Retirement: Average vs. Compounding Portfolio Effects Explained

Most people consider investment returns as a benchmark for judging the performance of their portfolio. This may be especially true for retirees and pre-retirees who likely have been invested in the market for some time. That experience might have been through brokerage mutual fund investments, brokerage accounts, or even retirement savings plans such as 401(k)s or IRAs.

But the reality is that many financial concepts rely on average returns to forecast future portfolio activity. Yet compounding growth and compounding losses are the real-life factors that will potentially affect a portfolio’s value.

In this discussion of “Retirement: Average vs. Compounding Portfolio Effects Explained,” we delve into the impact of these factors, particularly in managing sequence of returns risk—a significant concern for both retired households and those approaching retirement within the critical decade surrounding retirement

The Impact of Early Financial Losses

Sequence of returns risk is the concept that portfolio losses during your early retirement can have such a negative impact that they can be difficult to recover from. In financial circles, it’s also known as sequence risk.

Without an adequate time horizon to recover, the result could be diminished retirement income or disruption to your retirement plan. If losses are severe enough, it might even mean adjustments to your finances and lifestyle that you hadn’t planned for or anticipated.

On paper, it may seem like an investor with an early loss just has to gain back the same percentage as the loss. And here is where the effect of compounding losses comes in.

If your portfolio had a loss of 20%, a rebound of 20% wouldn’t be a full recovery. Actually, the portfolio would need to rebound 25% to go back to where it started.

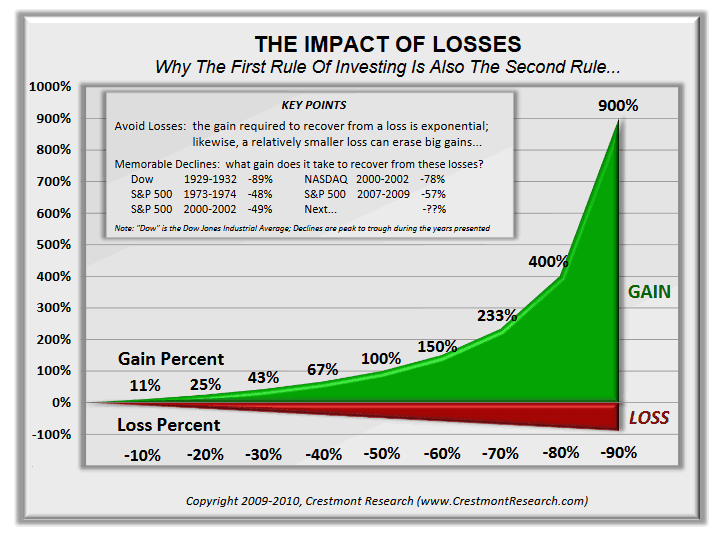

What about a loss of 50%? It would require a 100% rebound for a full recovery. Meanwhile, if a portfolio suffered a hefty 80% loss, it would need a 400% gain to return to its starting value. And these examples aren’t farfetched, as Ed Easterling of Crestmont Research observes in market performance history.

As presented by CrestmontResearch.com, “The Impact of Losses” graph by Easterling captures some of these trends. It shows how the Dow Jones Industrial Average, the S&P 500, and the Nasdaq have performed at different periods.

Source: Crestmont Research, CrestmontResearch.com “The Impact of Losses.” All rights reserved.

From 2007 to 2009 the S&P 500 dropped 57%. And from 2000 to 2002, the Nasdaq suffered a 78% decline. This isn’t to say that drops are the norm, but clearly equity markets have seen dips that low. What if a big loss hit your portfolio just as you were entering retirement?

A Common Concern

According to the U.S. Census Bureau, the average length of retirement is 18 years. So when you retire, your nest egg needs to last you almost two decades, and potentially beyond that.

We know that many of us may feel unprepared for such a long time-frame. A well-reported Allianz survey found that baby boomers fear running out of money before they die more than they fear death itself.

The conversation around sequence of returns risk, and its effect on retirement income, is an important one when considering a bigger picture: the reality of average versus compounding returns in a portfolio.

From a planning perspective, retirees can draw only on compounded returns on assets for income, not average returns on assets. After all, averages are just the “middle value” of all the changes in market index values – good and bad – across time.

Now, let’s go back to that scenario of when a portfolio suffers a loss first, then a rebound.

A net result in which the rebound doesn’t meet or exceed the loss is, of course, a net loss.

Of course, there is always volatility in how retirement portfolio assets will perform. They will go up and go down depending on specific market factors, economic conditions, and a host of other variables.

While we would like them to, portfolios simply don’t always trend up, as a forecast of average returns might suggest.

Measuring Volatility

We tend to think of stock market volatility as isolated to certain periods in time. But according to a leading authority on investment management and research, volatility is much more common than many people may realize.

Apart from being the head of Crestmont Research, Ed Easterling is also a respected author. He is the force behind “Probable Outcomes: Secular Stock Market Insights” and “Unexpected Returns: Understanding Secular Stock Market Cycles,” among other well-regarded books on investing.

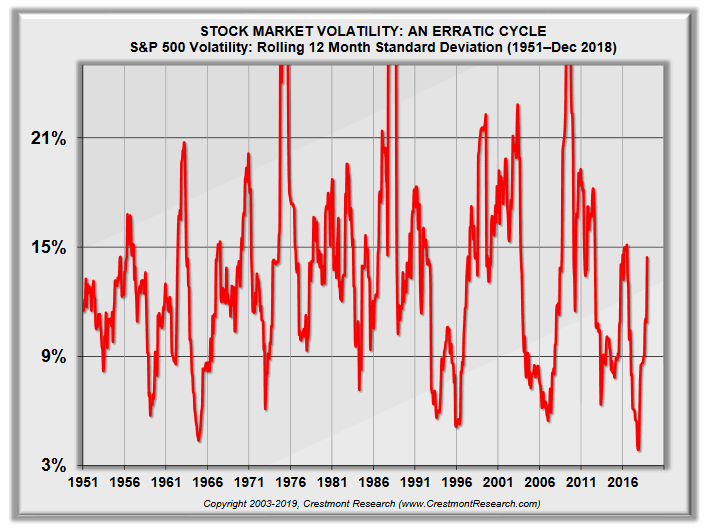

Another study by Easterling captures how market volatility can play out.

He recently published a snapshot of market volatility from 1951 through 2018. This time, Easterling broke down the data into rolling 12-month periods to examine statistical standard deviations in how the S&P 500 changed monthly.

His conclusion? Volality itself is volatile. The cycle of volatility was quite erratic, as shown in the pronounced peaks and troughs in the graph below.

Source: Crestmont Research, CresmontResearch.com, “Stock Market Volatility Cycle.” All rights reserved.

He also noted that periods of extremely low or high volatility tended to follow one another.

Another Market Study Brings Insights

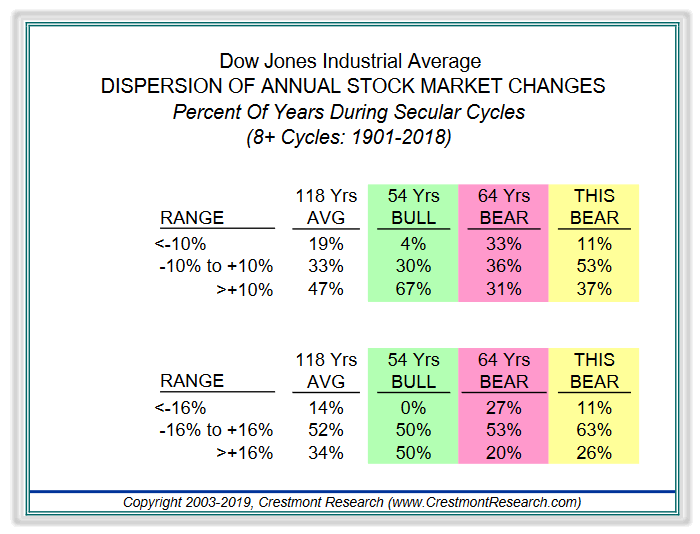

In another study, Easterling looked at 118 years of stock market performance, determining there have been 64 bear markets and 54 bull markets. This chart captures data on changes in the Dow Jones Industrial Average, when the DJIA index had single-digit changes within a range of -10% to 10%.

Source: Crestmont Research, CresmontResearch.com, “Dispersion of Annual Stock Market Changes.” All rights reserved.

In the first part of the Stock Dispersion table, Easterling notes three different ranges of index change:

1) Index losses greater than -10%,

2) Index changes between -10% and 10%, and

3) Index growth greater than 10%.

In the second part, the breakdown is:

1) index losses greater than -16%,

2) index changes between -16% and 16%, and

3) index growth greater than 16%.

Out of 118 years, the Dow Jones had index changes ranging between -16% to 16% for 52% of the time. That is more than half of the time that Easterling examined.

Consider Your Options

Knowing that volatility can be so prevalent, you might think about your current financial strategy. Once you have determined what you want for your unique vision of retirement, you may need to modify your path to get there by considering potential risks ahead of you. Do you have strategies for how you will manage and control them?

What is your risk tolerance? What are your income needs? What sources of income will you be using to pay for that ideal retirement lifestyle?

Depending on your answers to these important questions, it may be time to explore new financial options. You may want to consider strategies that can protect against the effects of compounding losses on the streams of retirement income you will use.

Does Your Retirement Need More Financial Safeguards?

With their guaranteed income assurances, annuities are often used as a strategy to safeguard income by paying for monthly living expenses — or for fixed-income needs in general. An annuity might make sense for your portfolio, depending on your personal situation, risk tolerance, time horizon, and liquidity needs.

Ask a qualified financial professional who can help provide guidance in your best interest. And if you are ready to explore your options — or you want another look at your existing retirement plan — financial professionals at SafeMoney.com can assist you.

Use our “Find a Financial Professional” section to connect with someone directly. Should you need a personal referral, call us at 877.476.9723.