10 Retirement Risks You Should Plan For – Part 1

Editor’s Note: This is Part 1 of a two-part series on retirement risks that we should definitely plan for. For more information on potential retirement money mistakes and how you can enjoy a comfortable retirement lifestyle, you may find helpful answers in The New Retirement Report. You can find Part 2 of this series here.

Top Ten Lists were a signature of David Letterman’s Late Night and Late Show legacies. Now that he’s 70, if Letterman were to prepare such a list today, it might look something like this: “The Top Ten Retirement Risks I Didn’t See Coming, But Should Have.”

While three decades on TV may give Dave the aplomb to tackle top retirement risks with more leniency, this isn’t the case for everybody. Not everyone can be blasé about what they face as they enter and move through retirement. To help you look ahead—and plan accordingly—we offer these Top Ten Retirement Risks You CAN See Coming.

Retirement Risks to Plan for

Here are some risks to consider when thinking ahead to your retirement future:

#1: Longevity Risk

This is definitely a “good news and bad news” risk. The good news? Statistics show you are going to live longer than previous generations have. The bad news? That means you will need more resources to fund your longer lifetime.

According to the Social Security Administration, a man reaching age 65 today can expect to live, on average, until age 84.3. A woman turning age 65 today can expect to live, on average, until age 86.6. But here’s the catch, those are just averages! About one in every four 65-year-olds today will live past age 90. And one out of 10 will live beyond 95.

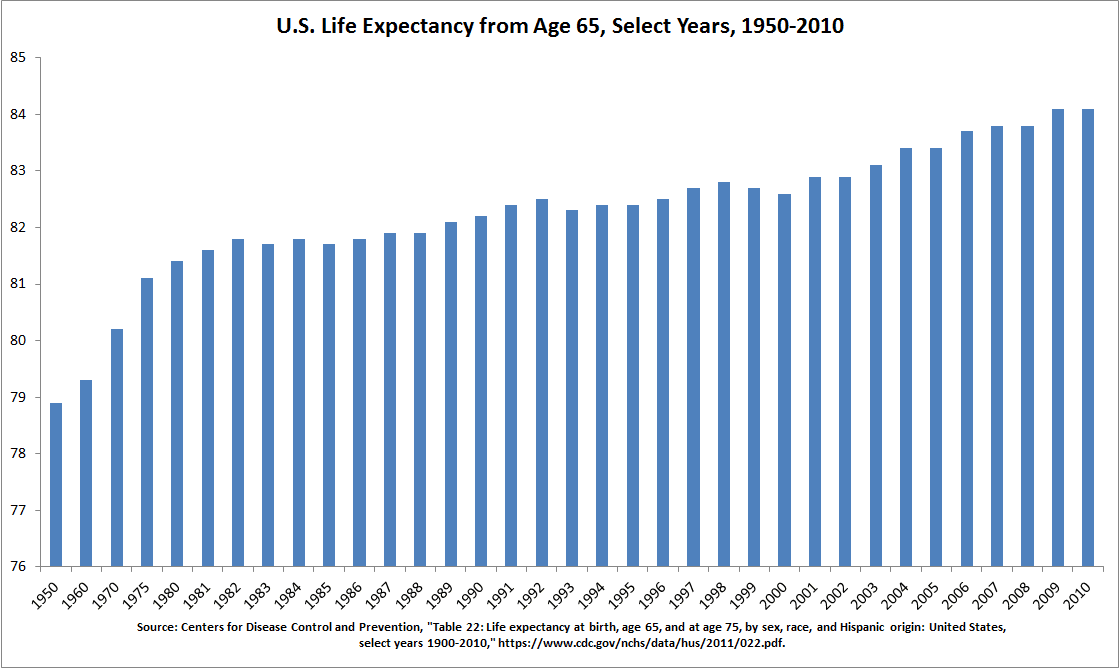

In the chart below, we can see how life expectancies from age 65 have gradually increased over time.

It’s time to calculate what you may really need for basic living expenses, medical costs, long-term care costs, and any other retirement spending projections.

#2: Health & Disability Risk

We all may anticipate the likelihood of needing more medical care as we age. But we may not foresee the impact of a sudden change to our health, including the advent of a disability. In “Addressing the Risk of Long-Term Disability on Retirement Income,” an article appearing in the Journal of Pension Planning & Compliance, David Kaleda, Emily See and Matt Schoen argue that long-term disability is a “hidden threat” to millions of workers’ retirement security.

Disability is “shockingly common,” the authors argue. They cite statistics that approximately 13% of U.S. workers will be disabled for five or more years during their time in the workforce.

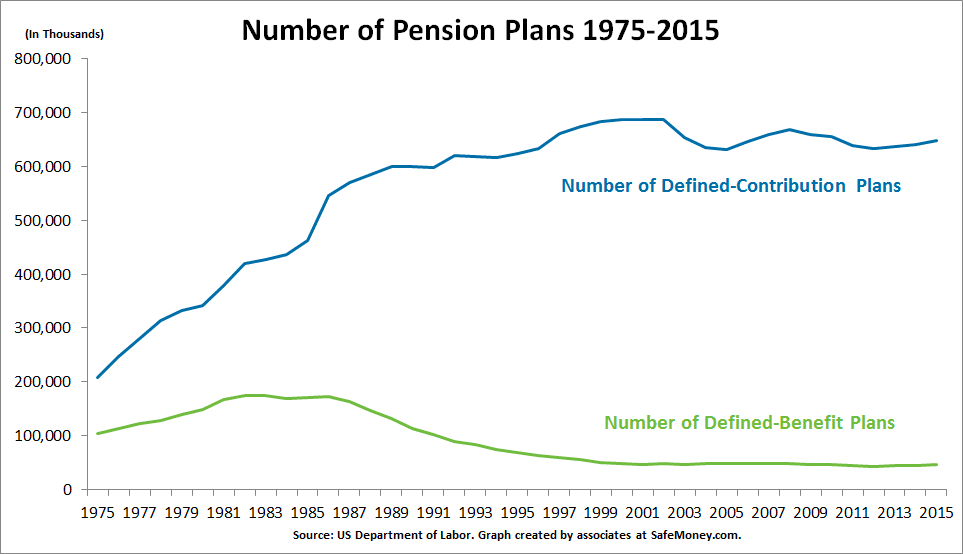

Because of our societal shift toward defined contribution plans — 401(k)s — and away from defined benefit plans — pensions — disability poses a heightened threat, as defined contribution plans generally do not accrue benefits for disabled employees. This shift can be seen in the graph below.

“A long-term disability has the potential to leave a worker with little or no retirement savings at all,” they write.

#3: Inflation Risk

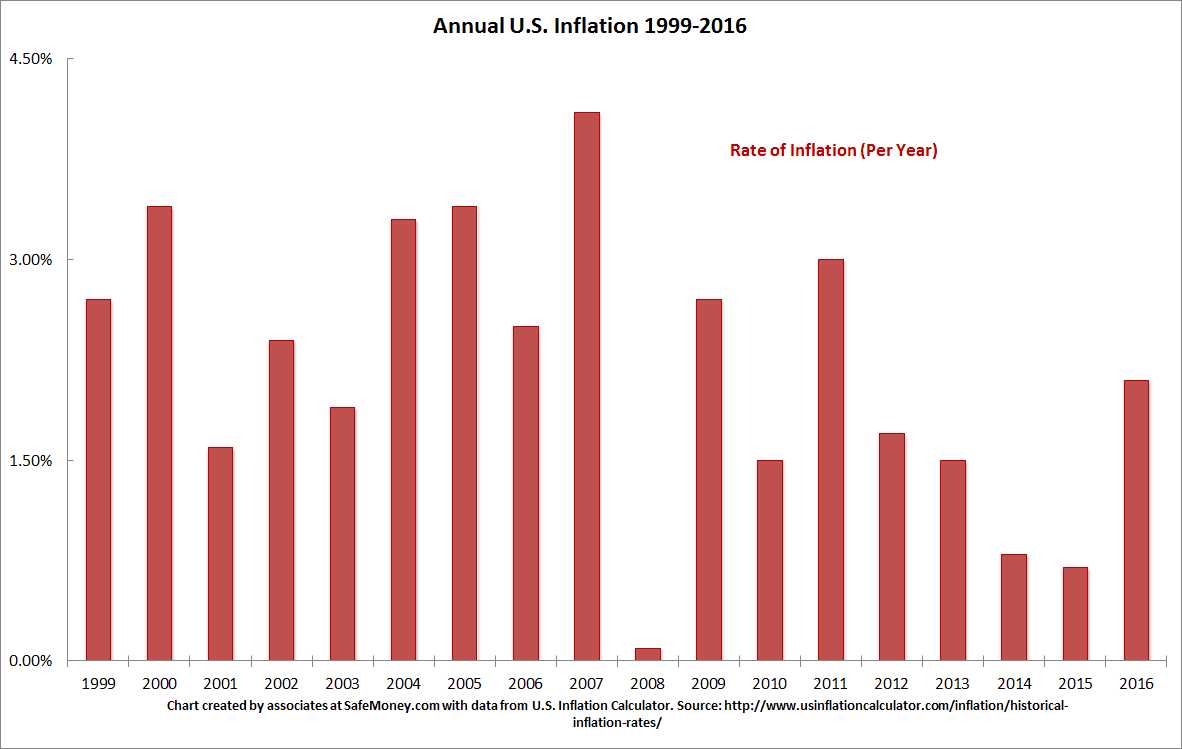

Inflation risk can be seen as purchasing power risk. Fidelity says it well: Inflation is the long-term tendency of money to lose purchasing power. And it can have a particularly negative effect on retirees because it chips away at retirement income in a few ways:

- Increases the future cost of goods and services

- Potentially erodes the value of assets set aside to meet those costs

- Potentially erodes the value of savings put aside for future retirement spending

Inflation tends to be higher for retirees due to healthcare costs, which have increased annually by 5 percent since 1981. Inflation creates an increased demand on income and is most damaging in later years of retirement.

#4: Income and Cash-Flow Risk

Retirement can definitely change your cash-flow. Your paycheck will likely be replaced by income from a variety of sources, such as Social Security benefits, personal savings, retirement account distributions, pension distributions (potentially), and annuity payments. At age 70.5, you will be required to take minimum distributions from your retirement plans.

If any of your income sources are interrupted, or if investments return less than expected results, you could face a cash-flow crisis. Careful planning will help you ensure an uninterrupted income flow.

#5: Investment Loss Risk

With recent market volatility fresh in our minds, many of us are considering what could happen if a market correction occurs before we have protected our assets from market risk. Or, what an early market drop in early retirement can mean for the rest of our golden years.

No one wants to build a healthy portfolio of stocks and bonds over a lifetime only to see it plummet in value greatly. Sequence-of-returns risk is a real threat for retirement income, even possibly meaning a reduced lifestyle standard should asset values drop too much in value.

The problem is, without a crystal ball, we can’t know when the hatchet might fall. Knowing that’s a risk, what can you do to protect and preserve critical retirement assets and savings from the chopping block?

Comfortable Tomorrows Start Today

Life doesn’t come with guarantees, but you can enjoy potentially more confidence and financial security with a rock-solid retirement plan. Working with a qualified financial professional can help you prepare for these risks as well as others, build strategies that let you achieve your goals, and bring the financial peace of mind you have worked hard for.

If you would like help from a professional who can guide you, SafeMoney can assist you. Financial professionals can help you get started with a goal-setting strategy session or answer your questions.

Use our “Find a Financial Professional” section to connect directly with a financial professional. Should you need a personal referral, call us at 877.476.9723.