What Are the Risks with Annuities in a Recession?

Annuities have become increasingly popular in recent years. While due to many reasons, two big ones are that annuities pay guaranteed income and provide tax-advantaged growth for your money.

The biggest advantage of their guaranteed payouts? Your income stream doesn’t change with political or economic conditions, such as a recession.

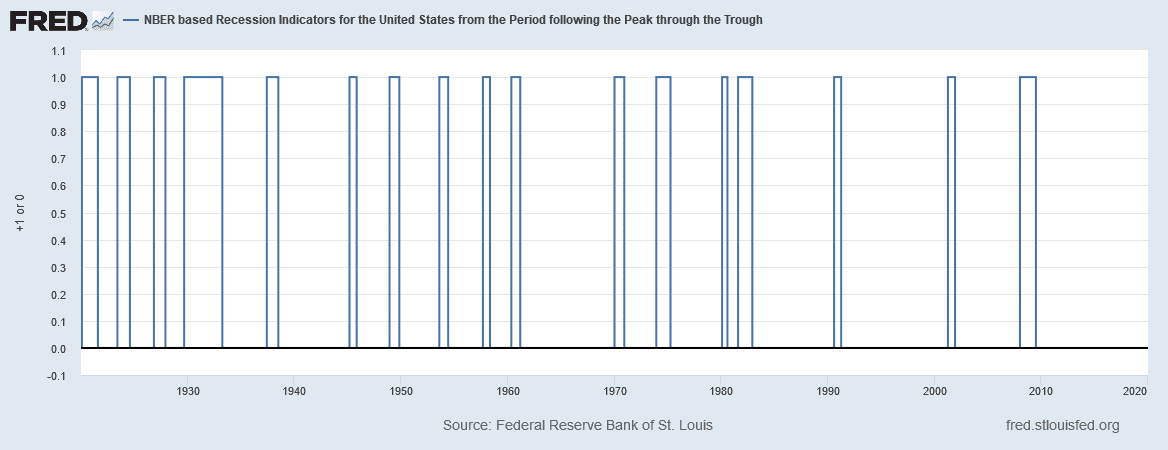

The technical definition of an economic recession is two successive quarters of negative economic growth. The National Bureau of Economic Research (NBER) is the body that determines when the U.S. economy is going through a recessionary period.

According to research by NBER and graph data from the Federal Reserve Bank of St. Louis, the United States has been through 17 recessions since 1920.

Annuities come in all sorts of flavors, but the two primary flavors are fixed annuities and variable annuities. One type of fixed annuity, the fixed index annuity, is so popular with retirees and working-age retirement savers, it’s also worth a mention.

The biggest risk with annuities in a recession is risk of loss – or how much the money you have parked in the annuity loses value due to market conditions. Depending on the type of annuity you hold, your money might be at greater risk for loss based on how the market behaves.

Let’s go into more depth about these annuity types and how a recession affects them differently.

How Do Annuities Work?

Annuities are a kind of insurance product. They come from life insurance carriers. In exchange for a lump-sum payment or series of payments, the insurance company pays you a secure, steady stream of monthly income payments.

Depending on how you set up payments with the insurance company, the income stream can last for 5 years, 10 years, 20 years, or even life. Not only that, the payouts can be structured so that only person receives them or that two spouses receive income. These are called “single life” or “joint life” payouts.

The IRS tax law classifies annuities as retirement savings vehicles. This gives them special tax treatment.

The money you put into an annuity grows tax-deferred, meaning the dollars you accumulate from its growth aren’t taxed until they are withdrawn. Your withdrawals are taxed as ordinary income.

Once you start your income from the annuity, you receive a monthly check that is always for the same amount. Many people flock to annuities because of the secure income streams they pay out for retirement.

What Risk Do Different Annuities Carry?

In a recession, variable annuities carry more risk than fixed annuities. In fact, variable annuities are the riskiest type of annuity.

The money inside a variable annuity is invested in a selection of funds called subaccounts. The subaccounts rise and fall with the values of the underlying securities (stocks, bonds, or real estate) that they hold. These fund choices are directly linked to market indexes, which recessions generally cause to go down.

On the other hand, fixed annuities give you guaranteed fixed interest rates. The interest rate is pre-set and is guaranteed for a certain period. Your fixed annuity contract will earn this interest no matter what the stock market does. Therefore the value of your money doesn’t go down.

Because fixed annuities protect your money during down periods, many people buy them for peace of mind. One type of fixed annuity, a fixed index annuity, allows you to earn interest based on an underlying index benchmark, but without market risk to your principal.

Fixed Index Annuities and Their Interest-Earning Potential

Fixed index annuities are a special kind of fixed annuity. They don’t pay a guaranteed rate of interest like fixed annuities.

Instead, the interest that they pay is linked to an underlying financial benchmark like the Standard & Poor’s 500 price index.

When the benchmark rises in value, the insurance company will credit the contract with interest based on a portion of that index increase. And when the index declines? The index annuity contract earns zero for that period, so the value of your money stays the same in spite of the index loss.

In return for this non-guaranteed rate, most fixed index annuities pay more interest over time than traditional fixed annuities. Keep in mind, though, this interest isn’t guaranteed, and in exchange for protection of your money, the insurer can also limit your index annuity’s growth with caps, participation rates, or spreads.

While your principal and earned-interest money are protected in fixed and fixed index annuities, your money could lose purchasing power due to inflation in periods when you earn low or no interest.

How Can Recessions Affect Variable Annuities?

In times when the market isn’t doing so well, it’s possible to lose money in a variable annuity. Why? Because they offer no guarantee of principal.

However, they can also provide better growth for your money than fixed or indexed annuities can because their potential for growth isn’t limited.

But variable annuities are by far the most vulnerable type of annuity to a recession of the three types of annuities. After all, the markets usually decline during a recession. This is due to the higher risk-reward relationship of variable annuities.

Fixed Annuities and Recessions

Contrast that with fixed annuities, which have less exposure to risk. When you start a fixed annuity contract, the insurance company takes the bulk of your premium dollars and puts them into low-risk, fixed-income instruments.

Under the law, life insurance companies must maintain dollar-for-dollar reserves for every dollar of fixed annuity premium they receive from you (and other policyholders). And these underlying investments are what support the insurer’s contractual guarantees to you.

With fixed annuities, most of these fixed-income assets are in Treasury securities and bonds. Many insurers include high-quality corporate bonds and mortgage-backed securities as part of their underlying holdings so they can boost yields from their overall portfolios.

The life insurer is legally bound to protect your principal, so your money is indeed quite safe in a fixed annuity during an economic recession.

What About Fixed Index Annuities?

In a fixed index annuity, the life insurer also invests in excess of 90 cents of every dollar into these types of underlying investments. But it also takes 3 to 5 cents of every dollar of index annuity premium and puts it toward call options on an underlying financial benchmark.

The value of these options will rise if the benchmark increases in value. This is how the insurer covers their upside liability with these contracts.

This is one reason that an owner of a fixed index annuity can have more growth potential for their money than in a traditional fixed annuity. Even so, when the underlying benchmark index falls, the money inside a fixed index annuity is protected from losses due to the index drop.

Indexed annuities can’t decline in value with index losses. But they will earn zero interest if their underlying financial benchmark posts a negative change during the crediting period.

Fixed annuities are quite impervious to recessions because of their guaranteed interest rates and safety of principal.

The Biggest Distinction for Risk Among Variable and Fixed Annuities

The chief difference of the risks of variable and fixed annuities, especially during a recession, can be seen in one interview with an insurance company executive.

Will Fullner of Lincoln Financial sat down for an interview with Retirement Income Journal. During then, he talked about how the premium dollars of fixed-type annuities go into the insurance company’s general account.

Here, insurers generally commit over 90 cents of every dollar of fixed annuity premium into low-risk, fixed-income assets. Those assets have relatively long maturation periods. The 10-year Treasury is considered a benchmark for insurance companies in this regard.

Compared to the market-based funds of variable annuities, these underlying fixed-income investments are quite safe.

Fullner explained the difference between a fixed index annuity as a “general-account product” and a variable annuity as a “separate-account product.” He said:

“The no-loss guarantee in FIAs came about because, by definition, a general account product is a principal-protected product. A separate account product can ‘break a buck,’ but a general account product can’t. The original target market for the FIA, if you remember, was the CD [certificate of deposit] buyer. We’ve been in a declining rate environment for almost 40 years. The FIA was born in an era when CD rates were coming down. People wanted safety but they also wanted a rate greater than they could get from a CD.”

Insurance Companies and Their Institutional Requirements

Earlier, it was mentioned that life insurance companies have heavy capital requirements. They must maintain, at minimum, dollar-for-dollar reserves in cash or cash-type equivalents for every dollar of premium they collect.

Not only that, life insurance companies go through routine audits so their risk for insolvency can be monitored. It makes it more efficient for detection of when an annuity company is starting to falter. Then insurance regulators can start working to resolve those issues.

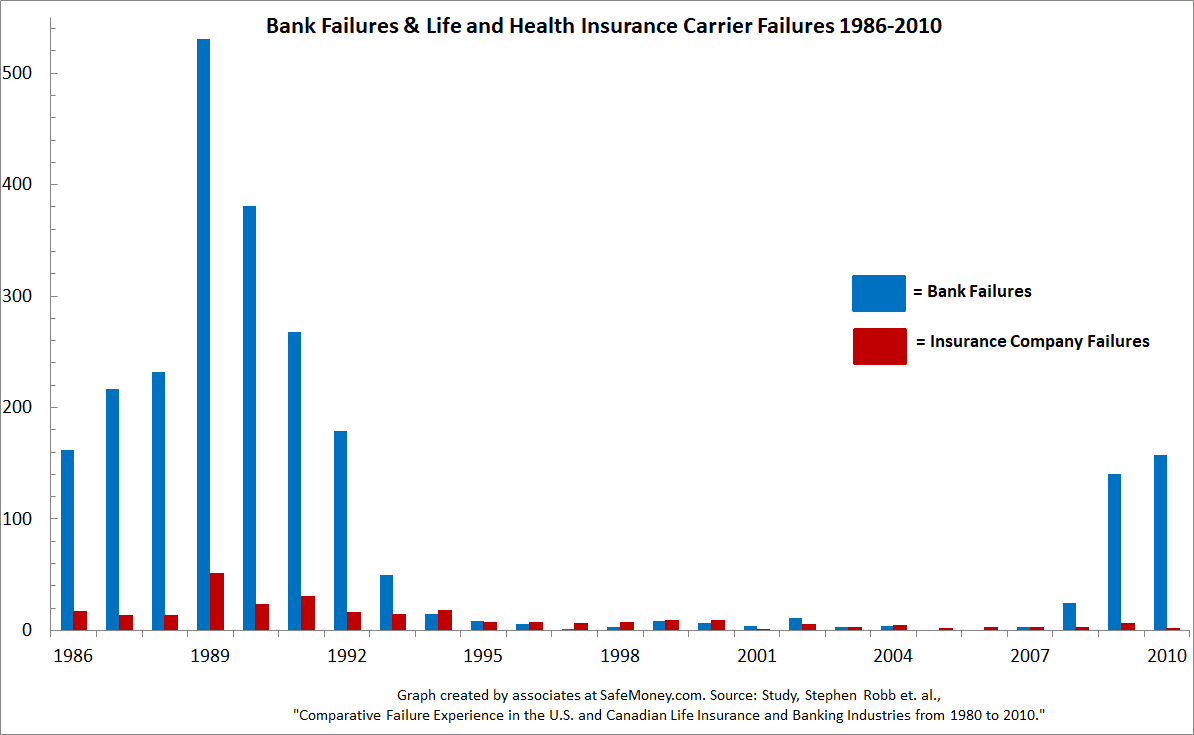

Hence fixed annuities tend to hold up quite well during recessions. To give an idea, you would think that the recessions of the 2000s had a strong effect on insurance company failures, but check out the graph below.

This doesn’t mean to suggest anything about insurance companies relative to bank failures, but rather how both institutions fared during these times.

Keeping Retirements Financially Secure in All Economic Seasons

The different annuity types offer varying degrees of protection from recessions. As market history shows, recessions tend to make market indexes decline. How much risk of loss you might face depends on what annuity you own.

Variable annuities are the most vulnerable but generally have the most growth potential. Index annuities protect your principal, but their values remain flat when their underlying index declines. Your money might lose purchasing power due to inflation in those times.

Fixed annuities are generally the type of annuity with the least risk during a recession. The insurance company is still on the hook, legally speaking, to pay you interest, even if the economy is in slowdown mode.

Put More Financial Peace of Mind in Your Corner

Consult your financial professional for more information on annuities. What if you are looking for a financial professional who understands annuities? Someone who can guide how you can put those “what ifs” for your retirement to rest?

No sweat. Help is a click away at SafeMoney.com, where many financial professionals stand ready to assist you.

Use our “Find a Financial Professional” section to connect with someone directly. You can request an initial appointment to discuss your situation. Should you need a personal referral, call us at 877.476.9723.