Fast Answers to Your Top 7 Social Security Questions

Like other people, you probably hold a Social Security card. But unless you are close to retirement, you may not know that much about Social Security benefits. As a large governmental program, Social Security has many rules and moving parts that can affect you.

Social Security plays an important role for retired households. Among elderly beneficiaries, 48% of married couples and 71% of single persons receive half or more of their income from Social Security. As you near retirement, you may have questions of your own. Learning more about Social Security will help you get the most out of your benefits.

Because Social Security is a major income source for many people, when you claim benefits might be one of your most important retirement decisions. However, moving through the ins-and-outs of this program can be daunting. To help you get started with planning for your benefits and other income sources, here are answers to seven top Social Security questions.

7 Top Social Security Questions Answered

1. When should you start your benefits? The choice to take benefits may be easy. But knowing when to take benefits can be difficult. No one-size-fits-all answer applies here, the right time for you depends on a number of variables.

Generally speaking, the age of eligibility for Social Security benefits is 62. Most people start their benefits at some time between ages 62-70. The benefit of delaying is larger monthly checks. The longer you delay, up until age 70, the more your Social Security payments will increase.

You may have heard it’s advantageous to claim your benefits as early as possible. But that can be a misnomer. For people born sometime during 1943-1954, claiming at 62 means a permanent 25% reduction in benefits. Among those born in 1955-1959, claiming at 62 means benefits are reduced by 25.83%-29.17%. And for those born in 1960 or afterward, taking benefits at 62 results in your benefits being permanently slashed by 30%.

You can see the personal effects of early Social Security claiming at 62 here.

On the other hand, taking benefits at age 70 will increase payments by about 32% more than taking at age 66. While the break-even age for taking at 70 versus 62 can be years out, it can be advantageous to wait. Your benefits increase each year you defer payments.

Overall, people may consider their expected retirement expenses, what income they’ll need, and what other sources, besides Social Security, will provide income. In other words, it should be part of your overall retirement financial plan. In many cases, it might make sense to defer benefits. If you have a partner, factor in their benefits and timing as well. The timing of your Social Security benefits claiming will affect their own benefits.

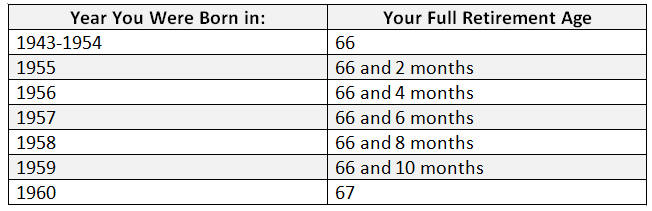

2. What is Full Retirement Age? According to the Social Security Administration, Full Retirement Age is the age at which you become entitled to full retirement benefits. In other words, your retirement benefits are “unreduced.”

If you were born after 1937, your Full Retirement Age is older than 65. For many people of the baby boomer generation, the Full Retirement Age will be 66. However, some will have a Full Retirement age of 67. The chart below shows at what point your Full Retirement Age kicks in.

Apart from your personal retirement benefits, your Full Retirement Age impacts spousal benefits you can receive. Depending on when you start receiving spousal benefits, from age 62-66, your spousal benefit amount may be reduced. You can learn more about on the Full Retirement Age page of the SSA website.

3. How much will you get in benefits? The Social Security Administration determines how much you will receive based on your lifetime earnings, and when you claim benefits. Of course, the timing of your SS benefits claim depends on your Full Retirement Age. You will want to base the timing of your benefits claim on your family history and medical record, among other things.

If they suggest a short life expectancy, earlier claiming may be advantageous. But on the other hand, a longer life expectancy may make a delayed claiming strategy more beneficial. A financial professional who understands retirement and Social Security issues can help you pinpoint the right timing strategies for you.

The SSA uses your lifetime earnings record in its benefit calculations. Your lifetime earnings report is based on your top 35 years of earnings.

An important note if you were a federal government employee or you worked for a foreign company that gave you a pension. The Windfall Elimination Provision (WEP) may affect your benefits. If this employment situation applies to you, you can learn about WEP and its potential effects here.

4. How can you increase your benefits? There are a variety of ways to increase your Social Security benefits. One way is to delay retirement past your Full Retirement Age. For those with a Full Retirement Age of 66, each year you defer Social Security payments results in an 8% credit to your benefits. By waiting until age 70, you can enjoy up to 76% more income than you would receive if you had claimed at age 62.

Working longer can bring more advantages than just increased benefits. Should you not have 35 years of earnings, the years without earnings will reflect an amount of zero. If you decided to stop work and start Social Security, it would hurt your payments going forward.

Choosing to work longer will replace years of zeros with years of earnings. You can also replace years of low earnings with higher-earning years. That could cause Social Security benefits to rise considerably.

5. Are Social Security payments taxable? Yes, they can be. How the U.S. government may tax your benefits depends, in part, on your tax filing status. If you file as an individual and your combined income is anywhere from $25,000-$34,000, up to 50% of your Social Security benefits may be taxable. If you make over $34,000, you might have to pay taxes on up to 85% of your benefits. Combined income is simply adjusted gross income added to non-taxable interest and half of your Social Security income.

Say you file a joint return with your spouse. If your combined income runs anywhere from $32,000-$44,000, you might have to pay taxes on up to 50% of your Social Security benefits. Should your combined income exceed $44,000, up to 85% of your Social Security benefits can be taxable. State income taxes could also apply to Social Security benefits, but the good news is many states don’t recognize these benefits as taxable income.

6. Can you keep working after you retire and claim benefits? Yes, you can definitely choose to keep working. However, if you retire before Full Retirement Age, claim benefits early, and earn certain amounts of income from work, your benefits will be reduced. At the present time, Social Security can deduct one dollar in benefits for every two to three dollars of earnings you get over certain income thresholds.

For claiming in years before Full Retirement Age, Social Security will take $1 in benefits from your benefits for every $2 of earnings above $18,960. If you claim in the months in your year of Full Retirement Age, but before the date of your Full Retirement Age, Social Security will deduct $1 in benefits for every $3 in earnings over $50,250.

However, once you reach Full Retirement Age, you will get your full benefits, no matter what your earnings are. If you were impacted by pre-Full Retirement Age benefit deductions, your benefits will also increase to make up for the benefits withheld during your pre-Full Retirement Age working years.

7. Should Social Security be your only retirement income source? No, you and others should consider other sources of retirement income, as well. For one, Social Security is a progressive program, which means it is designed to provide more benefit to people with limited financial means. Higher-income workers will need to save more to supplement their retirement lifestyle.

There is also the question of the program’s health. In 2020, the Social Security Trustees reported that absent any changes, both trust funds for Social Security retirement and disability benefits will be depleted by 2034. Thereafter, scheduled incoming tax revenues will be enough to give only 76% of scheduled Social Security benefits. While changes are likely to come, it highlights the importance of diversifying your income sources. That way you have more than sufficient, reliable cash-flow for all your retirement years.

Concluding Thoughts

While Social Security checks are an important, fundamental part of a retirement income plan, they are just one part of the puzzle. As you create projections for future spending and match them with expected income sources, you may want to consider strategies that will generate a reliable, lifelong income. When you need personal guidance with your income and financial goals, financial professionals at SafeMoney.com are ready to help you.

Use our “Find a Financial Professional” section to connect with someone directly. Request a no-obligation consultation to get started. Should you need a personal referral, call us at 877.476.9723.