How can High 401(k) Fees Affect Your Retirement Success?

As prior posts have mentioned, the 401(k) is the retirement savings plan most used by U.S. employers. Millions of Americans use it for their retirement saving goals. It’s no surprise as to why.

For one, the IRS permits pre-tax employee contributions of up to $22,500 (2023 contribution limit). Plan participants aged 50 and up are able to make pre-tax, “catch-up” contributions of an additional $7,500. Many 401(k)s also come with an employer match, providing a powerful savings incentive for U.S. workers.

Yet while the 401(k) is a valuable retirement savings vehicle, it has its downsides. One negative is the presence of high cumulative fees within some 401(k) plans and their in-plan investment menu. Over time, costly high fees can dwindle away earnings, which also siphons off money that would grow with compounding.

So there is also the opportunity cost of the money investors could have earned if those funds remained within their 401(k). It could be a difference of thousands, if not tens of thousands of lost dollars in potential retirement income.

9 Out of 10 Americans Fail to Pay Attention to Fees

Unfortunately, many people struggle in their knowledge of their 401(k) plans and investmentsy. This trend also applies to the public awareness of fees in 401(k)s. Many people underestimate what they pay, or don’t even know much about it.

This may be an issue for many people participating in 401(k) plans, unfortunately. In one study by NerdWallet, over 90% of Americans were found to have no idea of what their 401(k) fees were.

In another survey by Cerulli Associates, 45% of U.S. households reported a belief that they receive financial advice at no cost, or an uncertainty of whether they even pay for it.

What Effects can High Fees Have?

The average 401(k) plan’s fees tend to add up to roughly 1% of assets under management. All 401(k) plans have management and administrative fees, which are there to cover the costs of plan maintenance. Where other fees can add up are in the expenses tied to the investment funds you chose in your plan. For one, depending on whether a fund is passively managed or actively managed, the expense ratio of a fund can vary greatly. In turn, that determines how much investment operating expenses can impact someone’s 401(k) balance over time.

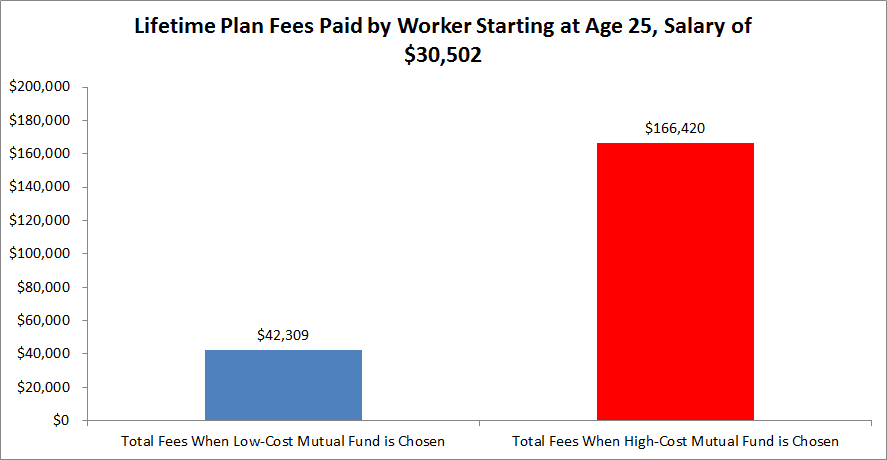

Take, for instance, some research on the historical impact of lifetime plan fees from the Center for American Progress. Say a worker has the option of investing in a mutual fund with a total expense ratio of 25 basis points – or 0.25% — and another mutual fund with a total expense ratio of 100 basis points – or 1%. Let’s see what the difference of .75% in annual fees can do over time.

Going back to the Center for American Progress’s illustration, assume our worker is 25 years old. Other important variables:

- She will save 5% of her annual salary in her 401(k) plan

- She has a 10% employer match

- Her yearly income is $30,502, the median income for workers within this age group

- She plans to stick with her savings goals for her working lifetime

With just the 0.25% fee of the low-cost mutual fund, her total lifetime fees would amount to $42,309. And as for the amount paid in lifetime fees for the higher-cost mutual fund? $166,420 – an over $120,000 difference!

Graph created by associates at SafeMoney.com. Source: “Fixing the Drain on American Retirement Savings,” Center for American Progress, Jennifer Erickson and David Madland.

According to Deloitte and the Investment Company Institute, investment operating expenses and fees typically represent 82% of all-in plan fees. Recordkeeping, administrative, and financial advice fees generally make up 18% of all-in plan fees, Deloitte and ICI also report. Some plans do account for recordkeeping and participant service expenses in the investment fees, though.

The Deloitte/Investment Company Institute study also found on average, plan participants pay 87% of total plan fees. With these figures, it’s not hard to see how costly high plan fees can erode retirement wealth. It could mean more years of working to make up for the financial shortfall, or even having to scale back retirement expectations.

Working Towards an End of Financial Illiteracy

401(k) owners can learn more about these fees in the plan literature, particularly the summary plan description and annual report. Much of the impact of high fees can be traced back to 401(k) plan participants’ lack of knowledge and neglect in paying attention to them.

Apart from careful review of plan literature, Americans would do well to boost their financial awareness in general.

Jim Chilton, of the Society for Financial Awareness, says the general effects of financial illiteracy are costly. When emotionalism drives our financial behavior, it ultimately leads to setbacks.

“Our behavior is our individual foundation of our financial identity. We want to look, act, and come across prosperous to all who know us – to do that, we are in a constant “hamster wheel mentality” of attempting to keep up with the folks we’re around: family, friends, neighbors, coworkers, church members, and so on,” he writes in the San Diego Union-Tribune. “This perpetual chase is quite damaging. Thus:

- Divorces are ascending to 60 percent.

- School loans have now surpassed auto loans and credit card debt combined.

- College graduates are coming out of school to a plethora of low paying or part-time employment.

- Prescription medications for anxiety and depression are at an all-time high”

Ultimately, financial demises can be reversed or avoided with a change in behavior, leading to self-discipline. It begins with saying “no,” as Chilton asserts.

Get Financial Help Now

Do you have a 401(k) plan? Will it be part of the bedrock which you depend on for retirement income? Do you have questions or concerns about how you can create an income plan that helps ensure your money lasts as long as you do? If you could benefit from personal guidance, a financial professional from SafeMoney.com can assist you.

Should you be ready to see if you are on track with your retirement financial and income goals, a SafeMoney.com financial professional can help you.

Use our Find a Financial Professional section to connect directly with an independent financial professional and request a personal strategy session to discuss your needs and goals. Should you want a personal referral, please call us at 877.476.9723.