How Debt is Crippling Americans’ Retirement Goals

According to MagnifyMoney, people are carrying more than goal checklists into retirement. A recent analysis by them looked at data from the University of Michigan Retirement Research Center (MRRC) Health and Retirement Study. Their results found that more Americans are shouldering debt in their 50s and over.

It’s a serious finding, given that Americans have named mortgages and other debts among their top five money concerns. In the study, MRRC researchers survey over 20,000 Americans aged 50+ on many topics of financial well-being. This publication showed survey results from 2014.

MagnifyMoney found a number of debt trends that could undermine, or even cripple, the retirement goals of numerous Americans. Let’s look at how debt is affecting older Americans and their post-work lives.

Older Americans’ Debt is Increasing

Both the percentage of older Americans with debt and the debt load they’re carrying are rising. In 1998, about 37% of people ages 56-61 shouldered debt. Their average debt load, in 2012 dollars, was $3,634.

Contrastingly, in 2014 42% of people within that age group carry debt. On average, their debt load is $17,623, a 385% increase from the 1998 debt-load level. And the effects of inflation on mortgages don’t fully explain the increase, says MagnifyMoney.

More than Just Rising Mortgage Costs

According to MagnifyMoney, nearly one-third (32%) of people aged 50 and up carry non-mortgage debt from month to month. On average, those with debt have $4,786 in credit card debt and $12,490 in total non-mortgage debt.

As MagnifyMoney points out, debt obligations can do a number on people living on a fixed income, since interest rates on debt tend to rise faster than asset earnings. In fact, some older Americans were carrying debt levels they might not be able to pay.

Credit Card Debt a Weighty Factor

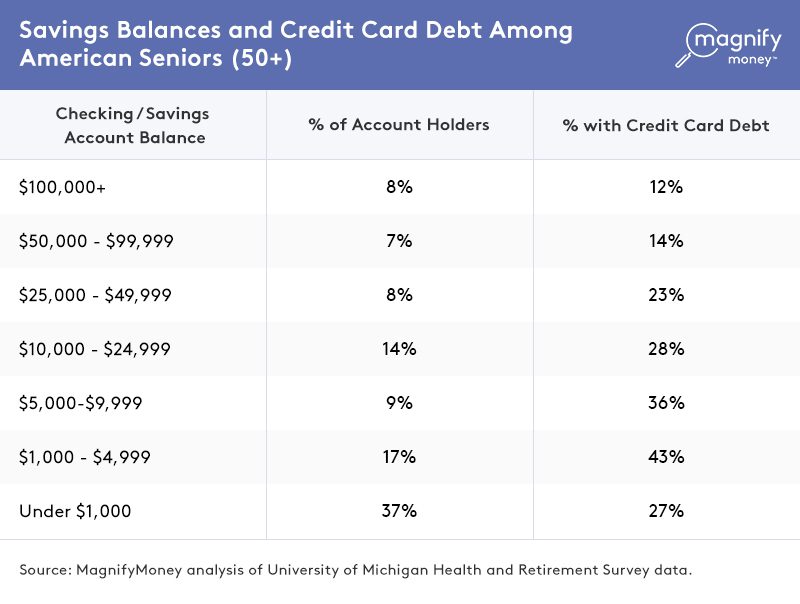

According to the analysis, 40% of all older Americans carry credit card debt exceeding $5,000. Going further, 22% have a credit card debt burden of over $10,000. On average, those holding $10,000+ in credit card debt don’t have enough money in their checking accounts for debt payoffs. The graph below shows different account balances for those with debt and no debt, as reported by MagnifyMoney.

Less Than $1,000 in Checking Accounts

The findings were also noteworthy on the cash reserves side. In the analysis, 37% of older Americans were found to have a checking account balance of less than $1,000. Among credit card debt holders, 2 in 10 (27%) had less than $1,000 in their checking accounts.

This lack of financial liquidity makes it difficult for people to handle other retirement expenses, let alone debt obligations.

Debt Widens Gap Between Goals and Reality

Older Americans with credit card debt exhibited other shortfalls in financial wellness. For instance, seniors without debt were found to have an average net-worth of $120,000. On the other hand, seniors with debt had an average net-worth of just $68,000.

According to the Federal Reserve Bank of St. Louis, the average interest on credit cards is 14%. A range of historical interest rates for credit cards can be seen in the graph below. This puts pressure on older Americans at a point when interest rates on safe financial instruments are already meager. And for older-aged Americans with smaller amounts of liquidity, that’s a wider gap for them to overcome when recovering from financial emergencies or large expenses.

Other Financial Pressures Besides Credit Card Debt

The analysis also found other financial pressures for older Americans beyond credit card debt, including:

- Student loan debt

- Other debt like car loans

- Supporting adult children and/or grandchildren

- Medical costs, including unexpected healthcare expenses

Part of the student loan debt burden is tied to support of younger generations. Nearly 3 in 4 (73%) of older student loan debts has debt benefiting children or grandchildren. Overall, the number of people over 60 with student loan debt shot up from 600,000 in 2004 to 2.8 million. Back in 2004, these individuals owed $6 billion, whereas today older Americans carry a whopping $66.7 billion in student loan debt — a more than 10x multiple from 2004!

Now, in regard to other generational money habits. A 2015 Pew Research Poll, 61% of American parents gave financial support to children within 12 months at that time. And 23% reported giving recurring financial support.

Working Towards Resolution

To get out of the debt debacle, some strategies advocated by MagnifyMoney include: coming up with a debt reduction plan, looking for ways to downsize including your home, limiting support of adult children, and working longer. While debt loads are burdensome, they are just one part of financial life. Overall, it’s prudent to work with a financial professional who can consider your situation, evaluate your needs and goals, and create a strategy to achieve your objectives.

If you’re looking for strategies to get your financial house in order — or to achieve other income and financial goals — financial professionals at SafeMoney.com are ready to guide you. They can help you discover powerful solutions using an assortment of retirement, financial, and guaranteed insurance strategies.

Use our “Find a Financial Professional” section to connect with someone directly. And if you need personal guidance, call us at 877.476.9723.