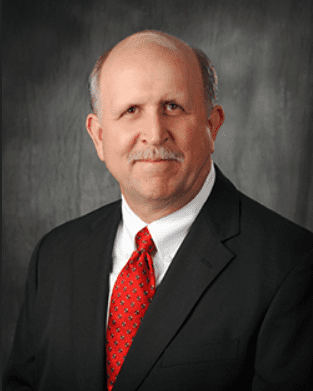

Today, we have the pleasure of sitting down with Jon Bellman, an experienced financial professional from Texas. Jon has been serving clients in the financial services industry for nearly three decades. He is the president and owner of Bellman Financial Services, an independent firm. As a financial professional, Jon is a strong believer in education and in clients understanding their options for well-informed choices.

Read More

A retirement bridge account is your strategy for bridging the gap between retiring and claiming your Social Security benefits. Claiming your benefits too early could lead to missing out on tens of thousands of dollars in lifetime benefits. And, for those retiring earlier than age 62, a retirement bridge account may be a necessity.

Whether you are retiring early or want to hold off on claiming your Social Security until later in life, a bridge account can be your financial lifeline. Here’s a quick overview explaining how you can work a bridge strategy into your retirement plan.

Read More

If retirement is looming on your horizon, you are probably wondering if you will have enough money to last you through the rest of your life. A secure guaranteed income stream can bring some peace of mind, but where exactly can you put one in place? After all, Social Security will provide some benefits, but will it be enough?

The good news is that even if you feel that you could have saved more money than what you have, there are still options for securing a guaranteed retirement income. Let’s take a deeper dive into what some of those options might look like, and what they can do for you.

Read More

Let’s get into a deeper dive on pension plans, alternatives that are available and will pay you guaranteed income for life, and how these options look in the full spectrum of retirement planning.

Are you looking for alternatives to a pension plan for guaranteed income in retirement? Perhaps you have a pension plan and worry about its future ability to make good on promised payments.

Pensions are becoming increasingly rare in corporate America today. Many private-sector employers have replaced pension plans with 401(k) or other profit-sharing plans to cut costs.

But if you are lucky enough to have a pension plan, it’s important to know how it works, what you will get from it, and explore pension alternatives for secure retirement options. And if you won’t be getting a pension, exploring your options can help you make well-informed decisions about retirement.

Let’s dive into pension plans, alternatives that guarantee lifetime income, and how these options fit into your overall retirement planning strategy.

Read More

Are you counting on a pension when you retire? Are you familiar with how it works? In this article, we will give a quick overview of how a pension plan works, different types of pension plans, and how payments from a pension plan to retirees work.

Once you have a better understanding of how your pension works, you will be in a better position to make well-informed choices about your overall retirement. That can include whether other sources of retirement income will help you reach your goals. Read on for a deeper dive into the basics of a pension plan and how it works.

An individual retirement annuity is a retirement savings vehicle issued by life insurance companies. The individual retirement annuity can come in fixed or variable flavors. Similar to traditional and Roth IRAs, it works much like any individual retirement account (IRA) and is subject to contribution limits.

The retirement annuity offers a steady income stream to its owners, and it can have higher fees than IRAs. You can check with your financial professional for more details on that. The retirement annuity, like an IRA, is available in both traditional and Roth versions.

Therefore, the annuity owner can take the upfront contribution deduction available to the traditional account. Or they can choose to receive tax-free income at retirement. With the private pension rapidly disappearing, creating your own pension-style payment stream may be a good idea for you.

Read More

We celebrate them as independent business owners, friends, neighbors, educators, advocates, and people who are doing good work in their corners of the world. What stands out about financial professionals on SafeMoney.com from countless others in the industry is their commitment to financial security, wellness, and peace of mind for people from all walks of life.

We celebrate them as independent business owners, friends, neighbors, educators, advocates, and people who are doing good work in their corners of the world. What stands out about financial professionals on SafeMoney.com from countless others in the industry is their commitment to financial security, wellness, and peace of mind for people from all walks of life.