6 Biggest Retirement Income Planning Mistakes to Avoid

Sure, life happens and we make mistakes. We learn and try not to repeat them. But in retirement income planning, the margin for error is smaller. Just one or a few mistakes could derail your goals or even put your retirement on the rocks.

If you are someone who plans to retire within the next 10 years or sooner, now is the perfect time to start putting your financial house in order. However, as you devote attention to daily tasks in the workplace and your household, it can be hard to make your post-work future a priority. But retirement can come sooner than you think, and it’s prudent to start preparations before your time has passed.

So, meet with your financial professional to discuss your goals, review the status of your retirement assets, and evaluate your financial picture. And as you near your retirement, it’s important to refrain from critical income planning mistakes. From bad saving and spending habits to easy-to-overlook risks and planning pitfalls, here are six critical retirement income planning mistakes you should avoid.

Common Retirement Income Planning Mistakes

1. Not having a written plan. It’s simple, but the first step in achieving a comfortable, income-secure retirement is having a plan. Yet many investors don’t have a retirement plan. According to the Employee Benefit Research Institute, 59% of Americans haven’t calculated how much retirement money they should have saved.

Just as importantly, few people put a plan in writing. Again, the Employee Benefit Research Institute reports, just 11% of working Americans have created a written financial plan. Retired Americans don’t fare much better— only 2 out of 10 (19%) have a written blueprint for their golden years.

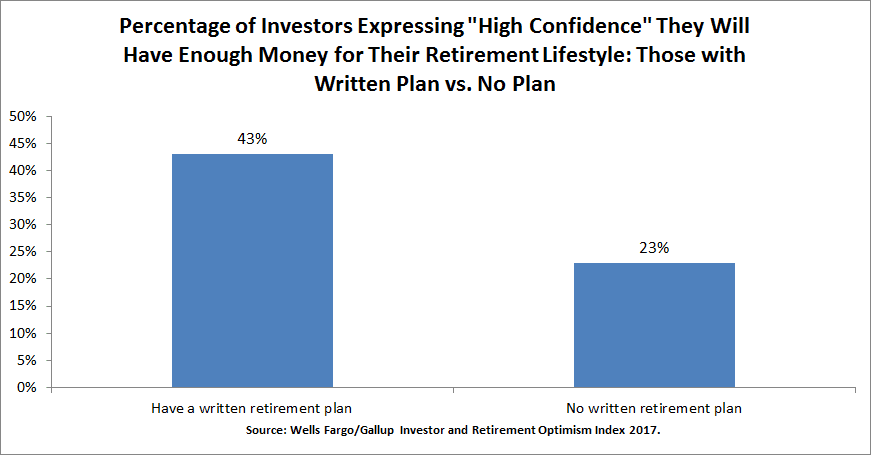

Point is, having a written plan can be a real game-changer. According to the Wells Fargo/Gallup Investor and Retirement Optimism Index from earlier this year, investors with written retirement plans were almost 200% more likely than those with none to believe they would have enough money for retirement.

Likewise, in an April 2017 study by Koski Research for Charles Schwab, those with a written plan were 60% more likely to make 401(k) contributions and 200% more likely to stick with monthly saving goals.

2. Potentially retiring too early. While it may be an exercise in patience, working for even a few years longer can do wonders for your income security. You bring home more money to work with, and if you’re behind in savings, you can put away those balances for your retirement future. A delayed workplace departure also means more time for your savings to grow tax-deferred.

Each year you work is another year you don’t have to take money from your retirement accounts, and subsequently your retirement income rises. Even more importantly, if you are in your sixties, working longer boosts your Social Security benefits. By working and delaying your benefits claiming until full retirement age, you will accrue more credits and sidestep costly benefit deductions that kick in with early filing.

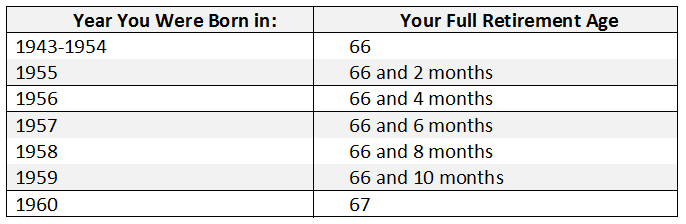

With that said, Social Security claiming depends on a number of factors. You may have a family history or medical history in which you expect to have a shorter retirement duration. In that case, early claiming may make sense. Or maybe you worry about getting what’s yours out of the Social Security program, having paid into it for many years. Program solvency concerns may be another reason. All things considered, it’s prudent to work with a financial professional who can help you determine what’s right for you. What full retirement age is for different baby boomers can be seen in the table below.

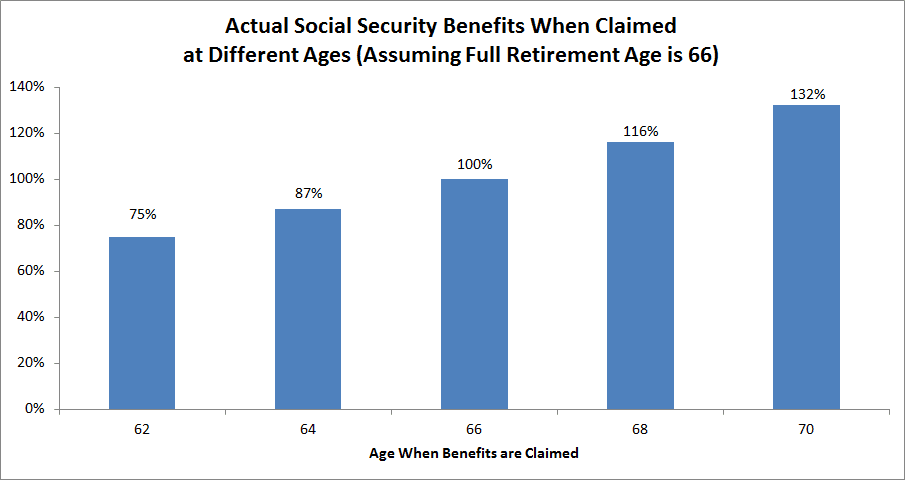

The Social Security Administration pegs the “traditional” retirement age at 66. But many Americans retire sooner than that. And unfortunately, often for less-than-ideal reasons, they claim Social Security early, which means they end up with permanently slashed lifetime benefits. The effects of early benefits claiming can be seen in the graph below.

According to the Center for Retirement Research at Boston College, more Americans start collecting benefits at age 62 than any other age. And in 2015, among Americans who actually chose their claiming age – as opposed to transitioning into Social Security benefits from disability benefits at full retirement age – 64% of men and 72% of women took their benefits earlier than their full retirement age.

If you do plan to keep working and claim your benefits early, be aware of the downsides. The Social Security Administration limits benefit payments when you are taking home work income before full retirement age. In 2018, when you claim your benefits early, the SSA deducts $1.00 of benefits for every $2.00 of earnings over $17,040. This applies when claiming benefits early before the year in which someone attains full retirement age.

If you claim benefits in the year of your full retirement age — but not the precise month when your full retirement age actually kicks in — $1.00 of benefits is taken from every $3.00 of earnings above $45,360. Note this second deduction applies in the months of the year of your full retirement age.

3. Not having a “retirement-ready” diversification strategy. Sure, deciding on an investment strategy and putting away money into retirement accounts takes work. Years of discipline and hard work! But while accumulating assets and building up savings requires diligence, it’s often taking money out of those retirement accounts – and minimizing taxes – that is trickier.

Retirement is different than the working years, because you will no longer have a job salary or wage earnings. Now, it’s a matter of drawing on accumulated assets for income. And while withdrawal guidelines such as “the 4% rule” may be helpful, the economic assumptions undergirding them are likely to change. So, it’s important to consider the following points:

- Do you have safeguards in place so you have steady, reliable income streams, even in poor market conditions?

- Does your portfolio have suitable asset protections so your money lasts for potentially 30 years or longer – especially as life expectancies increase?

- How exposed is your portfolio to market volatility?

- Generally speaking, is the amount of risk your portfolio carries appropriate for your age, circumstances, and financial picture?

It’s prudent to work with a knowledgeable financial professional – someone who understands the importance of income, protection, and risk management in retirement – to help you answer these important questions.

4. Planning only for joint income needs. If you are married or have a partner, chances are your retirement income plan is based on two people. Your plan may account for your needs together, and may include joint lifetime Social Security payments, pooled investment funds, cumulative portfolio assets, and your total savings. But what about the question of survivorship? What would happen when one of you is gone?

When one member of a couple passes away, a number of things change. Social Security income diminishes, other income sources may dwindle, and there may be tax implications with the deceased party’s assets, if they weren’t specified as jointly-owned property.

If you do have retirement accounts earmarked for the survivor, you will want to prepare now. Make sure the beneficiaries on those accounts are updated, so there’s an efficient wealth transfer. It’s important to assure that you and/or your partner will have access to that money when one of you is gone.

So, you will want to be sure that no matter what, the surviving partner is well-prepared. They may also be left to deal with health problems or other costly issues tied to aging. Your retirement income plan should account for those situations, as well – especially if one of you is no longer around to help your significant other. From a financial protection standpoint, joint life insurance of the “first-to-die” variety may be worth consideration. This type of life policy gives instant liquidity to the surving partner once someone deceases, it helps them bypass costly probate, and it gives the surviving partner with a tax-advantaged income source.

5. Neglecting costly health and care needs. Many people think they won’t have any long-term care needs. But the numbers may surprise you. According to the U.S. Department of Health and Human Services, someone turning 65 today has a 70% chance of needing long-term care in the future. And for that matter, other health costs, not to mention all-around costs of care services, can add up quickly.

Along with dumping pensions, employers are steadily taking health coverage in retirement off the table. Medicare may not pay for as many of the health costs that you think it does. For example, some expenditures not covered by Medicare include:

- Long-term care

- Majority of dental care

- Dentures

- Hearing aids and examinations for fitting them

- Eye examinations related to eyewear prescriptions

Now, to give an idea of retirement health costs in real-world figures. The financial research firm HealthView Services projects for total health costs:

- Total healthcare premiums, or Medicare Parts B and D, supplemental insurance, and dental insurance, for a healthy 65-year-old couple retiring in 2017 are projected to be $321,994. When accounting for the value of future dollars, the figure shoots up to $485,246!

- Factoring in deductibles, co-payments, and out-of-pocket costs, total retirement healthcare costs are projected to be $404,253 for a 2017-retiring, 65-year-old couple. When accounting for future dollars, the figure goes up to $607,662.

As for costs of long-term care: If someone requires care in a nursing home, the average cost is around $4,000-$6,000 per month. Or $48,000-$72,000 annually! Or say someone needs care from a home health aide or nurse – that can cost $100 per day, or as much as $3,000 per month.

There may be solutions to these needs, besides having to liquidate all of your assets to cover the costs of care services. Consult with a knowledgeable financial professional who can help you anticipate and prepare for these risks.

6. Not planning for a potentially long retirement. Life expectancies are on the rise. Thanks to medical and technology innovations, people are living longer. And in turn, this increasing longevity acts as a “risk multiplier,” enhancing the effects that inflation, taxes, market corrections, and other risks may have over the years.

If people are married, they live longer. A married couple’s life expectancy is age 93. Research projections estimate a 25% chance for one partner to live to age 97. As we continue to see more innovations on the medical and technology fronts, people may live even longer!

So, your retirement income plan should account for a potentially long retirement lifespan. That can be as many as 30 years or possibly even longer. You should have annual projections of your expected monthly costs-of-living, miscellaneous spending, and how you’ll pay for them. Overall, the goal is to make sure your money lasts as you need it – so you can enjoy a comfortable and financially confident retirement lifestyle.

Ready for Personal Guidance with Your Income Plan?

If you are ready for guidance on creating a plan that emphasizes income certainty, protection, and risk management – or you need a second opinion of your existing strategy – the financial professionals at SafeMoney.com can help you.

Use our Find a Financial Professional section to connect with a financial professional and start the discussion about your goals and needs. And should you need a direct referral, call us at 877.476.9723.