What Might Spending Look Like in Retirement?

Thanks to progress in healthcare and technology, you may expect to have a long retirement. But living to 100? While a lofty milestone, it’s not as out of reach as it may seem.

In 2014, U.S. government statisticians found that the number of people reaching age 100 had increased 40% from four years prior. And by 2050, the “100 and up” crowd is expected to grow to 3.68 million people worldwide.

Given the reality of lengthening lifespans, it’s no wonder why outliving retirement money remains a top concern. In an Allianz Life survey, almost two-thirds of surveyed Americans (63%) said they worried about running out of money in retirement more than death!

Financial planners and advisors call this chance of outliving your money a “longevity risk.” Building a well-defined retirement strategy will help you guard against this hazard, not to mention enjoy more financial peace of mind in your golden years.

Building a Financially Confident Retirement Lifestyle

A rock-solid plan will lay out how you maintain your lifestyle with the retirement income and assets at your disposal.

Whether someone lives to 100, goes beyond, or simply faces the prospect of a long-time retirement, the importance of managing your income and expenses also can’t be overstated. And it’s equally important to recognize that income alone doesn’t solve all problems in retirement if you don’t have a plan.

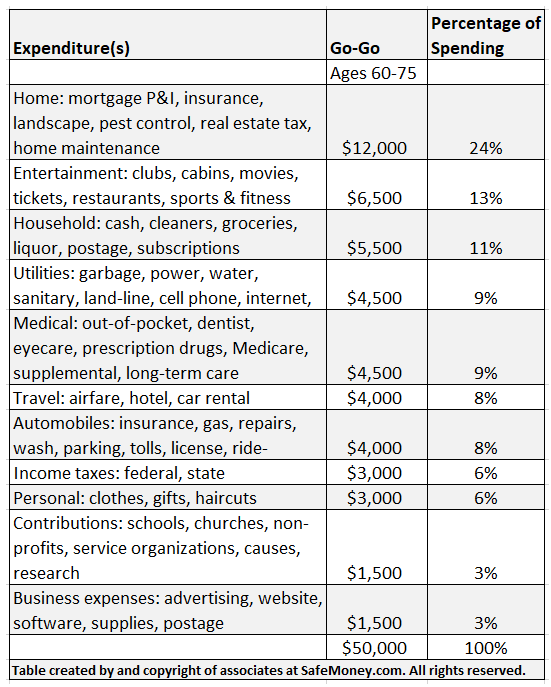

To help you plan for these golden years on the expense side of the ledger, we have assembled some general guidelines. For illustration, here’s an idea of typical expenses you might expect as you go through the three stages of retirement:

- Go-Go, 60-75: Just starting out, fit as a fiddle, traveling and living the dream

- Slo-Go, 75-90: Grandkids are growing up, may be time to consider selling the house or downsizing

- No-Go, 90+: Hung up your traveling shoes, every day is a blessing

General Planning Principles

Here are some general guidelines to help you plan your expense roadmap:

Mindset Matters

Before delving into your finances, check your midset. A little bit of philosophy will go a long way. We need to accept and be at peace with the fact that we all go through the same stages of life and aging. As the old saying goes, “Go with the flow!”

Professional Guidance Gives a Leg Up

You may be a DIY person when it comes to budgeting and doing your taxes. Whether you are or aren’t a DIYer when it comes to your financial management practices, you might benefit from the clarity of financial guidance.

Periodically consulting a trusted financial professional is always a good idea to sanity-check your monthly budget and household tax planning.

Plan for a Long-Term Outlook

Set up a 30-year income and expense plan in a spreadsheet. None of us has a crystal ball as to how long we will live.

You will want to look to your family history. Consider the possibilities by looking at your parents, your siblings, and your gut instinct.

Your best starting budget model for your plan is the one you are living now, adjusted year-to-year over the go-go, slo-go, and no-go years. Realistically account for taxes and inflation.

Have a trusted financial professional weigh in and back you up. Make your plan work off a conservative assumption that you may never work again. That way, your plan will help you be prepared for the scenario of when you must rely on your established retirement income streams.

Taking Care of Yourself Pays Off

Sports, fitness, diet, health, and wellness are among the most important areas for you to focus on. It’s good to plan ahead for the cost of healthcare in retirement, but addressing these areas now will help in your overall life outlook.

Taking care of yourself will help you be happy and healthy. What’s more, it can assist with the mitigation of any extreme health costs in the later years.

Keep Things Simple

Keep it simple, if you can. Less is more in retirement. This is the decumulation phase of your life, and it is a natural and sensible process for all of us.

Do you worry about about having to penny-pinch while you are retired? Spend less than you earn, it’s that simple! You have been doing this your entire life starting with your first paper route, so don’t stop now.

Retirement Expense Planning Across Three Stages of Life

In the table below, you will see a simplified model of the kind of expense distribution you might expect in retirement. This is based on an annual retirement spending budget of $50,000 funded by different sources. It doesn’t factor in the liquidation of any assets to generate income.

You might expect this sort of financial situation if you assumed a 20-year retirement timeline, and you used a middle-class living standard as the baseline for spending.

Of course, your income may be more or less, and your percentages of each classification (utilities, housing, medical, so on) may be different. But they will scale up or down based on your income. Depending on which income sources you used, taxes would also play into the picture.

This simple model is for demonstration purposes only. Your current budget that you are living right now is your best starting model for use in your retirement income planning. Then you can adjust it as you go.

Making Sense of Retirement Spending at Different Stages

Here are some guidelines as to how retirement spending may change with age and lifestyle:

Home Expenditures

Mortgage Principal & Interest (P&I), insurance, landscape, pest control, real estate tax, maintenance.

Downsizing over time from house to condo to independent senior living, will make the biggest impact on reducing expenses. The timing of each transition depends upon your overall health, your physical ability to take care of a house, and the cost of owning a home.

If aging in place as much as possible will be important for you, then start looking at options to make that a possibility. There are insurance and funding options out there that will help pay for at-home assisted living, for example.

Major maintenance and capital improvements to protect the market value of a house (roofing, HVAC, appliances, painting, furniture, remodeling) aren’t included in the above model.

Entertainment Spending

Clubs, cabins, movies, tickets, restaurants, sports & fitness. These discretionary expenses can be adjusted as necessary over time.

Household Expenditures

Cash, cleaners, groceries, liquor, postage, subscriptions. These are mostly discretionary depending upon lifestyle and living accommodations. Generally speaking, groceries and liquor will go down as we age.

Utilities

Garbage, power, water, sanitary, telephone, internet, TV, cell phone. These fixed expenses are mostly driven by lifestyle and size of housing.

Downsizing living accommodations generally takes place over time as health and mobility issues come into play. These costs can be wrapped into one monthly check if or when transitioning to an independent senior apartment.

Medical Expenses

Out-of-pocket costs for primary care and hospital, dentist, eyecare, drugs, Medicare A&B, supplemental, long-term care insurance.

There are few substitutes for Medicare backed up by a good supplemental insurance plan. If you do not have a Long-Term Care (LTC) strategy, develop a plan that may involve selling the house, or making use of other options. That can include asset based long-term care policies, LTCI insurance, certain annuities, or a reverse mortgage.

These are complicated financial choices, so always consult an LTCI professional.

Travel Spending

Airfare, hotel, car rentals. Consider travel in the Go-Go years if you can, while more financial resources might be stronger and your health is good.

Depending on the age make-up of your family, you may have in later years some family milestones you won’t want to miss. That may include graduations, weddings, reunions, and other happenings with loved ones or friends.

Automobiles

Insurance, gas, repairs, wash, parking, tolls, license, ride sharing.

Downsizing and/or transitioning to a hybrid vehicle — or a vehicle requiring less gas spending to get around — may be worth consideration.

Income Taxes

Federal, state, and city tax obligations. Many cities don’t have an income tax to pay. While many states are tax-friendly toward retirees, not all are equally.

Consulting a tax professional is a wise investment to make sure you prepare for and file correctly the taxes on qualified accounts (traditional IRAs, 401(k)s, other pre-tax accounts). Your financial professional can also help you weigh the tax efficiency of your long-term retirement plan.

Personal Care Expenditures

Clothes, gifts, haircuts. Shop smart to control your expenses.

Contributions

Charitable giving to schools, churches, nonprofits, and service organizations.

Consult your tax professional so you can optimize your charitable deductions. Depending on the strategies of how you give, you may be able to reduce how much taxes might eat into your retirement income.

Business Expenses

Advertising, website, software, supplies, postage. In the Go-Go and Slo-Go years, you may still be working part-time at a job, venturing into entrepreneurship, or working from home.

Ready to Plan for Your Retirement Financial Security?

It’s never too soon to start building your long-term retirement plan. Find a trusted financial professional to periodically sanity-check your plan. Balance enthusiasm for retirement with realistic expectations as to what you can spend. Work your plan every month and make tweaks based on changing conditions.

A plan will give you a financial roadmap and peace of mind. If you are ready to take the next step, financial professionals at SafeMoney.com can assist you.

Use our “Find a Financial Professional” section to connect with someone directly. Should you need a personal referral, call us at 877.476.9723.