How Long Can Bear Markets Like Coronavirus Has Reached Last for?

If you have any money in the market, chances are you have heard of recent slumps in U.S. market indexes.

From February 21st to February 28th, the Dow Jones Industrial Average index fell 12.4%. That drop was quickly followed by a couple of record setters in March. The worst drop in three decades came on March 13th.

The Dow fell 10%, its then-worst decline since the 1987 Black Monday market crash. Then, on March 16th, the market indexes had another record-setting drop. The Dow fell 12.9% and the S&P 500 declined 12% in one day, respectively.

On the whole, investor concerns over the novel coronavirus and the oil supply feud between Russia and Saudi Arabia have sent global financial markets into a tailspin. For those on the cusp of retirement, the timing couldn’t be worse.

Of course, every market is different. As a result, no one can be 100% sure of what will happen next. Even so, what might retirement investors face in the near future?

The decline has actually taken us into bear territory, which is typically defined a market drop of 20% or greater.

But as Peter Oppenheimer, chief global equity strategist at Goldman Sachs, observes, there hasn’t ever been a bear market spurned by a viral outbreak.

Entering New, Uncharted Territory

If we were to classify the coronavirus market activity as an “event-driven” bear market, it would be a first. But what have retirement investors faced with other event-driven market situations?

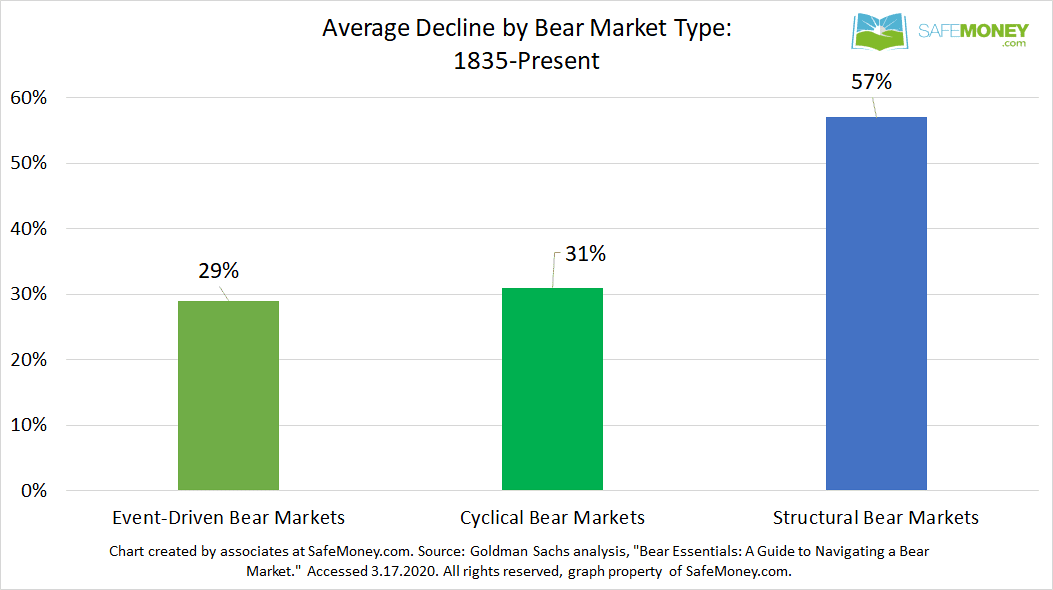

To give people a gander at the past, Goldman Sachs analysts looked at bear markets going back to 1835. They grouped the bear markets into three cohorts: structural bear markets, cyclical bear markets, and event-driven bear markets.

How Did the Markets Perform?

On average, event-driven bear markets saw a decline of 29%, according to the analysts. They also argued the current trends with coronavirus fears fit the model of an event-driven market scenario.

Structural bear markets saw an average decline of 57%. For cyclical bear markets, it was an average of 31%, the Goldman analysts found.

Goldman defines structural bear markets as drops being caused by financial bubbles or imbalances. In many cases, a shock to prices follows, such as deflation, according to CBS MarketWatch reporter Steve Goldstein.

In the case of a cyclical bear market, Goldman says this is a market drop coming on the tail end of an economic cycle. The cyclical bears’ markers are usually rising interest rates, imminent recessions, and declining corporate profits.

In the case of an event-driven bear market, an external shock is the culprit. Historical factors include oil crises, wars, or national crises in countries that have “emerging market” status. In other words, they are on the cusp of becoming a developed nation.

According to the Goldman analysis, on average, event-driven declines can last for longer than 20 months. But on the flip-side, markets tend to regain their footing and climb back to their prior highs within 15 months, says Oppenheimer.

Is This Time Different?

That being said, Oppenheimer sees some differences in this market compared to past event-driven declines. For one, interest rates are currently at incredible lows. That is when interest rates have already been at low levels for over a decade.

Because of that, pundits say policymakers don’t have as much “wiggle room” to combat the economic fallout with monetary policy. After all, interest rates have already been compressed for quite some time.

In contrast, past event-driven declines were more effectively counteracted with monetary policy responses, according to Oppenheimer.

Then, the nature of the external shock is also new this time around.

Novel coronavirus’ high contagion factor is leading many people to stay home. Or, at the very least, people aren’t going out in public as much as they were pre-corona.

Many companies and organizations are also sidelining their employees. If possible, they have moved them to telecommute positions. They are also taking other measures to “flatten the curve” of virus spread, such as canceling conferences and meetings.

Staying Home and Its Economic Effects

As a result, this “environment of fear,” as Oppenheimer puts it, compresses demand. People are remaining at home, whether by choice or by force.

Fiscal policy responses by Congress also are uncertain. Political gridlock in Congress, a brutal election approaching in 2020, and opposing party control of both houses of Congress may make it hard for lawmakers to meet in the middle.

Currently, some coronavirus spending bills have been passed and are underway. But there have been differences of opinion between Democrats and Republicans on what fiscal stimulus might look like.

Why It Matters for Retirement Savers

For retirement savers who are close to departing the workplace, taking heed is prudent.

Sequence risk can disrupt their retirement outlook, as they suffer losses in their early post-work years. As they live off their assets, those withdrawals just compound the effects of those initial losses over time.

The timing of when you retire and start living off the lifetime fruits of your labor couldn’t be more important in this regard.

How You Can Protect Your Retirement Security

However, there are many things that people close to retirement can do for future financial security. There is a type of annuity called a fixed indexed annuity that is linked to one of a variety of underlying benchmark indices.

When the index rises in value, then the annuity owner will receive interest based on a portion of that growth. But when the index falls in value, the annuity owner stays ‘high and dry’ and suffers no loss due to the index drop.

This type of annuity is rapidly growing in popularity for this reason. It can also provide a guaranteed income stream for life. However, many contract holders simply elect for recurring payouts so they can still access their money in the contract.

A Wide Variety of Solutions for Protection

Many types of indexed annuities are available in the marketplace today.

Each has its own set of features that should be understood in order to be used correctly. Some indexed annuities are designed foremost for growth. Meanwhile, others are built to maximize and pay steady monthly income.

Where should you start? With your financial advisor’s help.

Start Planning for Your Retirement Financial Comfort Now

Your advisor can help you determine the right strategies for protecting your “mission-critical” assets. Their guidance can also assist you with planning for dependable income streams, no matter what happens to the market.

Ask your advisor about how a fixed indexed annuity can help you grow your money while keeping it intact. Be sure to explore how the guaranteed income stream from an indexed annuity can strengthen your overall portfolio’s performance.

What if you are looking for guidance from a financial professional? Help is just a click away at SafeMoney.com. Many financial professionals are ready to assist you with your retirement and financial goals.

Use our “Find a Financial Professional” section to connect with someone directly. You can discuss your goals, concerns, and financial situation in your initial appointment. Should you need a personal referral, call us at 877.476.9723.