Social Security Benefits to Get a Big Boost in 2018

Good news! Next year, Social Security beneficiaries will get their biggest raise since 2012. The Social Security Administration reports that monthly benefits will receive a 2% Cost-of-Living Adjustment (COLA) in 2018.

For the average retiree, the increase amounts to around $27 extra a month. For the year, it adds up to an extra $324 in benefit payments. Social Security beneficiaries will see increased payments in January 2018, while increased payments for SSI beneficiaries will begin on December 29, 2017.

While this is welcome news, another development may offset the increased benefits for retirees. Many retirees actually may see little or no increase in payments. Most beneficiaries have Medicare Part B premiums taken from their Social Security. For those who have benefited from the “hold harmless” provision of Medicare law in recent years, Medicare may eat into some or all of the raise.

Let’s get more into the details of this now.

Medicare to Offset Benefits Raise?

First, let’s address “hold harmless.” Under Medicare law, the “hold harmless” clause means Medicare Part B monthly premiums can’t go up at a faster pace than Social Security’s yearly cost-of-living increases. This helps ensure that net benefits from Social Security do not decline.

In Medicare Part B, most participants pay a base charge for coverage. Higher-level income earners pay surcharges as well. In 2017, the base charge amount was $134. The trustees of Medicare predict that this will stay the same in 2018. More on that in a bit.

The hold harmless provision applies to 70% of Medicare participants who are enrolled in the Medicare and Social Security programs. Those outside the protection of hold harmless are:

- People who have delayed filing for Social Security benefits

- Persons who paid Medicare surcharges due to higher income levels

- Individuals who are newly enrolled in Medicare Part B

- People who are certain retired state or retired federal government workers

For the past two years, Social Security COLAs have been meager or not given at all. In 2016, Social Security saw no cost-of-living increase. As a result, the monthly premium amount for those protected under hold harmless stayed the same as before, which then was $104.90.

In 2017, Social Security beneficiaries saw a small COLA of 0.3%. As a result, the average monthly premium under the hold harmless provision rose, but not quite up to the level of the base charge amount. In fact, the average premium cost for those under hold harmless went up to $109.

Now Social Security will be receiving a 2% COLA, the biggest bump in years. Now the millions of Medicare participants, under hold harmless, may be paying the full amount of $134 per month. That would be a 22.9% increase in monthly premium from $109 in 2017.

What Have Social Security COLAs Been in the Past?

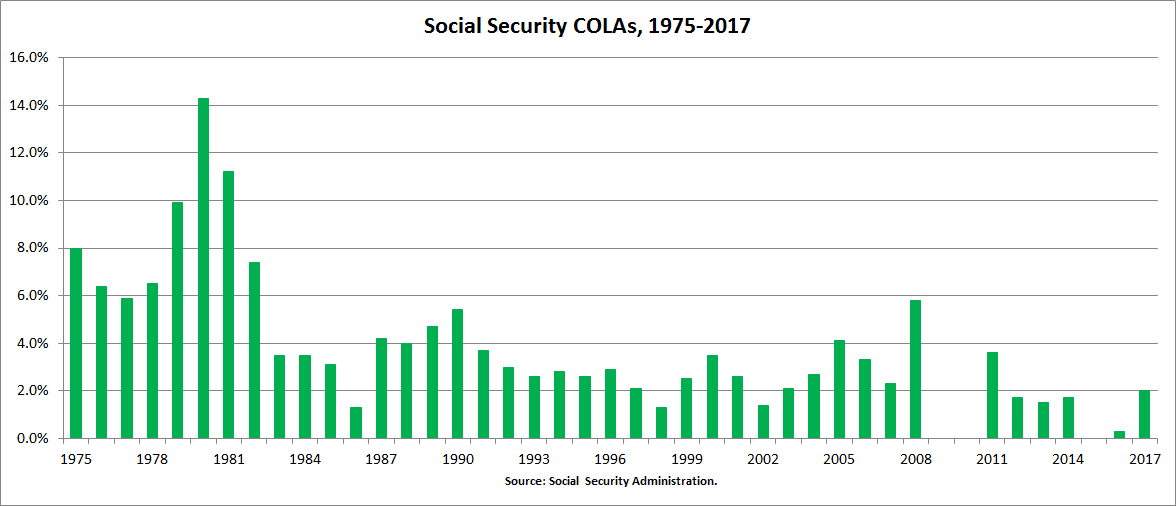

Prior to 1975, benefit increases were set by legislation. In 1975, Congress passed new laws that pegged Social Security benefit increases to cost-of-living adjustments, or COLAs.

Since 1982, COLAs have gone into effect with benefits payable for December. The graph below shows the values of annual COLAs over time.

COLAs and Inflation

While Social Security COLAs do help with rising costs of living, inflation continues to outpace them. That is particularly true of the rising costs of healthcare. In a recent report by HealthView Services, HealthView researchers projected healthcare inflation to rise 5.47% annually in coming years. A retired couple, turning 65 in 2017 and receiving average Social Security benefit payments, could pay up to 59% of lifetime benefits toward total lifetime healthcare costs. For a couple turning 55 in 2017, that figure can go up to 92% of lifetime benefits upon reaching Medicare age.

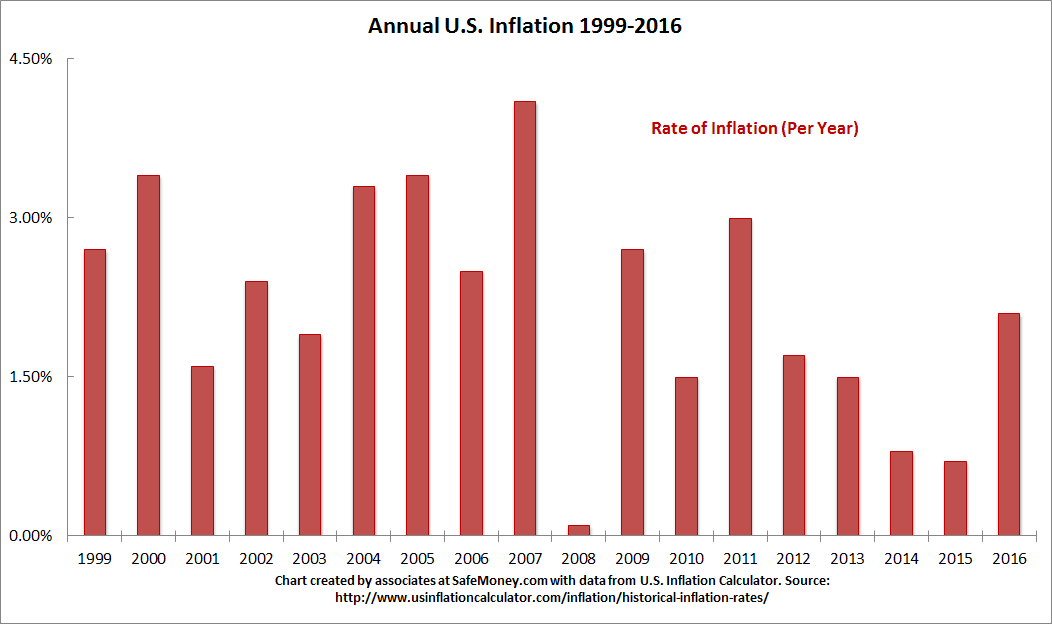

Overall, annual inflation patterns can be seen below for 1999-2016.

When it comes to retirement planning, this underscores the importance of having other income sources beyond Social Security. A solid financial plan will not only include strategies to deal with inflation, but also other potential risks to retirement income. Working with a retirement-focused financial professional can help you develop efficient strategies for Social Security, tax obligations, income, and protections against potentially costly retirement risks.

Final Thoughts

If you are ready to create a dependable plan that equips you with more confidence, financial professionals at SafeMoney.com can help you.

Use our “Find a Financial Professional” section to connect with someone who understands your retirement needs, goals, and challenges. And if you need a direct referral, call us at 877.476.9723.