Can You Afford to Gamble with Your Retirement Money?

The stock market has been surging to new highs. For the first time ever, the Dow Jones exceeded 20,000 in January. Then on the heels of President Trump’s first address to Congress, it charged ahead yet again. The Dow posted a 300-point jump, closing at over 21,000 on Wednesday, March 1. These gains come at a time when market volatility has also been on the decline. In early February the CBOE Volatility Index – more commonly known as the “investor fear index” – showed investor concerns on the decline.

However, even as the market goes up many people still worry about their investments. What will the market do next? Do they own too many stocks? When the market goes down, will it be just be a spill, a correction, or a crash? For that matter, do they have too much money in other risky, market-based investments?

For people close to retirement, this brings up an important question. Should you stay with your current portfolio allocation mix, or is it time to move into a safer strategy?

How Does This Bull Market Rank Against Past Bull Markets?

At present, this bull run is the second longest-running since 1928, as Jeff Sommer notes in the New York Times. From January 1 until March 3, the S&P 500 rose over 6%. Since the bull market started in March 2009, according to Sommer, the index has grown around 250%.

- According to the Bespoke Investment Group, quoted in the NYT article, the only longer bull run was from December 1987 to March 2000.

- As for market strength, the current bull market comes in third. Again, the 1987-2000 bull market ranks first, having attained a 582% gain.

- However, our current bull market runs close to the second. This second bull run occurred from June 1949 till August 1956 and achieved a gain of 267%.

Why does this matter? Because this bull run has been going for so long, data from past market performance may not be that useful in understanding future possibilities. But we do know from historical data that the market will go down.

The question is when it does trend downward, just how severe that downturn may be. And for people just 3-10 years out, investment losses could prove costly – especially for specific retirement financial and income goals.

What Might Lie Ahead?

No one ever really knows where the market is heading. But while historical data may not be as helpful, it can serve up indicators. Take, for instance, the long-term performance of the S&P 500.

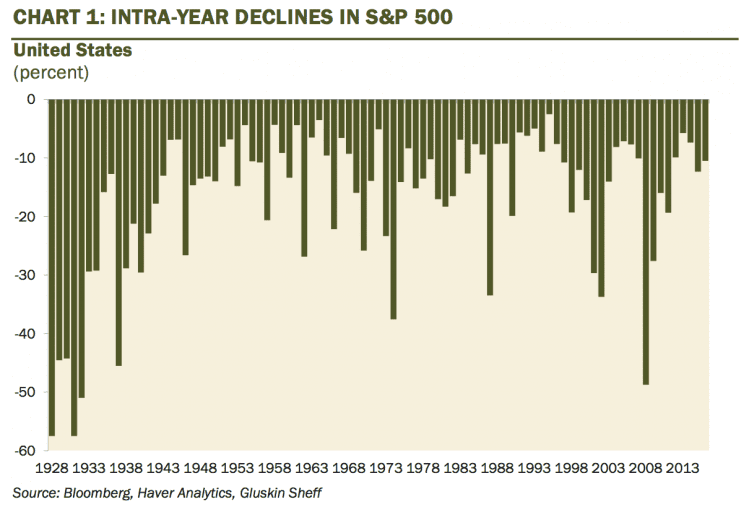

Over the last 89 years, in all but one year the S&P 500 has fallen at least 4.4% from an intra-year peak. In 75% of the time, the decline has been 10% or greater! In fact, the market corrections averaged out at 17%, and the median correction was 13% over this 89-year period. During 2016, there were four market corrections. These trends can be seen in the image below, courtesy of Bloomberg, Haver Analytics, Gluskin Sheff.

The Impact of Market Losses

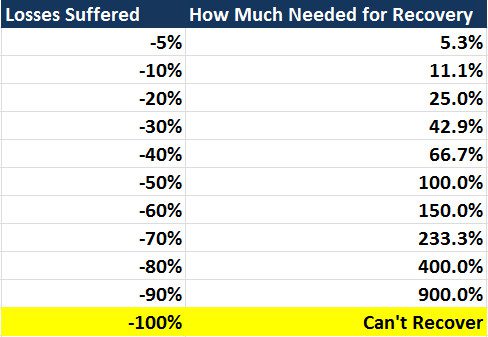

Whenever speaking of investment losses and recovery, we use the language of “average returns.” But this doesn’t completely capture the statistical reality of what we need to recover from losses in the first place. Consider the example below.

If your assets fell 30% one year and then gained 10% the next year, that would be an average return of 20%. However, it wouldn’t be a full recovery of what you lost in year one. In order to get back to where you started, your assets’ value would have to increase 43%, in order to make up for the initial 30% loss. This concept is called “actual returns.”

To get an idea of what actual returns look like at different levels of loss, consider the following:

For people who are retired or near retirement-age, these losses could prove costly. Ask yourself – would you have the time to wait to fully recover, even when the market might fall again and lead to further setbacks? Can you afford to put retirement income-generating assets at risk? What would portfolio losses, before you enter retirement, do for your financial peace of mind?

One Solution: Protecting Retirement Money with Safe Strategies

If you are in your fifties or older, you may want to consider ways you can keep your hard-earned money secure and intact. If appropriate, safe strategies with the contractual guarantees of annuities, or other fixed insurance products, may be worth evaluating. With help from an independent financial professional, you can uncover powerful ways to help you achieve your retirement financial and income goals. We invite you to request a no-obligation discovery appointment with a financial representative.

Use our Find a Licensed Advisor section to connect directly with an independent financial professional, and to request a personal strategy session to discuss your needs and goals. And should you have any questions or concerns, call 877.476.9723.