This Nobel Prize-Winning Physicist Sold His Medal to Help Cover Medical Expenses

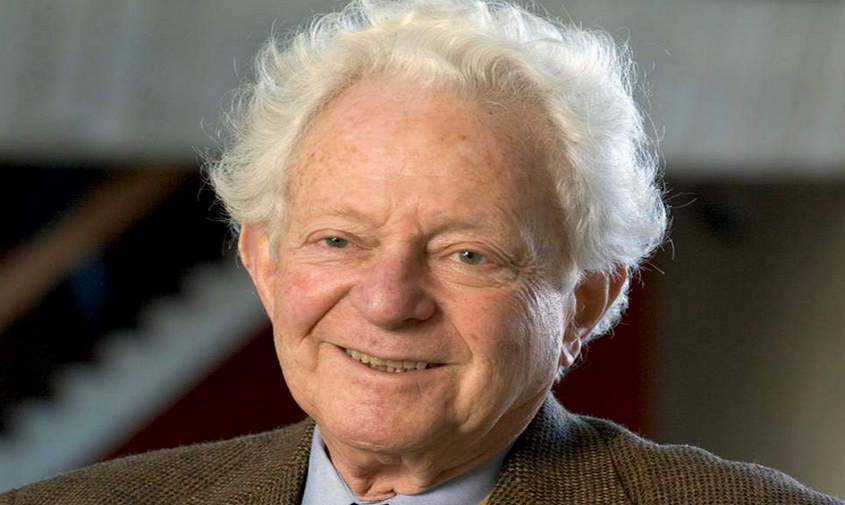

Photo Credit: Associated Press. All rights reserved, source link.

Nobel laureates are certainly top achievers. In 1988, Leon Lederman won a Nobel Prize for his work in physics. Apart from award-winning research into subatomic particles, he is famous for coining the infamous name of the Higgs bosin: the “God particle.”

Lederman passed away in a nursing home in Idaho on October 4. He was 96, according to the Associated Press. The AP describes him as a “giant in his field who also had a passion for sharing science.”

While Lederman’s contributions to science speak volumes, another striking story of him emerges from a past headline by NBC News.

And what happened? In 2015, the physicist was forced to auction his Nobel medal so he and his family could cover healthcare expenses. The medal sold for $765,000. It was a winning bid of $633,335 plus a buyer’s premium that drove the medal to its $765k sell price.

It’s yet another example of how high-cost retiree healthcare needs can change the financial situation of any of us.

Changing Health, New Challenges

Back when he received a Nobel Prize in Physics, Lederman used his winnings to buy a log cabin near the small Idaho town of Driggs. The cabin was intended as a vacation home.

But Lederman and his wife moved there as full-time residents in 2011, when Lederman started having significant memory loss issues. In time, they turned to an online auctioneer to sell his Nobel medal. From that they would use the proceeds to pay for care services relating to his dementia.

Speaking to NBC News at the time, Ellen Lederman, his wife, observed that the diagnosis of dementia had raised the prospect of costly medical bills and uncertainty for them.

“It’s terrible. It’s really hard,” she explained. “I wish it could be different. But he’s happy. He likes where he lives with cats, dogs, and horses. He doesn’t have any problems with anxiety, and that makes me glad he’s so content.”

Lederman’s uphill battle against costly medical bills is one of many examples of how healthcare expenses can add up in retirement.

Healthcare Cash Register Just Keeps Ringing

According to the Bureau of Labor Statistics, the top expenditure for retirees tends to be housing costs. But health costs can add up, especially with aging, when dependence on health services and prescription drugs grows.

Take, for instance, the area of long-term care. Just the cost of long-term care services and supports can be quite staggering.

In 2017, the median cost of a private room in a nursing home was $8,121 per month, according to data from Genworth. Overall, the price tag for a private room has risen more than 31% since 2009, Genworth reports.

How Much is the Lifetime Tab for Healthcare Spending?

And what about the cost of medical services, not to mention other healthcare needs?

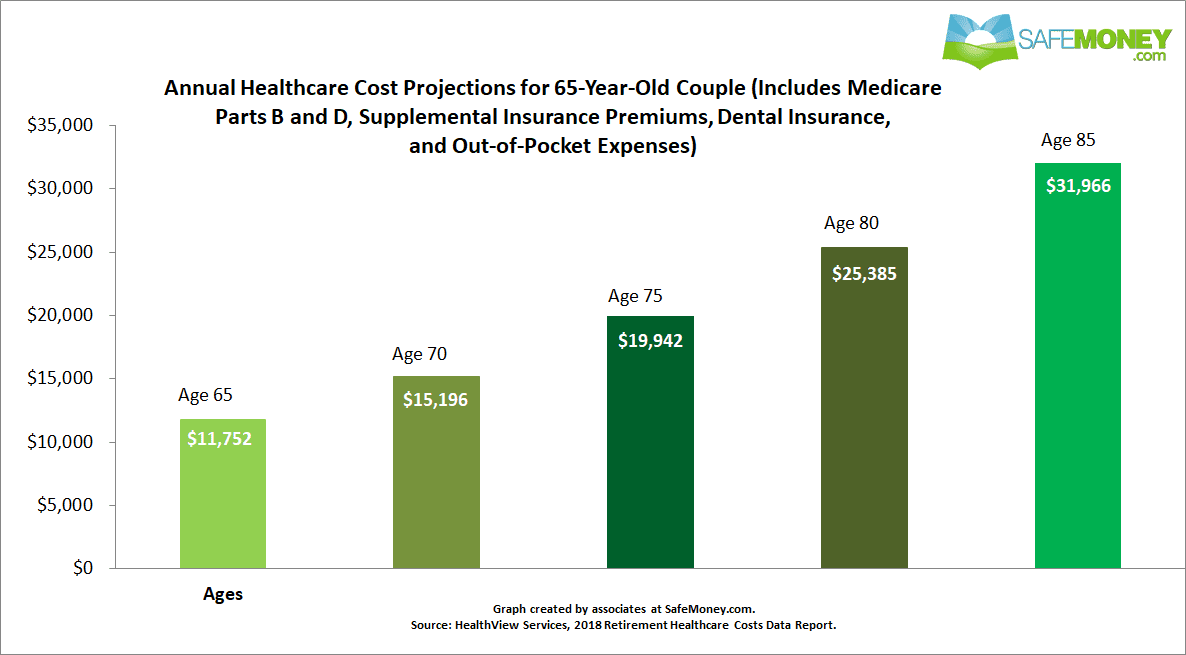

HealthView Services, a healthcare research firm, sketched out estimates of total lifetime retirement healthcare costs. It based its forecasts on healthcare claims from 70 million individual cases, actuarial, and government data sources. The projections include Medicare Parts B and D, supplemental insurance premiums, and dental premiums paid.

According to HealthView, a healthy 65-year-old couple retiring in 2018 could pay as much as $363,964 in today’s dollars for total lifetime healthcare costs. That doesn’t include the cost of any potential long-term care services, most of which aren’t covered by Medicare.

When the forecast is adjusted for future dollar value, a retirement-age couple may face as much as $537,334 in lifetime healthcare spending.

Rising Faster Than General Inflation

HealthView estimates that first-year health expenses may be $11,752. From there, costs will rise, driven by healthcare inflation.

Estimates of annual health costs at different ages can be seen in the graph above. While healthcare inflation is outpacing general inflation – which has held steady around 2.7% over the past year – it’s slower than in prior years.

HealthView forecasts that retirement healthcare expenses will increase at an annual average rate of 4.4% – down from its annual inflationary expectation of 5.5% from last year’s report. A slowdown in the growth of prescription drug costs was partly responsible for the slower pace of expected healthcare inflation.

Planning for Financial Security in Retirement

In an interview with Money.com, firm head Ron Mastrogiovanni emphasized that HealthView’s cost projections don’t include employer assistance with health costs.

“These estimates don’t account for the fact that, while working, your employer picked up about 75% of your healthcare costs, Mastrogiovanni says. In retirement, the costs are all on you, unless you’re one of the dwindling number of workers who has company-sponsored retiree medical insurance. ‘More and more of the coverage is on our shoulders,’ Mastrogiovanni says.”

Mastrogiovanni also recommends being aware of the likelihood of medical and health costs increasing with age. “Every year as we get older, healthcare eats up a bigger portion of what we spend on a fixed income,” he explains.

So, what can Americans do to help prepare themselves for healthcare spending in retirement – and still enjoy a comfortable retiree lifestyle?

Understand Your Options

According to experts, the first step is understanding what is available to you. Medicare, which Americans become eligible for at age 65, will cover a number of medical expenses, but not everything.

Mastrogiovanni notes that some of the items it doesn’t cover are routine dental care, vision, hearing aids, and most forms of long-term care.

Apart from Medicare coverage and supplemental insurance, there are a number of other options that can help with cost relief.

Healthcare Cost Relief Options

One possibility is a health savings account (HSA), which allows you to accumulate money within the account on a tax-free basis. People can withdraw funds from an HAS on a tax-free basis when they use the money for qualifying medical expenses. Section 213(b) of the tax code spells out what qualifies in further detail.

Apart from Medicare coverage, you may have some cost relief potential with certain life insurance policies. In recent years, life insurance carriers have updated and innovated life insurance contracts to have “living benefits.”

In other words, death benefit proceeds can be accelerated when a policyholder is living to pay for certain qualifying life events. Those include specific emergencies, terminal illnesses, confinement care situations, and other life events as outlined by a life insurance contract.

Be Familiar with Medicare

Medicare has different components: Parts A, B, C, and D. Here’s a general overview of what Parts A, B, and D involve.

Medicare Part A

Medicare Part A is hospital insurance which covers in-patient services in hospitals, critical access hospitals, and skilled nursing facilities. Its coverage may also apply to some hospice and home health services. When people apply for Medicare, they are automatically enrolled in Part A, and no monthly premiums are involved. An annual deductible must be paid before hospitalization costs are covered, however.

Medicare Part B

Medicare Part B is medical insurance and is optional. You pay premiums, which will be deducted from your Social Security checks. It means you have three months before you turn 65 to three months afterward for you to decide to sign up.

Being late for this enrollment period may mean higher premiums, unless you qualify for a special enrollment period. If employer-sponsored retiree medical insurance is available to you or is available through your partner’s employer, you may want to confer with the human resources department about your options.

Medicare Part D

Medicare Part D is optional and helps with prescription drug costs. It’s available to enrollees in Parts A and B as well as most Medicare Advantage plans.

With a Part D plan, you will have to pay a monthly premium and sometimes a deductible. You will also be responsible for copayments on prescription drugs. Each Part D plan will be different in its scope of coverage, including what is covered and what is not.

Options for Covering Long-Term Care Costs

For long-term care needs, a variety of insurance solutions may be tapped:

- Long-term care insurance

- Asset based long-term care policies

- Annuities with long-term care benefits

- Life insurance policies with living benefits for confined care

These different offerings can help provide cost relief by leveraging the assets of an insurance company toward different LTC expenses. Each option may come with its own requirements. That may include an inability to perform certain acts-of-daily-living for a policy to start paying benefits.

Other factors to consider include scope of coverage, how long an insurance carrier might pay benefits for, whether cost of insurance (and premiums) will go up, and what situations wouldn’t qualify as coverable events.

Be sure to explore any of these insurance options with an experienced, knowledgeable insurance-licensed advisor or agent.

Planning for an Income-Secure Retirement

While healthcare spending can be costly, it’s just one part of retirement. One of the primary concerns of retirement planning is ensuring you have enough income and assets to maintain your lifestyle. You also want to be sure your savings and assets last as long as you need them.

If you could benefit from guidance in getting your retirement financial strategy in order, help is a click a way. Financial professionals at SafeMoney.com stand ready to assist you.

Use our “Find a Financial Professional” section to connect with someone directly. Should you need a personal referral, call us at 877.476.9723.