Protect Your Retirement with Safe Money Solutions

As you gear up for retirement, you may have heard of “safe money solutions.” Are they right for you? It’s an important question, especially since retirement planning is more difficult than it’s ever been in history.

Past generations could count on company pensions that would pay them every month without fail until they died. But the disappearance of these pensions, coupled with the increase in longevity for retirees, has left many people with more questions than answers.

While Social Security will cover at least some of their expenses, most retirees will have to rely on income from their own investments and savings to make up the difference.

However, what many call a bewildering amount of financial choices in today’s market can leave people feeling frustrated.

According to the Investment Company Institute, nearly 120,000 regulated investment funds are available to retirement savers today. And what about other options? There are more annuities than hedge funds available, which doesn’t even begin to cover the universe of countless other instruments that can be tapped for retirement goals.

All that being said, what if you are looking for some choices that help guard your money and maximize income for retirement? Safe money solutions might be worth a look. And what are they? Generally speaking, a safe money solution:

- Provides some protection for your principal.

- Might pay out retirement income with higher confidence than, say, an equity position might give.

- Offer some growth potential with a guaranteed interest rate or other interest-earning opportunities.

Fixed-type annuities, bonds, and Treasuries are among the asset types that can be called “safe money solutions.” But among all of these, annuities are the only instrument capable of paying out a guaranteed income stream for life.

Annuities as a Safe Money Solution for Income

One example speaks powerfully to how annuities can provide permanent streams of monthly income, often at less cost than what other asset classes might give.

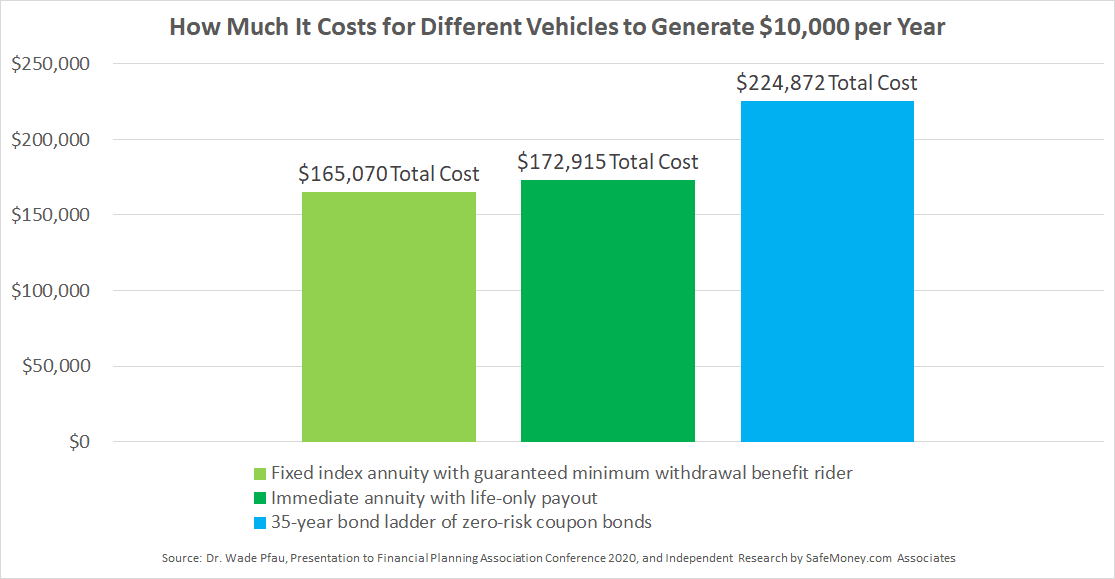

Dr. Wade Pfau of the American College for Financial Planning recently showed a comparison of different income-planning approaches. His presentation was at the combined Financial Planning Association (FPA) and Academy of Financial Services 2019 annual conference.

Pfau is the director of the Retirement Income Certified Professional program at the college. He showed how a 65-year old woman who purchases an immediate annuity with a life-only payout for $172,915 would receive $10,000 a year for life at current rates.

Comparatively, the same amount of money invested in savings today would produce about $6,920 per year, assuming 4% annual withdrawals.

Using Annuities or Bonds for Retirement Income

Pfau went on to compare the same annuity to a ladder of risk-free zero coupon bonds. A 35-year ladder of bonds that would guarantee $10,000 a year for 35 years would cost $224,872.

So the hypothetical woman in this example could put money in the immediate annuity, then allocate the $52,000 difference in an equity portfolio to guard against inflation.

However, every situation has trade-offs, and this scenario isn’t any different.

While the annuity pays more, the woman is forfeiting control of most of her money in order to receive the life-only payout. If she were to pass away early, the remaining balance of money in the immediate annuity would go to the insurance company.

What might be some alternatives, then? One answer is to put the money instead into a fixed indexed annuity with a guaranteed income rider. Let’s assume that she chose an “income-today” strategy, meaning she started payments to her right away.

This index annuity alternative would also yield $10,000 per year but only cost $165,070 upfront. What’s more, it would also allow the woman to retain control of at least some of her money and also possibly leave a legacy for her heirs.

If she were to invest the above balance into savings and withdraw it at a rate of 4% per year, she would only receive $6,602.80 per year for 25 years.

What Else Can an Annuity Do for You?

Fixed and fixed indexed annuities are backed by the insurance carrier’s cash reserves on a dollar-for-dollar basis. Most carriers have even more than a dollar in reserve for every dollar of outstanding premium that they issue.

Insurance companies do have ratings given to them by the rating agencies such as Fitch, Moody and Standard & Poor’s.

Any carrier with a BBB or B++ rating can be a safe haven for your money. Be sure to check the carrier’s solvency ratio, or the ratio of dollars-and-cents in reserves for each dollar of annuity premium they hold.

Those who have yet to get an A rating will often offer more competitive annuity contracts in order to entice retirees and mature-aged individuals to buy them.

A sound safe money solution for your retirement is going to incorporate at least a few of the following principles:

- Protection of principal and all financial gains from the effects of a bear market

- Sufficient liquidity

- Steady, reliable permanent income

- Favorable tax treatment

- Guaranteed protection of your “can’t afford to lose” income streams

Safe Money Solutions and the Retirement Red Zone

If you are in the retirement “red zone” (within 10 years of retirement in either direction), make sure that your portfolio is adequately diversified.

The “Rule of 100” (100 minus your age equals the percent of your portfolio you should have in equities) can be a good tool to start with. Keep in mind that it’s a back-of-envelope tool and a starting point. The equity portion of a portfolio is also important.

Your financial advisor can help you ensure the equity portion of your portfolio is in in several different segments of the economy and also all of the major cap sizes for mutual funds (i.e. small, medium, and large cap).

You will probably need some diversification in the fixed-income segment of your portfolio as well.

Determine Your Monthly Retirement Spending

The next step is to figure out your expenses during retirement.

This should include all of the basics, such as healthcare, clothing, rent or mortgage payments (if there is one), taxes, insurance, food and entertainment.

Be sure to also include miscellaneous expenses such as holiday and birthday gifts, unforeseen medical expenses, and car repair and maintenance bills. Long-term care expenses should also be considered here.

This schedule of expenses should probably be projected out for at least 30 years, and inflation should also be taken into account.

Put Your Income Strategy into Action

Once you know what your retirement expenses will be, you can begin plotting out an income plan that will cover them. The foundation of this plan will most likely be Social Security. Be sure to talk to a Social Security expert before making an election.

If you are planning on taking Social Security at age 62, you can increase your monthly benefit by three-quarters if you wait until age 70.

You may have to work for a few more years than you intended in order to maintain your current lifestyle when you retire. Then again, working until age 70 can provide a triple financial benefit.

Not only can it allow you to defer taking Social Security until you are 70 years old. It also shaves a few years off the timespan that you will have to stretch your savings over.

What’s more, you can also beef up your retirement portfolio with additional contributions to your IRAs and/or employer-sponsored retirement plan.

Benefits to Delaying

Working until age 70 may also enable you to pay off more of your debt. A retirement cash-flow plan that doesn’t include a mortgage payment will stretch much further and be more forgiving than a plan with one.

Even paying off a car loan will stretch your dollars much further, so the more debt that you can eliminate before retirement, the better.

A Secure Retirement Starts Today

Planning for retirement in today’s world is much different than in times past. But an adequately diversified portfolio that is tailored to your risk tolerance, retirement objectives, and time horizon can go a long way towards providing the income security that you need.

Consult your financial professional for more information on creating a safe income solution that meets your needs. If you need help looking for a knowledgeable financial professional, help is only a click away at SafeMoney.com.

Use our “Find a Financial Professional” section to connect with someone directly for an initial appointment. Should you need a personal referral, call us at 877.476.9723.