Retirement Tax Planning – How You Can Get More from Your Money

When it comes to taxes, you can be sure that Uncle Sam will want his share. Retirement tax planning can help you make the most of your money. Tax-wise strategies let you maximize your income and keep more of what you have accumulated over a lifetime of hard work.

But while Uncle Sam’s tax collections are a certainty, what is less than clear for millions of retirees is their own tax bills. Many don’t know whether they are paying too much in taxes or not – and how, in turn, that affects their retirement income streams.

Fortunately, there are several ways that you can reduce your tax bill after you stop working through the proper use of annuities and IRAs.

The order in which you withdraw your assets can also substantially impact the amount of tax that you will have to pay. Studies have shown that a properly-structured withdrawal schedule can extend the life of an investment portfolio by as many as 6 years in some cases.

An Alarming Trend

Of course, when it comes to taxes, the name of the game is always to pay as little as possible.

A study of retired high-income households shows how high tax bills can deplete your personal cash-flow. In 2010, Lincoln Financial Group completed a study on retirees ages 62-75 with annual incomes of at least $100,000.

Their finding? Most high-income retired households shelled out about one-third of their income to the tax man. Not only that, taxes were their single largest expense.

Furthermore, a survey conducted by Nationwide Financial Group in 2018 showed that retirees still struggle in their tax knowledge. Among people who had been retired for at least a decade, three-quarters admitted to some degree of uncertainty about their taxes and whether they had done adequate tax planning.

The Timing Factor

Most high net-worth retirees have three types of accounts:

- Taxable (retail brokerage or investment accounts),

- Tax-deferred (traditional IRAs and qualified plans), and

- Tax-free (Roth IRAs and non-qualified plans).

“Conventional” financial wisdom has told us in the past to withdraw assets from your taxable accounts first, then deplete your tax-deferred accounts and finally draw last on your Roth accounts. However, this policy is not always correct.

There are several factors that can influence how much tax you pay on your distributions and, thus, which bucket to draw your money from.

For example, a retiree in his 90s may incur substantial medical expenses during the year. That means that any taxable income he receives may effectively be tax-free after deducting his healthcare costs.

Therefore, it may make sense for him to draw from his taxable or tax-deferred accounts and allow his Roth money to keep growing.

Many tax planners will also advise their clients to take just enough distributions from their tax-deferred accounts so that they will remain in the 10 or 15 percent bracket when they file the following year.

And, of course, those who are charitably minded may incur substantial deductions with their annual gifts. In turn, that can allow them to draw more out of their taxable accounts than they could otherwise.

Front and Back Loading Retirement Tax Strategies

There are two main strategies that advisors recommend when it comes to the timing of taxable distributions.

Front loading is where the advisor has the client pay as much tax as possible within the first few years of retirement. In exchange, they will owe virtually nothing in taxes during their later years. In the case of back loading, the client pays as little in taxes as possible during the first 10 years in retirement.

Using the Front Loading Tax Planning Strategy

This front loading retirement tax strategy is considered to be somewhat safer than the back loading option, as this alternative provides a measure of legislative protection for the investor.

Retirees won’t have to worry about paying more in taxes in the future than they will have to pay now due to the rising costs of Social Security, Medicare, and other programs. In most cases, taxes are accelerated through the use of Roth conversions coupled with an annuity.

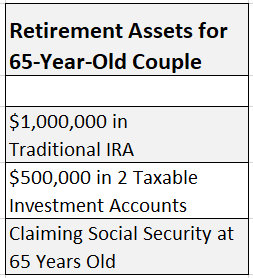

A couple with $1 million in qualified (pre-tax) assets and $500,000 in taxable retail investment accounts could begin converting their qualified assets to Roth accounts each year for 10 years. In the process, they might pay in taxes a total of perhaps $200,000.

At that point, they will have most likely depleted their qualified assets and only have Roth accounts remaining. Then they can bequeath their Roth-based assets to their children or other heirs with no tax bill.

The Front Loading Retirement Tax Strategy in Action

However, the back loading strategy has its advantages as well. If someone can minimize their distributions and other forms of income upfront, then this will allow a greater percentage of their assets to grow over time.

This can be accomplished through the use of SPIAs (Single Premium Immediate Annuities) that will pay out for five to ten years. The annuity exclusion ratio will help to reduce the amount of taxable income that the client has to declare during this period, especially if a non-qualified SPIA is used.

Through careful planning, it may be possible to keep a client’s income from exceeding the Social Security tax threshold by using SPIAs or other tax-advantaged instruments.

However, as mentioned previously, this plan could easily backfire if taxes increase substantially in upcoming years. One situation that could trigger this may be to fund the rising costs of Social Security and Medicare.

The hypothetical couple mentioned above might only pay about $50,000 in taxes during the first ten years. Then they would be left with another $150,000 to grow over time.

The NUA Rule

There is one sure way to pay less tax if you own company stock inside your 401(k) plan. The Net Unrealized Appreciation (NUA) rule will allow you to spin off this stock when you retire and sell it in a single separate transaction.

Your sale proceeds will then be taxed as a long-term capital gain instead of as ordinary income. Of course, that assumes that you have held all of the shares you are selling for a least a year. If not, then you will have the gain on the shares you have held for less than a year taxed as a short-term gain.

There are a few rules you have to follow in order to accomplish this. But you can save a substantial amount of money by doing this, especially if you are in a high tax bracket and have accumulated a large number of shares.

Conclusion

The question of whether to pay taxes now or later is one that each person will have to discuss with their financial professional.

There may not be one best way to do this, but some alternatives will most likely be better than others. A large part of what may be right for you will depend on your personal goals and situation.

If you are looking for an experienced financial professional to help you explore retirement tax planning strategies, help is a click away at SafeMoney.com. Use our “Find a Financial Professional” section to connect with a financial professional directly. Should you need a personal referral, please call us at 877.476.9723.