Long-Term Care Planning – Why You Can’t Afford to Ignore It

Long-term care planning (or LTC planning for short) isn’t perhaps the most exciting topic. But most people can’t afford to ignore it in retirement. In one of its bulletins, AARP observes “by the time you reach 65, chances are about 50-50 that you will require paid long-term care someday.”

For Christine Benz, Director of Personal Finance for Morningstar, it’s the four-ton elephant in the room. “Long-term care is the unsolved problem for so many people,” she told AARP. And probability of use might not be the only reason why. There is also the hefty price tag to consider.

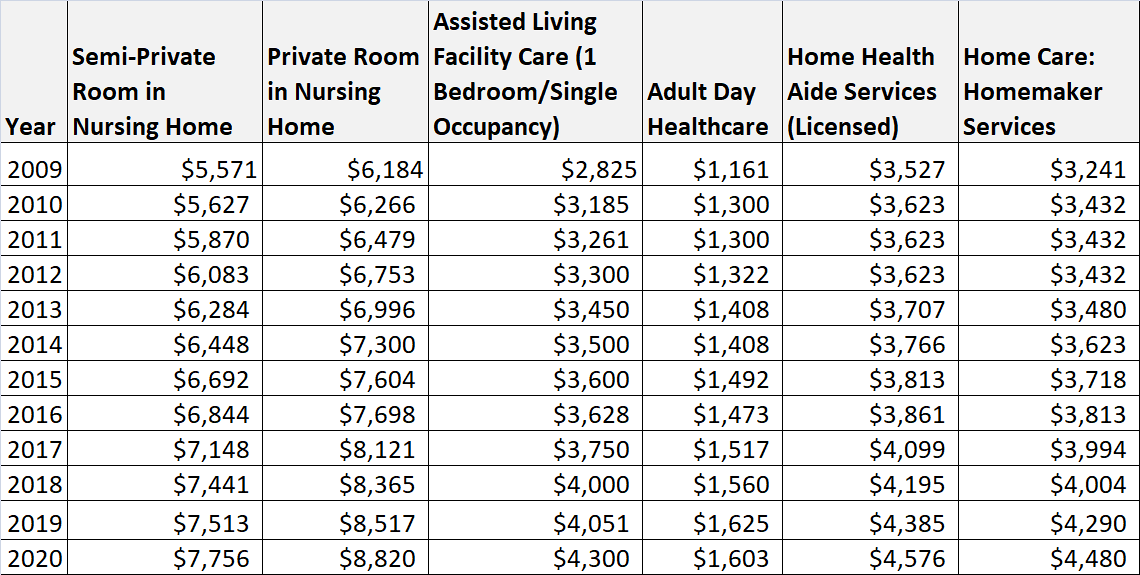

For years, Genworth has tracked the monthly national median costs of various long-term care services in its “Cost of Care Survey.” Those nationwide costs swelled by double-digit percentages from 2009 to 2020, with some LTC services seeing a 30+% cost increase.

“What about state to state?” you may ask. Let’s look at the median expense for a common LTC need, nursing home care, and its cost depends on where you live. In 2020, the least expensive state for a semi-private room in a nursing home was Texas at $5,019 per month. Meanwhile, Connecticut was the most expensive state at $12,927 per month.

Here’s another clincher to think about. Those estimates are without factoring the cost impact of other healthcare needs in retirement as well!

Knowledge is foresight, so it pays to understand the basics of long-term care and what it can entail for retirement planning purposes.

What is Long-Term Care?

According to the U.S. Administration on Aging, long-term care is “a range of services and supports you may need to meet your personal care needs.” These services include medical and non-medical care for people with chronic conditions or disabilities.

Most long-term care actually isn’t medical care services. Rather, it provides care services for those who need help with daily basic tasks. The industry terminology for these tasks is activities of daily living, or ADLs.

Some of the activities that long-term care may help with are:

- Bathing

- Eating

- Dressing

- Caretaking for incontinence or personal hygienic acts

- Using the bathroom

- Transfers to a chair, bed, or other settings

These activities aren’t the only tasks for which someone may receive long-term care. Other critical everyday tasks may also be covered. These activities are called instrumental activities of daily living, or IADLs. Examples of these tasks may include:

- Housework or homemaker services

- Grocery shopping

- Preparing meals and cleanup

- Responding to emergency alerts like a tornado alert

- Help with medication

- Pet caretaking

- Money management

- Phone communications

Long-term care services and support may be administered at home, in a facility, or in retirement community settings.

Who Needs Long-Term Care?

A study by the U.S. Department of Health & Human Services suggests that 1 in 2 Americans turning age 65 will need at least some form of long-term care.

Other estimates put forward by LongTermCare.gov said that as much as 70% of 65-year-old Americans could expect some need for long-term care in the future.

In 2000, nearly 10 million people in the U.S. needed long-term care, according to a 2003 study by researchers Roger and Komisar. In this group, 3.6 million individuals were 65 or older (over one-third of the population).

Overall, HHS researchers have found that age, gender, health condition, and presence of a disability are predictors of long-term care needs:

- As people advance in age, the more likely they will need LTC services.

- Women outlive men by as much as five years, on average, making them more likely to require long-term care.

- Accidental or chronic illnesses, or disabilities, are reasons for why people may require LTC assistance.

- Family history, individual chronic conditions, or poor diet-exercise practices may also up someone’s chances of LTC needs.

How Much Does Long-Term Care Cost?

It may be surprising, but Medicare doesn’t pay for most long-term care. Medicaid does provide some coverage of LTC services at home or in a nursing home facility. However, people must meet certain eligibility requirements for Medicaid.

You can learn more about what Medicare and Medicaid may cover here.

Since national statistics suggest that half of Americans reaching 65 may need long-term care, it’s good to see what overall costs of long-term care may be. The table below shows national median costs for different long-term care services and supports, with data from Genworth’s Cost of Care Surveys.

These costs can quickly add up depending on however long you might need long-term care. In one earlier study, HHS researchers said that most Americans requiring LTC services may need assistance for just a couple years.

However, other segments of the population, the researchers project, may require assistance for five years or longer. And even for potentially shorter periods of care, those needs could come out to substantially high overall expenses.

All of this brings up an important question. What strategies or protections can you use to minimize the risk of the long-term care cash register downsizing the quality of your retirement?

How Can You Pay for Long-Term Care?

While you will want to consult with a knowledgeable financial professional about your choices, a few options may be at your disposal:

- Self-insurance, if you have sufficient personal assets to do it and they won’t be part of your legacy goals,

- Indexed annuities with wellness benefits or confinement care benefits that can pay you enhanced income for certain long-term care situations,

- Long-term care insurance that offers traditional coverage for long-term care needs,

- New-generation life insurance policies with living benefits,

- Asset based long-term care policies that can provide tax-free benefits.

Long-term care insurance is routinely discussed in the financial press, so we will highlight those last two options really fast.

Quelling the Long-Term Care Cost Frenzy

Living benefits on a life insurance policy may also be called life insurance riders, depending on the carrier. The riders may be already built into the policy, or they may be added on for additional premium. Check with your financial professional for details about any policy you may be considering.

With those specialized benefits, you may accelerate proceeds from your death benefit amount toward certain long-term care expenses as well as costs for other qualifying health conditions. You may have the choice to accelerate part or even all of the proceeds. Your policy will spell out in more detail about what may qualify.

Now, let’s go back to the asset based long-term care policy option. An asset based LTC policy may offer lifetime long-term care benefits for individuals and couples. These policies are structured to offer those benefits on a tax-free basis, based on provisions within the Pension Protection Act of 2006.

This legislation, which came into effect in 2010, created new tax benefits for what are known as long-term care combination plans. Under its provisions, distributions from the cash value of a life insurance or annuity policy may be used toward long-term care needs.

As always, no financial product or strategy is right for everyone. Be sure to ask an experienced financial professional about these options, including potential pros, cons, or other factors that may affect your situation.

Need Help with Your Long-Term Care Planning?

While long-term care may have a heavy cost impact on retirement, it’s just one part of the overall puzzle. An effective retirement strategy will assist you in ensuring you have all of your financial ducks in a row. Pre-retirement planning can help you enjoy more financial confidence, peace of mind, and overall sense of wellness.

If you need help with exploring strategies for your retirement income and financial goals, financial professionals stand ready to help you at SafeMoney.com. Use our “Find a Financial Professional” section to connect with someone directly. Should you need a personal referral, call us at 877.476.9723.