How to Use Catch-Up Contributions to Boost Your Retirement

Why Catch-Up Contributions Matter More Than Ever

If you’re age 50 or older, the ability to make catch-up contributions can provide a powerful boost to your retirement savings and income strategy. With longer lifespans, rising costs, and new rules in effect, those extra contributions can make a significant difference.

In fact, for 2025 and beyond, retirees and near-retirees face not only the challenge of accumulating enough, but also converting that into reliable income. Industry insights show the shift toward income planning, lifetime income solutions, and smart use of tax-advantaged tools.

Understanding Catch-Up Contributions

Catch-up contributions allow workers age 50+ (and in some cases older) to contribute above the standard limits to retirement accounts such as 401(k)s and IRAs. This gives you a chance to accelerate savings as you approach retirement.

For example:

- In 2025, the 401(k) catch-up limit for those age 50+ stood at an additional $7,500 for many plans.

- Not all plans are identical—some employers may offer even higher limits or different rules depending on age and income.

These extra dollars not only increase your savings but can help create a stronger foundation when converting savings to income.

How Catch-Up Contributions Help Your Income Strategy

1. Adds More Principal for Lifetime Income

By contributing more now, you grow the base you’ll need when converting savings into income (annuitizing, creating a personal pension, etc.). This strengthens your “income floor” and reduces risk of outliving your money.

2. Benefits From Tax Advantages

Catch-up dollars are often pre-tax (for 401(k)s) or may qualify for tax credits. This lowers your taxable income now—or if using a Roth catch-up (depending on plan rules), creates more tax-free income later.

3. Helps Offset Rising Costs & Inflation

Because lifetime income strategies depend on the size of your savings and timing, every extra dollar you contribute increases how much monthly income you can build later—helping keep pace with inflation, healthcare costs, and longevity.

4. Leverages Legislation & Workplace Trends

As industry research notes, plan sponsors and advisers are increasingly focusing on retirement income and broadening choices for plan participants. Catch-up contributions align with this shift, allowing you to take advantage of these enhanced options.

Who Qualifies & What to Check

- You must typically be age 50 or older by year end to make catch-up contributions for that year.

- Verify with your employer’s plan or your IRA provider for specific limits, eligibilities, and deadlines.

- In 2026, rules may shift further (especially given evolving legislation and industry trends). Stay informed.

- Check whether your plan offers Roth catch-up options (after-tax) or only traditional pre-tax. The choice affects your future tax and income flexibility.

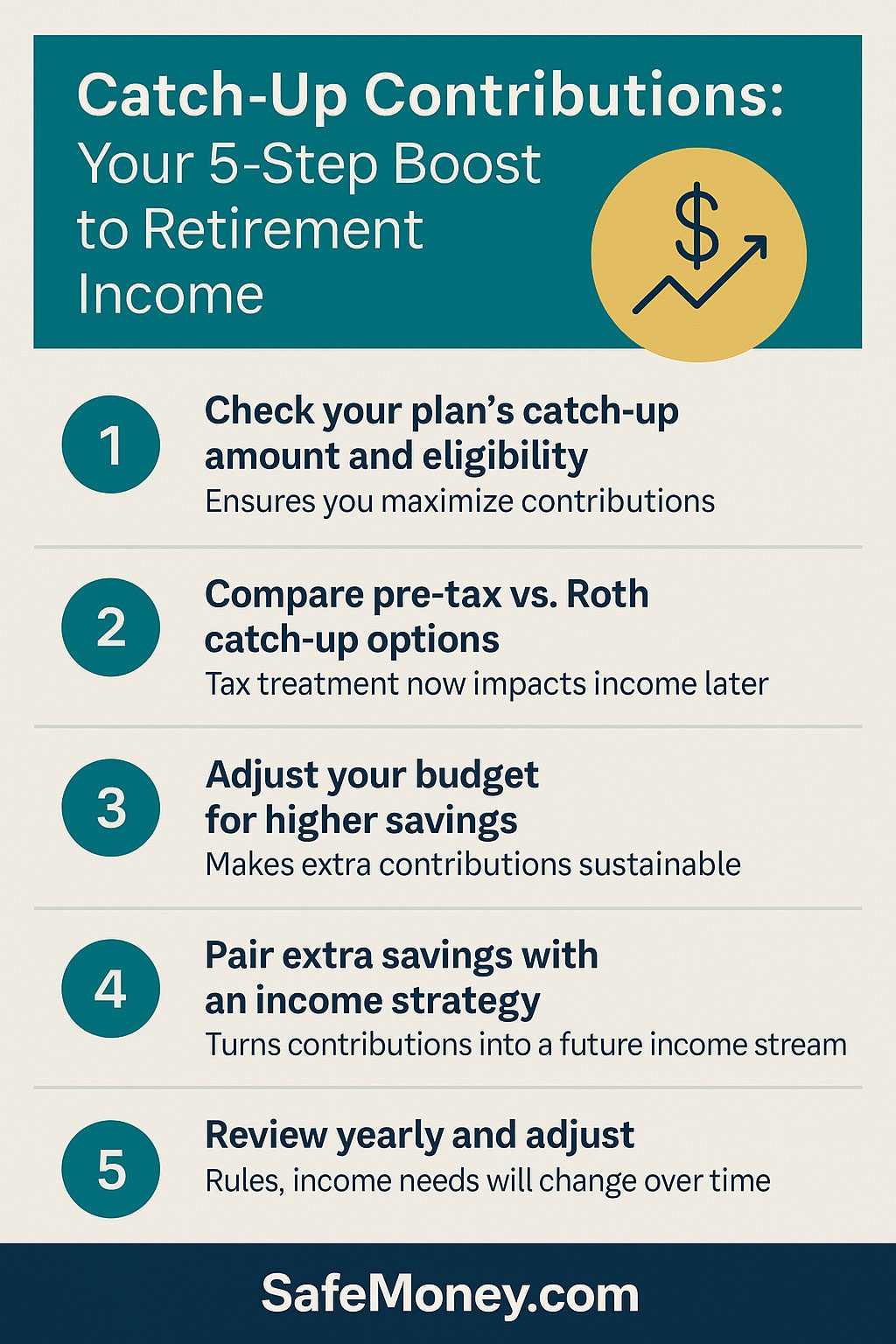

Step-by-Step: How to Maximize Your Catch-Up Strategy

| Step | What to Do | Why It’s Important |

|---|---|---|

| 1 | Check your plan’s specific catch-up amount and eligibility. | Ensures you know exactly how much extra you can contribute. |

| 2 | Compare pre-tax vs Roth catch-up options. | Tax treatment now affects income later. |

| 3 | Adjust your budget and cash flow to accommodate higher savings. | Makes the extra contribution sustainable. |

| 4 | Pair extra savings with an income strategy. | Converts contributions into a future income stream, not just savings. |

| 5 | Review yearly and adjust. | Rules, income needs, and markets evolve — review keeps your plan current. |

Common Mistakes to Avoid

- Skipping catch-up because “I’m too busy” – Every extra dollar counts, especially when converting to lifetime income.

- Using catch-up as “extra spending money” – The goal is to strengthen your retirement income floor, not just boost savings.

- Ignoring tax treatment of contributions – Whether you choose pre-tax or Roth affects future income, tax liability, and flexibility.

- Not linking contributions to income planning – Dumping savings into accounts without planning how you’ll use them later can leave gaps.

Final Thoughts

If you’re age 50 or older, catch-up contributions are one of the most under-utilized yet high-impact tools available to strengthen your retirement income plan. They not only boost your savings but help you build a foundation for guaranteed lifetime income, reduce tax risk, and protect against the unknowns of retirement.

Take action now: check your plan limit, decide pre-tax vs Roth, adjust your budget, and integrate the extra savings into your broader income strategy.

Because when you’re adding not just dollars—but security, confidence, and future income—you’re not simply saving for retirement—you’re planning for a lifetime.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Sources: Alight Solutions • Charles Schwab • J.P. Morgan Asset Management • Internal Revenue Service (IRS) • U.S. Department of Labor • Fidelity Investments

Disclaimer: This article is for informational and educational purposes only and should not be construed as financial, tax, or legal advice. Consult a licensed professional about your specific retirement savings and income strategy.