Break Even Age for Social Security: Maximize Your Benefits

Many people worry about running out of money in retirement. Choosing the right time to claim Social Security can make a big difference. By figuring out your break-even age for social security, you can maximize your benefits and worry less about your finances.

In this blog, we’ll explain the break-even age, how to calculate it, and why it’s so important for your retirement planning.

What’s the Break-Even Age?

Your break-even age for Social Security is a key turning point. It’s the age when claiming benefits later becomes more financially rewarding than claiming early.

On one side, you have the smaller payments you get by claiming early, but you get them for a longer period. On the other side, you have the larger payments you get by delaying, but over a shorter time frame. The break-even age is when those two sides become equal.

Your Full Retirement Age and the Break-Even Point

Your Full Retirement Age (FRA) is the age at which you can start receiving your full Social Security benefit. It usually falls between 66 and 67, depending on when you were born.

If you claim benefits before your FRA, you’ll get less each month, but you’ll receive payments for a longer period. Meanwhile, if you delay benefits past your FRA, you’ll get more each month, but for a shorter period.

Life Expectancy

Your life expectancy also determines your break-even age. Delaying benefits might be a good strategy if you expect to live a long and healthy life. You’ll eventually receive more in total benefits than you would have if you claimed early. However, claiming early might be a wiser choice if you have health concerns or a family history of shorter lifespans.

How To Find Your Break-Even Age

Step 1: Find Your Full Retirement Age (FRA)

First, find your Full Retirement Age (FRA). It’s the age you qualify for your full Social Security benefit. You can easily find your FRA using the Social Security Administration’s online tool or by talking to a financial advisor.

Step 2: Estimate Your Benefits at Different Ages

Next, you need to estimate what your monthly benefit would be at different claiming ages. You can find this information on your Social Security statement or use online calculators. Typically, you’ll want to estimate your benefits at your FRA and at least one earlier and one later age (such as 62 and 70).

Step 3: Calculate and Compare

Now for the calculation: determine the total benefits you’d receive if you claim at each age. Let’s say your FRA is 67. Calculate how much you’d get in total if you started at 62, and then calculate the total if you started at 70. Compare these totals to see when the benefits from waiting to overtake the benefits from claiming early. The point where they cross is your break-even age.

Step 4: Use Online Calculators

The Social Security Administration and other reputable financial websites offer free calculators that can help you with this process. These calculators can give you a good starting point, but remember, they might not consider all your circumstances.

Step 5: Get Professional Advice

If you want a more accurate calculation or need help understanding your options, talk to a financial advisor. They can give you personalized advice and help you make the best decision for your situation.

Remember, your break-even age is just one factor to consider when deciding when to claim Social Security. But knowing this number gives you valuable information to plan for a financially secure retirement.

Break-Even Age Charts

Want a quick snapshot of your potential break-even age? These charts can help you visualize the tipping point where delayed claiming pays off more than claiming early, based on your Full Retirement Age (FRA).

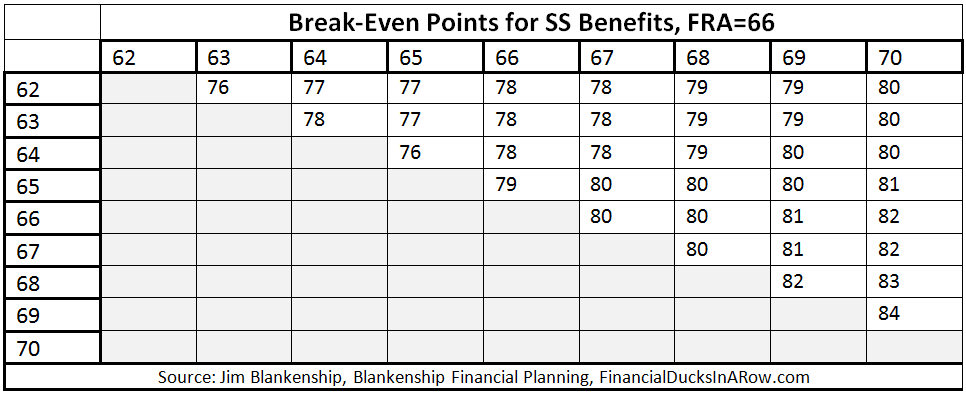

Break-Even Age Chart for FRA of 66

If you were born between 1943 and 1954, this chart is for you. Find your potential claiming age on the left side and follow the line to the right. The point where it intersects with a later claiming age is your estimated break-even age. For instance, if you’re considering claiming at 62, the chart shows you’d break even around age 78 compared to claiming at your FRA of 66.

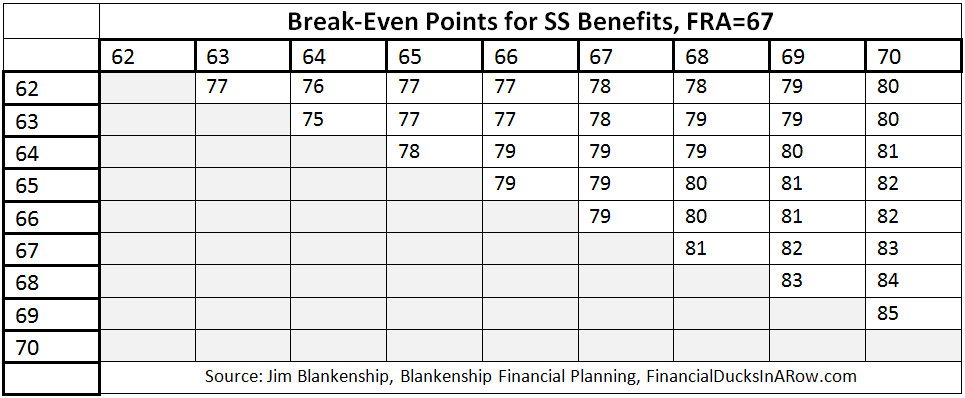

Break-Even Age Chart for FRA of 67

If you were born in 1960 or later, this chart is tailored to you. Use it the same way as the first chart. Let’s say you’re debating between claiming at 62 or waiting until your FRA of 67. The chart shows you’d reach your break-even point around age 78.

These charts offer a helpful starting point, but remember, they are just estimates. Your actual break-even age depends on your situation, including your health, family history, and other sources of income.

Also, the charts don’t account for potential changes in Social Security benefits over time.

Factors To Consider Other Than the Break-Even Age

Your break-even age is a helpful starting point, but it’s not the only factor to weigh when deciding when to claim Social Security. There are many other things to consider when making this important decision.

Health and Life Expectancy

Are you generally healthy? Do you have any existing conditions or a family history that might affect your lifespan?

If you’re in good health and anticipate a long life, delaying benefits might be the better option. You’ll enjoy those bigger checks for many years. But if you have health issues, claiming early might be wiser, allowing you to receive benefits while you can.

Spousal Benefits

If you’re married, consider your spouse’s age and financial needs. Claiming early can mean a lower survivor benefit for your spouse if you pass away first. Delaying your benefits could result in a larger monthly income for them later in life. Talk with your spouse about the options and choose a strategy that benefits both of you.

Income and Savings

Your other income sources, like pensions or savings, also matter. If you have a pension or a well-funded retirement account, you might be able to delay claiming Social Security and get a higher monthly benefit later. But if you rely on Social Security to cover your living expenses, claiming early might be the best way to go.

Work Status

If you’re still working, be mindful that earning too much before your full retirement age can temporarily reduce your Social Security benefits. However, once you reach your FRA, you can earn as much as you want without any penalty.

Risk Tolerance

Delaying your benefits is a calculated risk. If you live past your break-even age, you’ll receive more benefits over your lifetime. But if you don’t, you might not receive as much as you would have if you had claimed earlier. Think carefully about your comfort level with risk as you make this decision.

When Should You Claim Your Social Security Benefits?

Option 1: Claim Early

Claiming as early as age 62 gives you access to your benefits sooner. This can be helpful if you have immediate financial needs or health concerns. But remember, your monthly payments will be smaller for the rest of your life.

Pros:

- Receive benefits sooner.

- Potentially helpful if you have immediate needs or health concerns.

Cons:

- Permanently reduced monthly payments.

- Might not be the best option if you expect to live a long life.

Option 2: Delay Your Benefits

Delaying your benefits until after your Full Retirement Age (and up to age 70) means you’ll get a larger monthly check. This could be a smart move if you’re in good health and expect to live a long life. However, you’ll receive benefits for a shorter period.

Pros:

- Larger monthly payments.

- Could be beneficial if you’re healthy and expect to live a long life.

Cons:

- You’ll receive benefits for a shorter period.

- Might not be ideal if you have immediate financial needs.

What’s The Best Choice?

The best choice for you depends on your circumstances. Think about your health, financial needs, and family situation. Talk to your spouse about how your decision will affect them, especially when it comes to survivor benefits.

If you have other sources of retirement income, like a pension or savings, you might have more flexibility when you claim. However, if you rely on Social Security for your living expenses, claiming earlier might be necessary.

Secure Your Retirement with Smart Social Security Choices

If you’re unsure about the best time to claim your benefits or need help calculating your break-even age for Social Security, contact an advisor from SafeMoney. They can provide expert guidance and help you create a personalized plan for a comfortable and worry-free retirement.

Remember, the decisions you make today can have a lasting impact on your financial well-being. Don’t decide hastily and ask for professional advice.

Need Expert Guidance?

For personalized financial advice, connect with a professional today. Visit our “Find a Financial Professional” section to get started. If you prefer a personal referral for your first appointment, call us at 877.476.9723 or contact us here to schedule a meeting with a trusted and licensed independent financial professional.

🧑💼 Authored by Brent Meyer, founder and president of SafeMoney.com. With over 20 years of experience in retirement planning and annuities, Brent is dedicated to helping you secure your financial future. Discover more about his extensive expertise here.