Retirement Income Planning: 5 Tips for Lifelong Financial Security

If only retirement income planning were as easy as answering one question: “What is your number for lifetime retirement security?”

That would be nice if retirement boiled down to just one number. But this oversimplifies what it takes to enjoy a secure retirement because, in truth, it requires a customized income planning approach.

Why? Because determining how much money you need in retirement is just as much a personal question as it is a mathematical one.

Just think about your goals and what you might need financially to make them happen. Do you plan to travel? To begin a career ‘second act’ by getting involved with entrepreneurship or consulting? To donate time and resources to causes that are near and dear to you personally?

Bottom-line, everyone will have different income needs. So, here are five important tips to help guide you through your retirement income planning process. You can also further explore some topics by checking out the other SafeMoney articles linked to throughout this piece.

1. Maintain Self-Determination and Own Your Income Plan

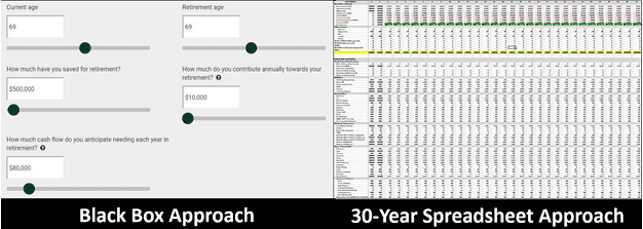

It’s very important that you “own” your personal 30-year retirement plan. You might have seen the “black box” approach that financial companies promote as a way to attract you to their brand of products and services.

However, retirement isn’t a simple matter of putting a few numbers in boxes online and calculating an answer. An effective way to really take control of your retirement plan is by having a clear idea of what your income and expenses will be.

A proven-to-be-effective strategy for tracking those is using a 30-year planning spreadsheet that can model and forecast your income, expenses, and change in assets.

2. Realistically Model and Forecast Your Income and Expenses

Using your 30-year (or longer) retirement planning spreadsheet (“PLAN.xls”), think through and realistically forecast your expenses and income.

If you were to graph the process of life through retirement, it might look like climbing up a hill on one side to the peak. Then it could slowly descend on the other side of the hill to the valley below.

We might call this the “Arc of Retirement.”

This ‘Arc’ is driven by the inevitability of aging and its impact on the rise and fall of one’s overall physical health, energy, strength, and cognitive abilities. The Arc will inform your thinking and 30-year forecasting of both income and expenses.

Your retirement income streams most likely will be a blend of one or more of the following sources:

- Wages and/or payments from employment, real estate holdings, business ownership

- Social Security

- Pension

- Private annuities

- Withdrawals from a 401(k), 403(b), 457, IRA, Roth Account

- Mutual funds and stocks

- Liquidation of assets

Carefully model and forecast each income stream as best you can in your plan.

When doing so, plan to cover your highest-priority “must-pay” expenses with retirement income streams that are essentially fixed, monthly recurring for a lifetime, and guaranteed, such as Social Security and pension payouts.

3. Decide Upon the Level of Market Risk in Your Portfolio

How much of your nest egg to put into market-driven accounts is a tough judgment call. After all, the years before and in retirement aren’t ones of accumulation, but arguably of protection and distribution. There is also the potential pitfall of sequence risk.

This is the money you will use to pay for all the expenses of your preferred retirement lifestyle. The question is how to convert your lifetime-accumulated portfolio into various income streams – and how much income should be under “lock and key” and how much income open to volatility.

The answers will differ for everyone, as people have different tolerances for risk. That isn’t to mention other planning variables like the length of their financial timeline, how much liquidity they need, and what their goals and objectives are.

With that said, one way to mitigate income volatility is by adding a private annuity to your portfolio. Annuities are the only private-sector financial products capable of generating a guaranteed lifetime income.

You might explore annuities as part of the basis of your income plan for covering fixed living expenses and other must-pay expenditures in retirement.

4. Always Have a Backup Plan for Survivorship and Emergencies

One of the most important goal of any plan? To maintain “income continuity” in place after the first death in a couple.

Nothing beats a checklist, so make a Master List of everything the surviving spouse will need to keep the ship sailing smoothly.

In the event of a major unplanned cost or crisis or forced retirement, try to build in a backup plan to cover the costs by a reserve fund, tapping a retirement account or home equity, and insurance(s).

A financial professional can help you walk through these critical “what ifs” and develop a strategy that meets your needs as a couple.

5. Consult a Financial Professional

You can benefit greatly from the expertise and guidance of a trusted financial professional. Some ways they might be able to assist you are:

- Reviewing your plan

- Looking for shortcomings

- Providing some alternative ideas

- Keeping you abreast of changing laws and regulations

- Providing ideas to enhance your forecasted income streams

- Helping you stay accountable to your plan and goals

- Working with you to determine when any adjustments or changes might be beneficial

You can receive a second opinion of your existing plan, develop one if you don’t have one, and have someone “sanity-check” the assumptions present in your existing retirement strategy.

Investors who work with a financial professional often report better outcomes in a variety of areas: higher retirement savings, more confidence about their retirement finances, better peace of mind, and an improved sense of personal wellness are just a few.

Putting Your Retirement Income Planning in Order

These guidelines are to help you get started on the right foot. Perhaps you would like another professional opinion of your existing retirement plan. Or maybe you think there are additional steps you can take toward your goals.

No matter what, if you are ready for help from a guide, financial professionals at SafeMoney.com can assist you.

Use our “Find a Financial Professional” section to connect with someone directly. You can request a no-obligation first appointment. Should you need a personal referral, call us at 877.476.9723.