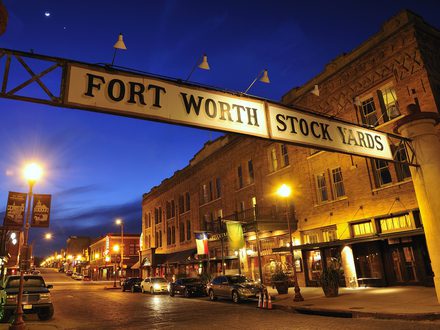

Federal Retirement Planning – Fort Worth, TX

Are you looking for your help with your federal retirement planning in the Fort Worth area or someplace else in the Dallas-Fort Worth Metroplex? Federal employees have great benefits, but their retirement benefits are also among the most complicated programs worldwide. Making well-informed choices starts with understanding your options, and it can be hard to understand your benefits, their ins-and-outs, and how different choices may apply in your situation. For example, do you know how much it would cost to leave a survivor benefit to your spouse if you passed? What if your spouse passed away first — what would happen to the money?

You deserve to know what different situations may entail. To that end, it pays to work with an independent and experienced federal retirement planning consultant who can explain your federal benefits to you. Start by searching for a federal retirement planning expert in Fort Worth or nearby. Find someone active in your community and open to answering your questions. At SafeMoney.com, we work with independent federal benefits experts serving Fort Worth, Saginaw, Haltom City, North Richland Hills, Hurst, Bedford, Euless, Colleyville, Arlington, Kennedale, Mansfield, Forest Hill, Crowley, Benbrook, White Settlement, Weatherford, and the surrounding areas.

If you have questions about what your benefits will look like now and at separation of service, your options for retirement, common benefits mistakes, and technical questions such as the cost of a survivor benefit, generating reliable income from your TSP, how life changes impact your benefits, and so on, we can help. We can usually cover all your federal retirement benefits planning questions in an hour or so.

Give us a call at 877.476.9723, and we will connect you to a SafeMoney.com independent financial strategist. They will run a comprehensive federal benefits analysis report for you, where you can identify gaps in your benefits and ways to cover them. Both the report and the meeting are free. You will walk out with a better understanding of your federal benefits and what different options can look like. Contact us today to request your benefits walkthrough.

A Mandate for Federal Benefits Education for All Federal Employees

Request Your Federal Benefits Analysis

Join hundreds and hundreds of other federal employees from all agencies -- gain clarity for your financial future. Complete the form to request your free federal benefits analysis and walkthrough.

There is no standardized system that is set for the U.S. Government to educate its employees. What was your personal experience? Perhaps you went through a hurried orientation presentation and were given an 800 number (with long waits) to call if you had any questions.

Your benefits affect the financial well-being of your family, not to mention you personally. This widespread lack of knowledge of U.S. Government employees about their hard-earned benefits isn’t acceptable. You more than deserve to understand your benefits, different options, and how various life changes as well as other situations may affect things.

When you are ready for help with your federal retirement planning, contact us. Our SafeMoney.com financial professionals have been privileged to serve many U.S. Government employees around the United States. Your federal retirement planning guide will answer your questions and provide you with a free, personalized federal benefits analysis so that you can envision your future 10, 20, or even 30 years from now (depending on where you are in your career).

What Can a Federal Retirement Planning Consultant Do for You?

The federal employee benefits that you have earned will depend on the retirement system to which you belong: CSRS or FERS. Most federal employees (90+%) are covered by FERS, but some long-time federal government employees belong to CSRS.

If you are in a unique employment situation with the federal Government, such as in a law-enforcement role of some sort, you may have unique benefits, or your benefits may be computed in a unique way. Talk to us for help with your individual situation.

Whether you are a new career hire or a long-time GS/GM-level employee, searching for information on your federal employee benefits may have been a hassle of an experience. Lots of information is available online, but it can be all over the place. What’s more, much of that information is cookie-cutter or one-size-fits-all — hardly a good fit for your personal conditions.

You need this benefits information customized to you so you can make well-informed financial decisions for you and your family. Instead of settling for generic, across-the-board guidance that isn’t about you, why not work with someone who can answer your specific questions about your benefits? They can show you more about your specific benefits, provide computations for what they look like now and in the future, and explain your options to maximize those benefits.

When you contact us, we will connect you with a SafeMoney financial professional who can answer your toughest questions and more. They will also provide you with a free, personal, integrated federal benefits analysis.

What’s In a Federal Benefits Analysis?

Your federal benefits analysis will an integrated walkthrough of all your benefits, including your pension, life insurance coverage, surviving spouse benefit options, retirement investment plan, and how everything ties together.

These different aspects of your federal retirement planning picture will be covered:

- Computations for your federal employee benefits

- Present and future pension calculations

- TSP, FEGLI & Social security projections, among others

- How much money you will have each month when you retire

- Survivor benefits, and life coverage information

- Different timing options for you to retire based on your benefits and income

Your federal employee benefits consultant will be able to answer your questions about your report. They can also answer questions on topics like military buyback, sick leave, and CSRS offsets.

Get Some Clarity on Your Benefits and Answer Your Federal Retirement Planning Questions Today!

Have Questions About Your Financial Goals?

877.476.9723You can request your free integrated federal benefits analysis and report via the form on this page, or by phone. Call us at 877.476.9723 and we will connect you to a SafeMoney.com independent federal retirement planner serving the Dallas-Fort Worth Metroplex.

Over the years our SafeMoney.com team has helped tens of thousands of households learn and plan for a successful retirement. If you are looking for an explanation of different options for your benefits and financial future, please feel free to reach out at any point.

Give us a call, and we will show you how personalized service can make a difference to your retirement strategy. We look forward to serving you!