Working in Retirement: Wishful Thinking or Within Reach?

Countless surveys say that Baby Boomers and Gen Xers aren’t saving enough for retirement. But a recent survey from Transamerica Center for Retirement Studies shows another place where American workers are falling short: preparing for work in retirement.

In the study, 56% of workers said they expect to work at least part-time past age 65. Among Baby Boomers, 6 in 10 (65%) expect to or already working past the traditional retirement age. More than half of Gen Xers (56%) also planned on at least part-time employment during retirement.

However, that vision may be out of reach, as few workers seem to be taking steps to make it happen. Less than half of workers (46%) are keeping their skills up-to-date, a finding that held for Baby Boomers and Gen Xers alike. And only 18% are scoping out the job market and opportunities available, with 15% of Baby Boomers and of Gen Xers alike reporting an active lookout.

Overall, a number of workers seemed to believe their employers would let them stay on part-time — which well could not happen due to present employment market conditions and practices. Meanwhile, the findings don’t bode well for expectations of working past 65. That’s even as 83% cited financial reasons as why they plan to continue doing so.

Why Work Opportunities in Retirement May be Limited

Even though a majority of workers said their current employers support working past 65, employment statistics may show otherwise. As Catherine Collinson, president of Transamerica, noted in a Forbes column by Richard Eisenberg — looking at data trends such as the labor force participation rate shows a step-off in employment after age 65.

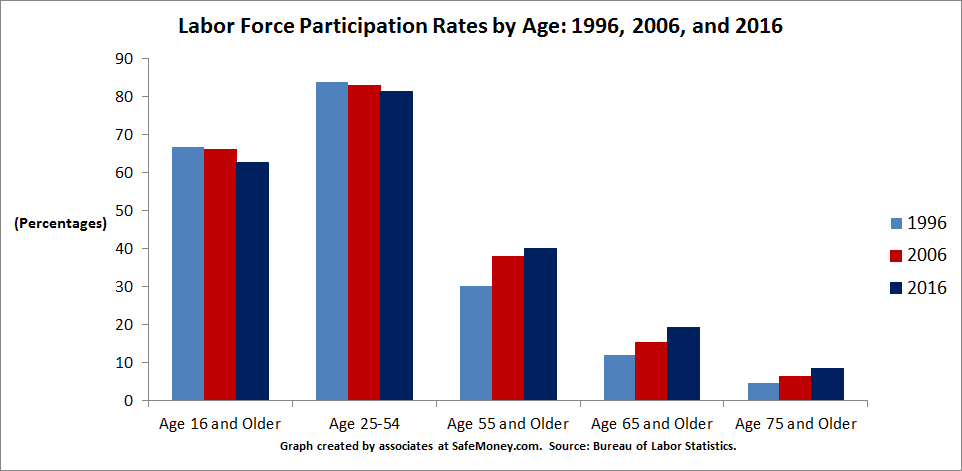

This decline in employment after age 65 can be seen in the graph below, which shows participation rates by age group over a three-decade spread.

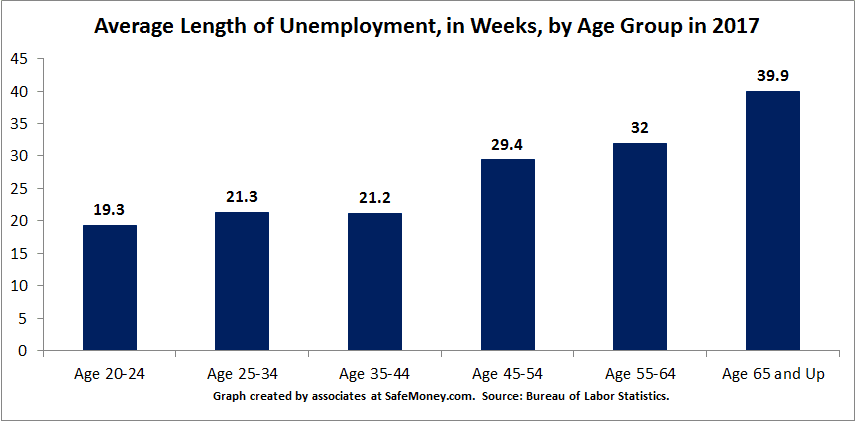

Another point of interest is duration of unemployment by age group. Compared to workers in younger age groups, workers who are 65 years and older have a longer average length of unemployment. Whereas a 20s-something had an average unemployment span of around 19-21 weeks in 2017, a worker aged 65 or beyond had an average duration of nearly 40 weeks.

Why This Matters for Retirement Planning

Retirement is the sum of many moving parts: lifestyle, social engagement, physical and mental well-being, financial security, personal recreation, spirituality. People have different visions for how they will spend their retirement years. For many, work will be just as much a vehicle for staying engaged as a source of income.

Many workers told Transamerica that they envision a post-retirement lifestyle balance of part-time work with other activities. 3 in 10 cited paid work as a retirement dream, with pursuing an encore career, starting a business, or continuing to work in the same field being top-mentioned goals.

From a financial planning perspective, retirement work expectations affect a lot of areas:

- People behind in retirement savings may view continuing employment as a long-term post-retirement source of income.

- However, many people find themselves retiring earlier than they planned, with many surveys reporting health as the deciding factor.

- Workers planning to stay with their current employer may believe they will have benefits in part-time work.

- In the Transamerica survey, 3 in 5 workers (60%) indicated they believed they would keep the same level of benefits, but many employers don’t offer benefits to part-timers.

- Changes in workplace benefits can affect retirement saving goals.

- Perks that came with full-time employment, such as tax-advantaged employer retirement savings plans, might not be available with part-time work.

- That can shrink the amount of savings vehicles available to workers, and if they are already behind on saving, they will need to adjust their retirement savings strategy accordingly.

- Reductions or loss of benefits that provided cost relief, such as health benefits, may mean that a shift to part-time work means more healthcare and other personal costs to shoulder.

These survey findings suggest that U.S. workers should start thinking more realistically about working in retirement, particularly the ways they wish to. Whether working at a current employer or someplace else, find out if you will be eligible for benefits. That includes whether contributions to an employer-sponsored retirement plan, like a 401(k), will be an option, and whether health benefits will continue to be available.

Preparing for the Future

There are other ways in which you can prepare to work during retirement in the way you envision. If a current employer is attractive, as Eisenberg notes, when nearing the departure date from full-time work, you could discuss with your supervisor your options. That may be serving as a part-time, paid mentor to new hires or promoted persons.

Of course, it’s also important to diversify your post-retirement job prospects. Networking, training for new skills, and researching employment opportunities in your preferred area to retire are ways to plan ahead. Even so, just 4% of Baby Boomers and 10% of Gen Xers report “going back to school and learning new skills” to stay ahead with in-retirement job opportunities.

And if part-time work will be a source of income for you in retirement, it’s important to ensure you have other income sources in place, too. Changes in health could prompt work interruptions or even an outright workplace departure, which could drastically change your income picture.

Working with a retirement-focused financial professional helps you plan proactively for your work vision and other retirement goals. They will help you plan for other income streams, get those in place, determine what liquidity you need for emergency situations, evaluate your complete financial picture. Overall, it’s about getting you ready to enjoy your retirement with confidence.

Ready for Personal Financial Guidance?

As you make decisions about your work expectations, a financial professional at SafeMoney.com can help you efficiently plan the rest of your retirement financial puzzle.

Get in touch with someone directly by using our “Find a Financial Professional” section. If you need a personal referral, call us at 877.476.9723.