Planning for Longevity in Your Retirement

Good news: People are living longer. But with increasing lifespans comes greater financial risk, like outliving your retirement money or facing costly health expenditures. Planning for longevity in retirement has become crucial. Decades ago, many Americans worked for the same company for years, often receiving a defined-benefit pension. Then, they shifted into a comfortable post-work lifestyle. However, times have changed. Retirement could now last 20-30 years, or even 40 years! This brings the challenge of preparing financially for an extended post-work lifespan. Here are some quick tips to help you plan.

How Quickly Has Longevity Evolved?

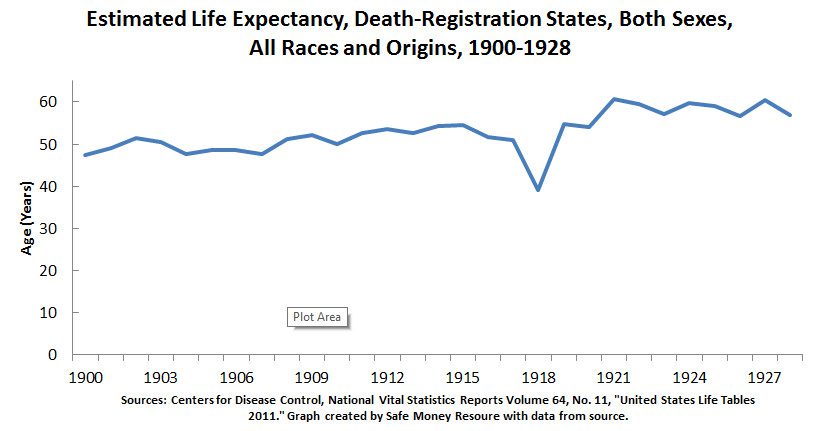

Life expectancy statistics paint a compelling picture. In 1900, life expectancy rested a little north of 47 years. Over the next 28 years, it gradually increased, as the graph illustrates below.

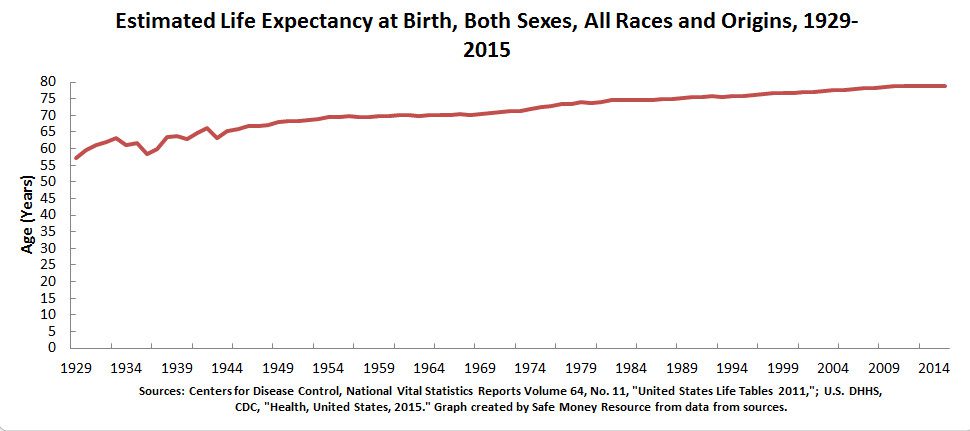

From there, life expectancy takes a drastic, upward surge. In 1950, it was 68.2 years. By the end of the 20th century, it increased to 77 years – a 30-year gain in just a century. Historically, this was an unprecedented leap forward in quality of life improvements – and the rapid pace at which those gains arose was equally historic.

In 2015, life expectancy reached 78.8 years. The point is quality of life standards have evolved rapidly. This raises the question of how we can prepare to live longer, and live comfortably, moreso than our predecessors did. It’s certainly an interesting question as long-term retirement planning models continue to evolve, and one we should consider as we discuss ways to plan for longevity, below.

Steps to Prepare for Longevity in Retirement

Look past life expectancy. When planning for retirement, what should you use as an age benchmark? The problem with life expectancy is it’s just an average. It’s an estimate of how one-half of people will pass away before attaining it, and the other half will exceed it. Financial planning for up to an older age in retirement is definitely a prudent tactic.

An age benchmark that financial professionals are increasingly turning to is probability of reaching select ages. In a survey commissioned by InvestmentNews, advisors reported using an average lifespan of 91 for men and 94 for women in retirement income plans. According to the Centers for Disease Control and Prevention, in 2014 a 65-year-old woman could expect to live for another 20.5 years, and a 65-year-old man another 18 years. Future projections indicate there could be 1 million people reaching age 100 in the United States by 2050, as well.

The point is a planning marker using later-term ages, whether in the form of probability of reaching a select age or a fixed planning horizon up to a certain age, is better than use of life expectancies. For couples, it’s important to account for partner timelines in financial planning, as well. Data from the CDC indicates women are likely to outlive their partners.

Develop a clear vision for your post-work lifestyle. When it comes to pre-retirement lifestyles, we tend to take cues from social norms and our parents’ example. Some common life goals for many Americans that fall before retirement include:

- Working on your career or business

- Attaining a satisfactory level of professional success

- Achieving higher levels of income-earning power

- Buying or building a home

- Getting married

- Having children

- Working toward a certain net-worth

- Developing robust personal and professional social networks

However, post-work narratives aren’t as clearly defined or laid out. In many cases, people may be working with a blank slate in terms of their retirement goals and expectations. And as lifespans increase, the golden years might well be mixed chapters of recreation, work, volunteering, and other forms of community involvement.

So, develop a clear vision for what you hope to achieve in retirement. Do you and your partner have travel aspirations you have been putting off? Do you want to start your own business? Pursue consulting opportunities, but on your own time? Want to spend as much time as possible with loved ones, such as grandkids? Become more involved with your community or social networks relating to your personal passions?

As you and your partner envision your ideal lifestyle, unpack expected day-to-day activities from more infrequent objectives, such as traveling to another country. This will help distinguish expenses tied to these objectives into different areas of retirement spending, and help separate daily living expenses from more infrequent, miscellaneous expenditures. Then you can develop a clearer picture of what your monthly fixed-income needs are likely to be over the long run.

Tip: Read “5 Steps to Building an Effective Retirement Plan” to help you prepare for greater retirement success.

In the financial planning process, then it’s a matter of shifting from an accumulation mindset to an income and spending mindset. Your retirement plan should include long-run projections for monthly household budgetary needs, based on anticipated monthly and miscellaneous spending goals, and be matched with the income sources from which you will pay for those needs.

Consider working part-time to offset effects of increasing longevity risk. Work life extensions may be beneficial in a number of ways. Under various retirement planning models, such as the 4% withdrawal rate strategy, people may be depleting their nest egg for 20-30 years or longer. That could lead to considerable anxiety, even if someone’s financial resources are quite extensive. Maintaining some participation in the workplace can not only help supplement your finances with additional income, but help combat inflation. Wages tend to increase over time.

However, if you do work longer, there are downsides along with the upsides. Working longer may not be in the cards for as long as we would like. According to research from LIMRA Secure Retirement Institute, 49% of retirees say they retired earlier than they planned, with a plurality reporting health being the primary motivating factor.

Retirement employment can also affect income from Social Security. You are eligible to claim your benefits starting at age 62. For many baby boomers, the Full Retirement Age is 66. If you elect to claim your benefits before your Full Retirement Age, your benefits could be permanently slashed.

For every $2 of earnings above $16,920, the Social Security Administration deducts $1 of benefits. And if you claim in the year of your Full Retirement Age, but months before your actual FRA date, $1 of benefits will be deducted from every $3 of earnings over $44,880. Make sure any working plans account for these potential downsides.

Consider diversifying income sources. As you consider the long-term picture, consider what sources of income you’ll be drawing from. Some questions to consider:

- What asset allocation does your portfolio and overall financial holdings have? What is your diversification strategy for retirement?

- Does it offer the right level of safety for your income – particularly protection from effects of market volatility?

- Are they optimized to generate the lifelong income you will need in retirement, possibly for as long as 20-30 years or even more?

- What are the tax implications of when you will be drawing income from those sources?

- How does the timing of your Social Security claiming tie into your overall income planning picture?

Remember, we have talked about how retirement can well last for many years. If you worry about having sufficient income certainty for all that time, you may want to consider strategies offering permanent, lifelong income you can rely on for all your retirement years.

Use our Find a Licensed Advisor section to connect directly with an independent financial professional, and to request a personal strategy session to discuss your needs and goals. And should you have any questions or concerns, call 877.476.9723.