How Can Taxes Affect the Growth of Your Money?

There are only two sure things in this life, and they are death and taxes. Taxes affect us at every turn financially, and investments are no exception.

The taxation of your assets can have a substantial impact on how much money you end up with. As any financial advisor will tell you, it’s not what you make that matters, it’s what you get to keep.

Increase Your Nest Egg with Tax Deferral

With that in mind, there are ways to increase the stockpile of savings that you have for your post-career lifestyle. ‘Tax-me-later’ vehicles can increase the amount of money that you have in retirement. In financial circles, this sort of vehicle is known as a tax-deferred asset.

In other words, it’s an asset where you don’t pay taxes on your money until you start making withdrawals from there. When you do withdraw money from this asset, you will pay income taxes on the withdrawn amount.

Tax Deferral Has Limits

The upside with this option is your money can grow for years without taxes slowing down its growth. There are age limits to the benefit of tax deferral, however. Under IRS tax rules, when you withdraw money from a tax-deferred vehicle before age 59.5, you will likely have to pay a 10% penalty for an “early withdrawal” as well as income taxes.

If this vehicle is inside a retirement account like a traditional IRA, you will also be required to start taking withdrawals at a certain age. In these situations, the growth benefit of tax deferral can’t continue forever.

Under current tax law, once someone turns age 72, they must start taking required minimum distributions (or RMDs) from their traditional IRA. Since the money grew tax-free inside the account for so many years, this is so that the federal government can ensure that it’s still able to collect tax revenues on the retirement money.

How Can the Power of Tax Deferral Benefit You?

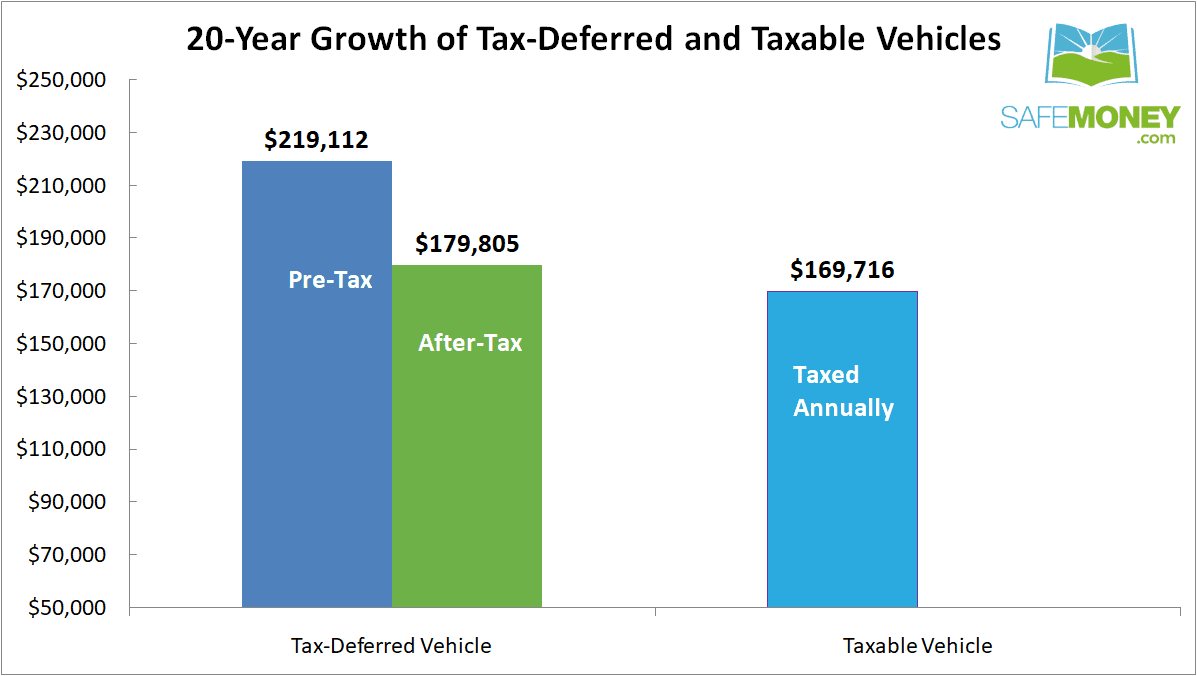

Below, the illustration shows how tax-deferred growth can potentially increase your nest egg over time compared to taxable growth. In a taxable vehicle such as a bank CD, your money can grow each year. But paying annual taxes on the growth can take a big chunk out of what you would otherwise have in retirement.

In this example, both the tax-deferred vehicle and the taxable vehicle have $100,000 sitting in each account. Let’s assume that the money inside each account grows by 4% each year. And to illustrate the effect of taxes, we will use a 33% effective tax rate assuming federal and state income taxes are being paid.

After 20 years, the money that grew tax-deferred came out ahead of the taxable money by about $10,000. That is even after accounting for all of the earnings in the tax-deferred vehicle being taxed 33% at the end.

Click here to see this image in full-size render.

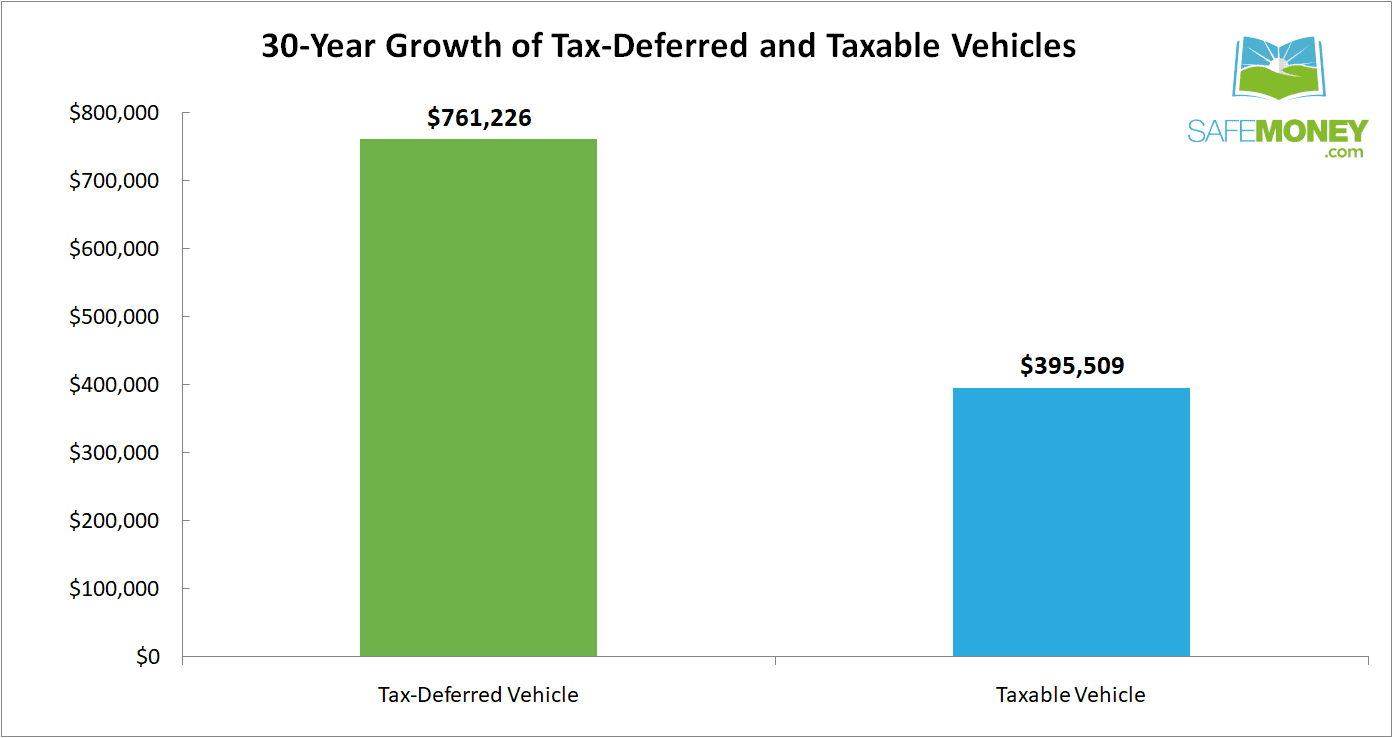

Another example brings this difference into even sharper focus. Say that we take that same $100,000 and let it grow for 30 years with a 7% average annual rate of growth. Again, the total tax rate is 33%, between state and federal taxes paid.

Click here to see this image in full-size render.

After 30 years, the tax-deferred asset grows to an impressive $761,226. Meanwhile, the taxable asset comes in at a mere $395,509 at the end of 30 years.

That is a big difference of $365,717, assuming that the taxable investment paid a total rate of tax of 33% between state and federal taxes.

Growing Your Money Alongside Retirement Accounts

Your retirement accounts let you harness the power of tax-deferred growth for growing wealth. You can save money on a pre-tax basis in IRAs and employer-sponsored retirement plans, but you can only put so much into them each year.

This is why annuities can be such a valuable addition to your portfolio. There is no such limit on the amount of money that can be placed into an annuity.

If you buy an annuity outside of your IRA or qualified employer retirement plan, then your money will compound inside the annuity alongside your monies in your retirement accounts.

Why Does Tax Deferral Work So Well?

The previous two examples demonstrate several powerful principles of investing:

1. Tax-deferred growth over time lets your money benefit from triple-compounding interest: growth on your principal, growth on your earnings, and growth on the tax money you didn’t pay at that point.

2. Compounding over time, tax-deferred growth can increase your savings and, by extension, the amount of income you have to tap when you retire from a full-time career.

3. Growth in vehicles that don’t have tax-advantaged treatment will ultimately leave you with less in savings — and therefore less retirement income.

Tax-deferred growth vehicles such as annuities can be a nice complement to retirement accounts you are already using. You can grow your money inside this complementary vehicle for later benefits in retirement. What might those be?

Those benefits can include guaranteed lifetime income, protection against market risk, and a guard against costly health bills, among many others. The relatively low risk of a fixed-type annuity can help diversify and counterbalance other risks you might be taking in other accounts.

Put Compounding Growth to Work for You

Albert Einstein once said that compounding interest was the most powerful force in the universe. One of the few things that can really slow this force is taxes, which leaves you with less money to grow and make more money over time.

But annuities can allow you to defer taxation until retirement, even if you are already taking advantage of an employer plan and an IRA. Consult your financial advisor for more information about how annuities work, and whether they could be a good addition to your overall retirement portfolio.

What if you are looking for a financial professional to help you achieve your retirement and financial goals? No sweat, many independent financial professionals are available at SafeMoney.com to assist you.

Use our “Find a Financial Professional” section to connect with someone directly. You can request an initial appointment to discuss your situation and explore a working relationship. Should you need a personal referral, call us at 877.476.9723.