The Importance of the Rule of 100 in Retirement Planning

Retirement planning is a critical aspect of financial management, and understanding the principles that can guide you through this process is essential. One such principle is the Rule of 100, a guideline designed to help you determine the appropriate allocation of your retirement assets across different phases of your life: accumulation, preservation, and distribution. This rule suggests that as you age, a greater portion of your retirement savings should be invested in safer, more conservative income-based accounts, while the allocation to riskier assets should decrease.

Understanding the Rule of 100

The Rule of 100 is a simple formula that helps you adjust your investment strategy based on your age. According to this rule, you subtract your age from 100 to determine the percentage of your portfolio that should be allocated to risky investments like stocks. The remaining percentage should be allocated to safer, conservative investments such as bonds, annuities, and other income-based accounts. For instance, if you are 60 years old, the Rule of 100 suggests that 40% of your portfolio can be in riskier assets, while 60% should be in safer investments.

3 Phases of Money

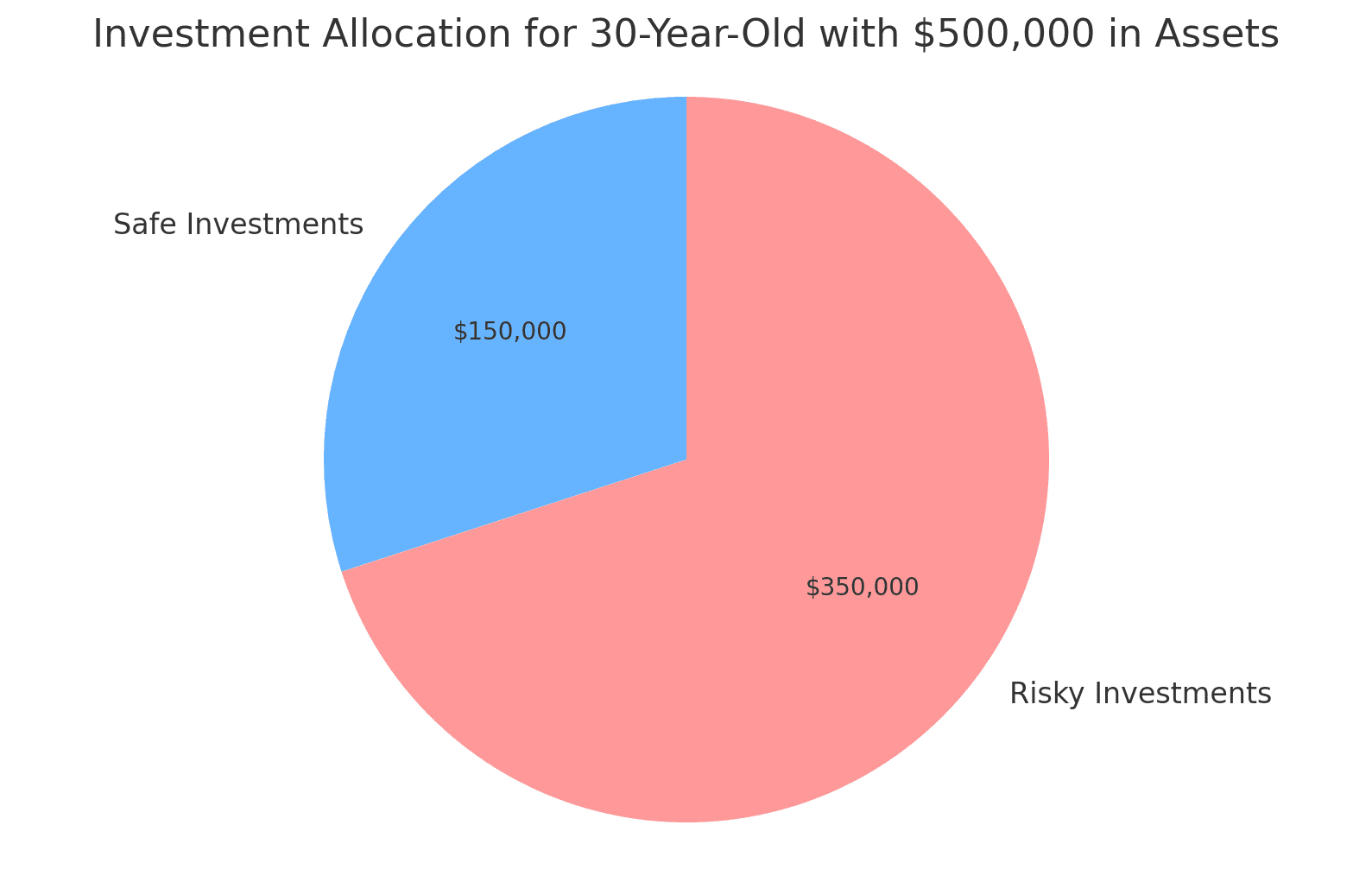

- The Accumulation Phase: The accumulation phase typically spans the early to mid-stages of your working life, generally from your 20s to your 50s. During this period, the primary goal is to build your wealth. Because you have a longer time horizon before retirement, you can afford to take on more risk in your investment portfolio. This means a higher allocation to stocks and other growth-oriented investments, which historically have provided higher returns over the long term. According to the Rule of 100, a 30-year-old might have 70% of their portfolio in riskier assets and 30% in safer investments.

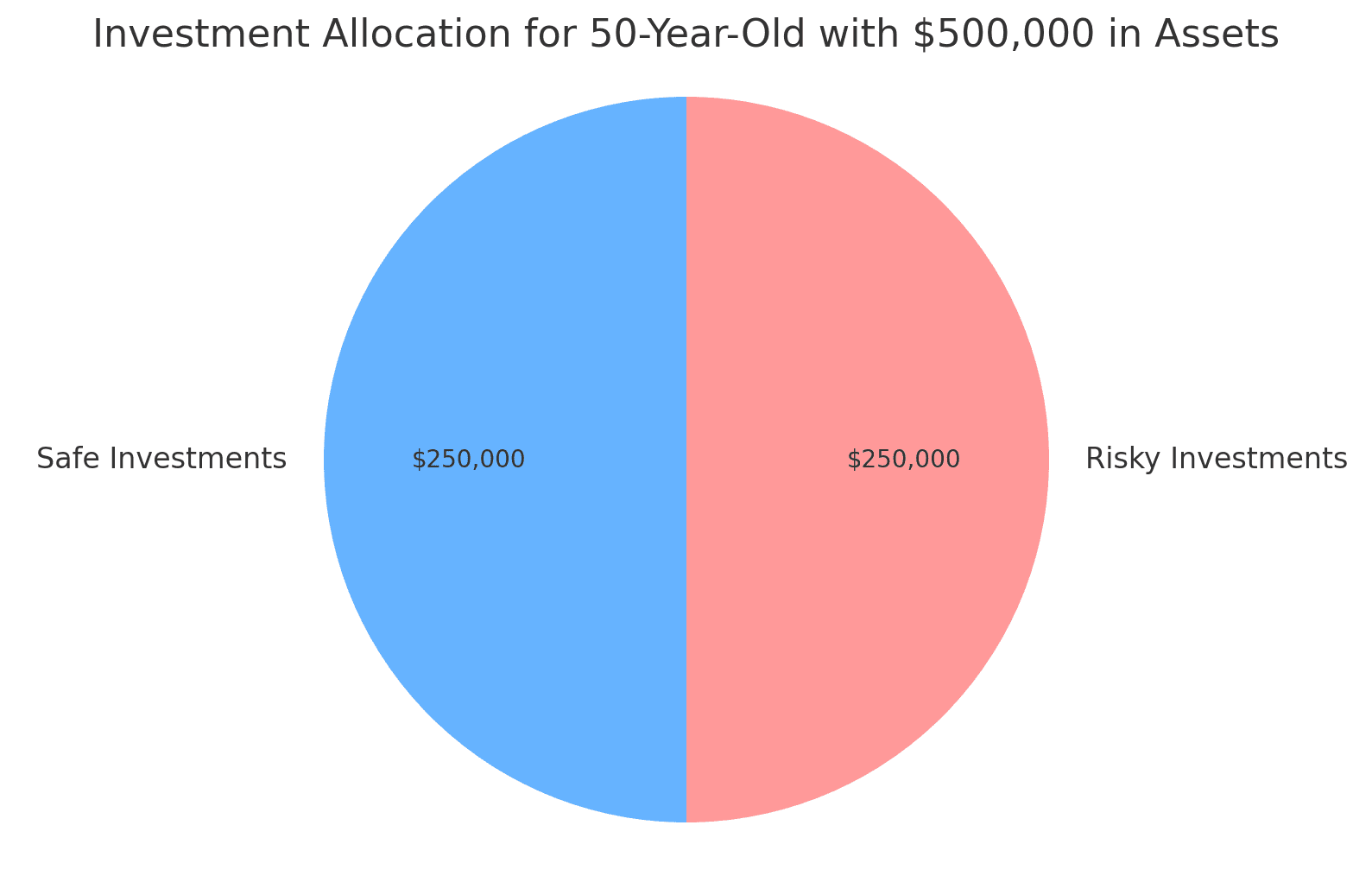

The Preservation Phase: As you approach retirement, usually in your 50s and early 60s, your focus should shift from accumulation to preservation. The preservation phase is about protecting the wealth you have built while continuing to grow it at a slower, more stable rate. During this stage, the Rule of 100 suggests a gradual reduction in your exposure to riskier assets and an increased allocation to more conservative investments. For example, a 60-year-old would typically have 60% of their portfolio in safer investments and 40% in riskier ones. This adjustment helps safeguard your retirement savings from market volatility and reduces the risk of significant losses as you near retirement.

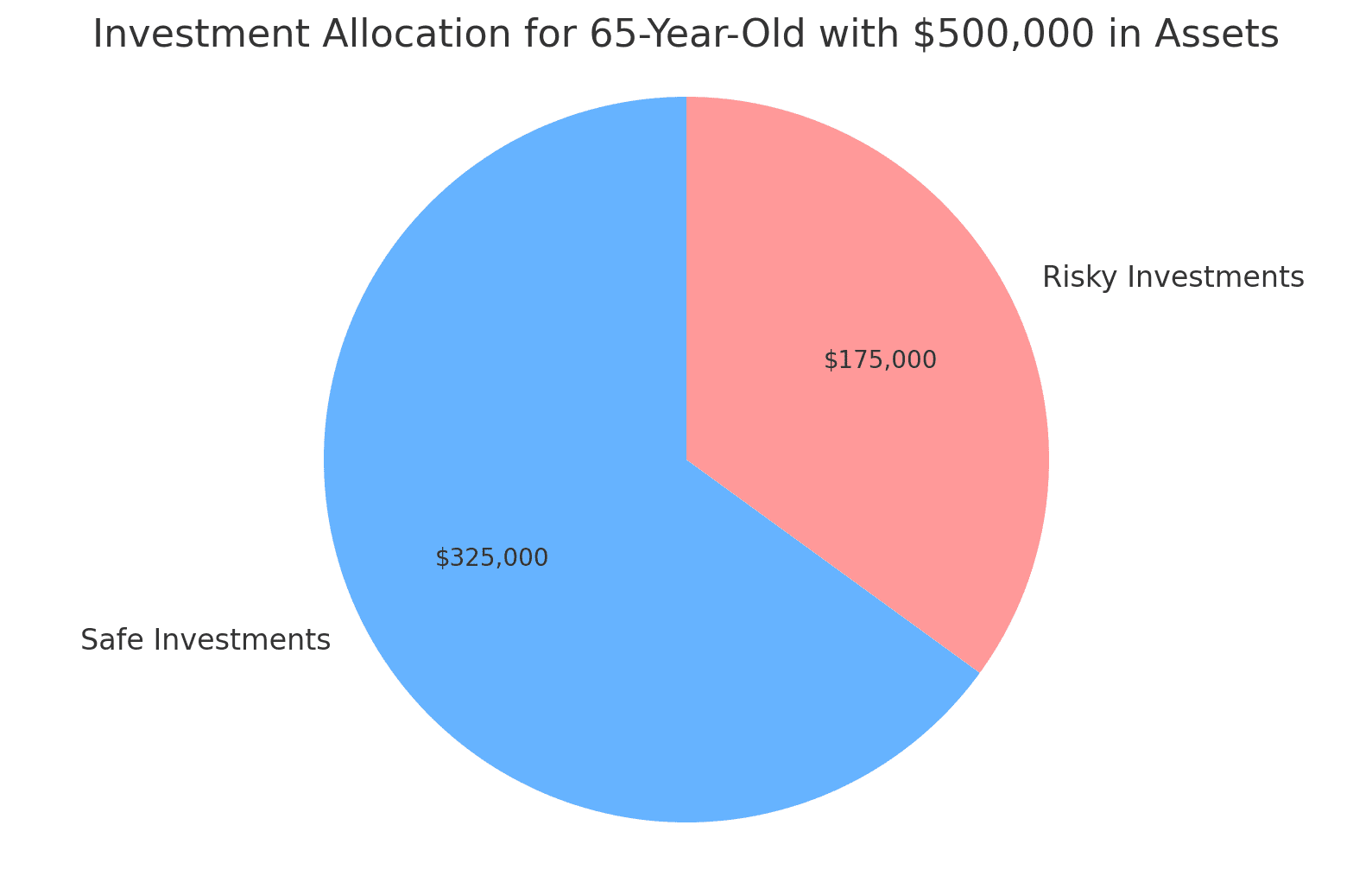

The Preservation Phase: As you approach retirement, usually in your 50s and early 60s, your focus should shift from accumulation to preservation. The preservation phase is about protecting the wealth you have built while continuing to grow it at a slower, more stable rate. During this stage, the Rule of 100 suggests a gradual reduction in your exposure to riskier assets and an increased allocation to more conservative investments. For example, a 60-year-old would typically have 60% of their portfolio in safer investments and 40% in riskier ones. This adjustment helps safeguard your retirement savings from market volatility and reduces the risk of significant losses as you near retirement.- The Distribution Phase: The distribution phase begins when you retire and start drawing down your retirement savings. This phase can span 20 to 30 years or more, depending on your longevity. The primary objective during this period is to ensure that your savings last throughout your retirement while providing a stable income stream. The Rule of 100 indicates a substantial shift towards conservative investments, minimizing risk and focusing on preservation and income generation. A 70-year-old retiree, for instance, might have 70% of their portfolio in safe, income-producing investments and only 30% in riskier assets.

Implementing the Rule of 100

Implementing the Rule of 100 in your retirement planning involves several key steps:

- Assess Your Risk Tolerance: While the Rule of 100 provides a general guideline, it is important to assess your personal risk tolerance. Some individuals may feel comfortable with a higher or lower allocation to risky assets based on their unique financial situation and retirement goals.

- Diversify Your Portfolio: Diversification is critical at all stages of retirement planning. Ensure your portfolio includes a mix of asset classes that align with your risk tolerance and investment horizon.

- Regularly Review and Adjust: Your financial situation and market conditions can change, so it is essential to regularly review and adjust your portfolio. This ensures that your investment strategy remains aligned with your retirement goals and risk tolerance.

- Consult a Financial Professional: Working with a trusted licensed financial professional can provide personalized advice and help you implement the Rule of 100 effectively. They can assist in creating a tailored investment strategy that balances growth, risk management, and income generation.

Safe Investments for the Preservation and Distribution Phases

As you transition into the preservation and distribution phases of your life, it’s essential to focus on investments that offer stability and guaranteed income. Some of the safe investment options include:

1. Certificates of Deposit (CDs)

- FDIC Insurance: Insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank, for each account ownership category.

- Fixed Interest Rates: Offer predictable returns.

- No Risk of Principal Loss: Principal is safe as long as the CD is held to maturity.

2. High-Yield Savings Accounts

- FDIC Insurance: Insured by the FDIC up to $250,000 per depositor, per insured bank, for each account ownership category.

- Liquidity: Easy access to funds without penalties.

- Higher Interest Rates: Better rates compared to regular savings accounts.

3. Money Market Deposit Accounts

- FDIC Insurance: Insured by the FDIC up to $250,000 per depositor, per insured bank, for each account ownership category.

- Interest Rates: Generally higher interest rates than regular savings accounts.

- Check-Writing Privileges: Limited check-writing capabilities for flexibility.

4. U.S. Savings Bonds (Series I and EE)

- Government Backing: Backed by the full faith and credit of the U.S. government.

- Inflation Protection: Series I Savings Bonds provide protection against inflation with adjustable interest rates.

- Tax Benefits: Interest is exempt from state and local taxes and can be deferred for federal taxes until redemption.

5. Treasury Securities (Short-Term)

- Government Backing: Backed by the full faith and credit of the U.S. government.

- Low Risk: Short-term Treasury bills (T-bills) mature in one year or less, minimizing interest rate risk.

- Liquidity: Highly liquid and can be sold in the secondary market.

6. Money Market Funds

- Stability: Aim to maintain a stable net asset value (NAV), usually $1 per share.

- Low Risk: Invest in short-term, high-quality investments like Treasury bills and commercial paper.

- Liquidity: High liquidity, allowing easy access to funds.

7. Treasury Inflation-Protected Securities (TIPS)

- Government Backing: Backed by the full faith and credit of the U.S. government.

- Inflation Protection: Principal adjusts based on inflation, preserving purchasing power.

- Fixed Income: Provide regular interest payments on the adjusted principal.

8. Fixed Annuities

- NAIC/State Guaranty Associations: Covers insurance products including life insurance policies, health insurance, and annuities. Varies by state but generally up to $300,000 in life insurance death benefits, $100,000 in cash surrender value, $250,000 in annuity present value, and $500,000 in health insurance benefits.

- Guaranteed Income: Provide a guaranteed stream of income, which can be especially valuable during retirement.

- Principal Protection: The principal is typically protected from market fluctuations, offering stability.

- Tax-Deferred Growth: Interest earned on annuities is tax-deferred until withdrawal.

9. Fixed Indexed Annuities

- NAIC/State Guaranty Associations: Covers insurance products including life insurance policies, health insurance, and annuities. Varies by state but generally up to $300,000 in life insurance death benefits, $100,000 in cash surrender value, $250,000 in annuity present value, and $500,000 in health insurance benefits.

- Principal Protection: Protects the principal from market losses while offering the potential for growth based on a market index.

- Guaranteed Minimum Interest Rate: Offers a minimum interest rate, ensuring some level of return.

- Tax-Deferred Growth: Interest earned is tax-deferred until withdrawal.

10. Immediate Annuities

- Guaranteed Income: Provides a guaranteed income stream immediately after a lump-sum investment.

- Longevity Protection: Ensures income for life or a specified period, reducing the risk of outliving your savings.

11. Cash Value Life Insurance (Whole Life, Universal Life & IUL)

- Death Benefit: Provides a guaranteed death benefit to beneficiaries.

- Cash Value Accumulation: Builds cash value over time, which can be borrowed against or withdrawn.

- Tax Benefits: Cash value grows tax-deferred, and policy loans are generally tax-free.

Rule of 100 Investment Allocation Example:

| Age | 30-Year-Old | 50-Year-Old | 65-Year-Old |

|---|---|---|---|

|

|

|

|

| Total Assets | $500,000 | $500,000 | $500,000 |

| Safe Money | $150,000 (30%) | $250,000 (50%) | $325,000 (65%) |

| Risky Money | $350,000 (70%) | $250,000 (50%) | $175,000 (35%) |

This article, “The Importance of the Rule of 100 in Retirement Planning,” provides general information and is not financial advice. Consult a licensed financial professional for personalized advice.

Key Points: No Guarantees: The Rule of 100 does not ensure specific outcomes. All investments carry risks. No Fiduciary Relationship: This article does not establish a fiduciary relationship. Seek independent advice. Investment Risks: Even “safe” investments have risks. Annuities depend on the issuer’s claims-paying ability. Tax and Legal Advice: This article does not provide tax or legal advice. Consult qualified professionals. The author and publisher are not liable for any decisions made based on this content

If you’re seeking tailored guidance, consider consulting a financial professional. Visit our “Find a Financial Professional” section to connect directly. For a personal referral to an independent, licensed advisor, call us at 877.476.9723 or contact us here to book an appointment.

🧑💼Authored by Brent Meyer, founder and president of SafeMoney.com, with over 20 years of experience in retirement planning and annuities. Learn more about my extensive background and expertise here