Fed Study: Every American Lost $70,000 in Retirement Income from 2008 Financial Crisis

The Great Recession that began in late 2007 was a painful period in many Americans’ lives. Everyone who was invested in the market, people who were overextended in mortgages, and those who lost jobs as a result of a crippled economy, were among the millions affected.

Since then, many people have recovered from the financial setbacks. Nevertheless, a new study by the Federal Reserve Bank of San Francisco suggests that challenges linger. According to Fed researchers, the long-run effects of the financial crisis cost every American an estimated $70,000 in lifetime income.

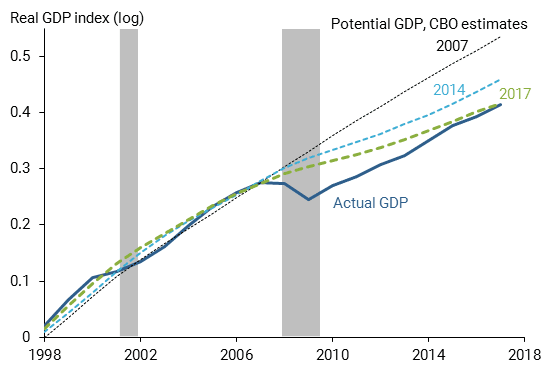

The researchers point to a big decline in domestic output levels as a primary cause of those losses. Based on early-2000s Congressional Budget Office forecasts, our national gross domestic product remains well below what its 2007 trend implies we might have been at now. And it’s said to be unlikely that the economy will ever make up that lost territory.

While that specter raises many questions, it brings up another important, practical query. How should people preparing for retirement overcome this gap?

Lingering Effects of the Financial Meltdown

Regis Barnichon, a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco, authored with two colleagues an Economic Letter on this matter.

They write: “A decade after the last financial crisis and recession, the U.S. economy remains significantly smaller than it should be based on its pre-crisis growth trend.”

One possible reason? The large losses in the economy’s productive capacity following the financial crisis.

“The size of those losses suggests that the level of output is unlikely to revert to its pre-crisis trend level. This represents a lifetime present-value income loss of about $70,000 for every American,” they report.

What’s more, no matter how our economy may grow, the researchers believe that it won’t match where we were headed in 2007. “We find that a large fraction of the gap between current output and its pre-crisis trend is associated with the large 2007–08 financial shocks,” according to the Economic Letter.

Source: Federal Reserve Bank of San Francisco, Regis Barnichon et. al., FRBSF Economic Letter,”The Financial Crisis at 10: Will We Ever Recover,” August 2018. Source link here, all rights reserved.

Author notes: Dashed lines show potential GDP estimated by the CBO in different years, measured in natural log terms, with the 2007 estimate of potential normalized to zero in 1998, such that subsequent changes are measured in fractional terms. Gray bars reflect NBER (National Bureau of Economic Research) recession dates.

“Our estimates suggest that the economy is unlikely to regain this large output loss and GDP is unlikely to revert to its previous trend level,” the authors say.

“Financial market disruptions can have large costs in terms of societal welfare by causing persistent losses in the level of GDP. This suggests that finding ways to prevent or contain future financial crises is an important research and policy priority.”

What Lessons Should We Take From This?

While none of us preparing for retirement can fathom the idea of facing a similar market dive, the effects of one would be devastating. In financial circles, such a situation, or just dealing with portfolio losses in general early in retirement, is called sequence of returns risk.

A 2018 study from the Center for Retirement Research at Boston College sums up the potential hazard.

“If households choose to hold a significant portion of their savings in equities to increase the income their savings provide, they will be more exposed to sharp market downturns that arrive early in retirement,” according to the center study.

And what about solutions for households approaching retirement?

One effective response may be to “increase their retirement income and reduce their fixed expenses,” the study concludes. “Working longer, annuitizing wealth, and taking out a reverse mortgage would increase retirement income.”

Taking Action Toward Peace of Mind

The first step toward avoiding an unpleasant shift in your retirement plan is to diversify your portfolio.

It’s especially important for those close to or already in retirement. By shifting from an accumulation mindset to an asset preservation focus, those near retirement age can seek ‘safety’ focused financial strategies to preserve and protect what they have built.

Many retirees and people of working age take a conservative approach to their invested money. If it makes sense for someone’s risk tolerance and overall financial picture, the next step toward peace of mind could mean creating a “guaranteed income bucket.”

In other words, a portion of their assets might be earmarked to annuities or other solutions offering guaranteed lifelong income. This bucket of income would supplement other sources of guaranteed income such as Social Security. What’s more, this income, when properly structured, wouldn’t change with equity market activity.

Consider Your Personal Economy

Another important point is being mindful of our personal economies. To be clear, not ‘economy’ in the sense of GDP or other national metrics, but rather what it means for us personally in dollars and cents. That covers the financial resources required to maintain your lifestyle and well-being, including:

- Your spending levels

- Your budgeting numbers

- Your monthly cash-flow

- Your sources of income

- Your portfolios, assets, and savings

- Household debt, liabilities, and other stats tied to lifelong financial habits & choices

The needs for income can vary so much from person to person, it’s almost like having your own ‘financial fingerprint.’

Retirement: A Different Financial Animal

Retirement is nominally a slowdown in the activities we partake in for decades — whether it’s salaried employment, running a business, or sustaining passive income streams. As such, it should be treated differently from other life stages in your financial planning.

Even so, many folks continue to chase the return when retirement is a different financial animal. You have to figure out how to take your accumulated assets and turn them into income-generating sources that last as long as you may need them.

Evaluating our personal economy of individual spending habits, financial goals, and month-to-month living expenses is one of the most important components of retirement financial success.

Need Help Preparing for Your Financial Future?

As you work through the “what ifs” of your retirement financial picture, you don’t have to do it alone. If you seek guidance, financial professionals at SafeMoney.com can assist you.

Use our “Find a Financial Professional” section to connect with someone directly. If you need a personal referral, call us at 877.476.9723.