How Does Inflation Affect Retirement Planning?

Inflation may not be the most exciting topic, but nowadays retirees may experience it first-hand for as long as 30 years or more. They can see its real effects on the purchasing power of their money over such an extended period.

Just think of what has happened to the cost of buying a new home over the past 30 years. Inflation has run rampant, and it can have such a big impact on retirement spending that it even warrants protection against it as part of an overall financial plan.

How Does Inflation Play into Retirement Planning?

How can you account for this risk in your retirement income planning? It’s prudent to have some sort of assumption about inflation in your calculations. You might use an annual inflation factor of expenses rising by 2% per year.

That has been in line with historical inflation of late, although this trend may change with the trillions of dollars in government spending for coronavirus (and those new trillions now floating around in the U.S. monetary supply).

What Can the Future Hold?

It’s difficult to say what inflation may be in the future. Not even seasoned economists can predict inflation with pinpoint accuracy for 12 months from now. But it’s still worthwhile to include different scenarios of inflation in your retirement planning.

Unemployment has also been recovering, but it’s hard to tell what it may look like in the future. Not even the U.S. Department of Labor’s national labor-tracking models were ready for the unprecedented disruption that the novel coronavirus pandemic brought to U.S. labor markets.

This massive disruption also had a macroeconomic impact on workers’ earning expectations. What’s more, the effects of that disruption are likely to remain with us for quite a while. One thing is clear. Wages haven’t risen as quickly as prices have, at least in most sectors.

How Much of a Retirement Risk Can Inflation Be?

So, just how much has inflation affected the buying power of money? What might the impact of inflation mean for your retirement and how much financial runway you might get from your income, so to speak?

Here are a few crucial areas of retirement expenses and daily living expenses that have changed over the decades. The aim is to give you an idea of how much these costs can grow over time – and why having a retirement income plan in place can help you be ready and confident for them.

In these discussions below, we took datasets from the U.S. Bureau of Labor Statistics and the U.S. Census Bureau. These datasets are averages of prices in cities across all regions of the United States, and for consumers of all age groups.

While some of these costs and expenditures are likely to be higher for those of retiree age — healthcare spending, for instance — our purpose was to show how, even across location and age, these costs rose substantially.

New Housing

The effects of cumulative inflation can be seen strongly in the U.S. housing market. In 2020, the median price for a new home was over 13 times what the median price was for a new home in 1970. The hard numbers of how this has changed over time can be seen below.

Click here to see this image in full-size render.

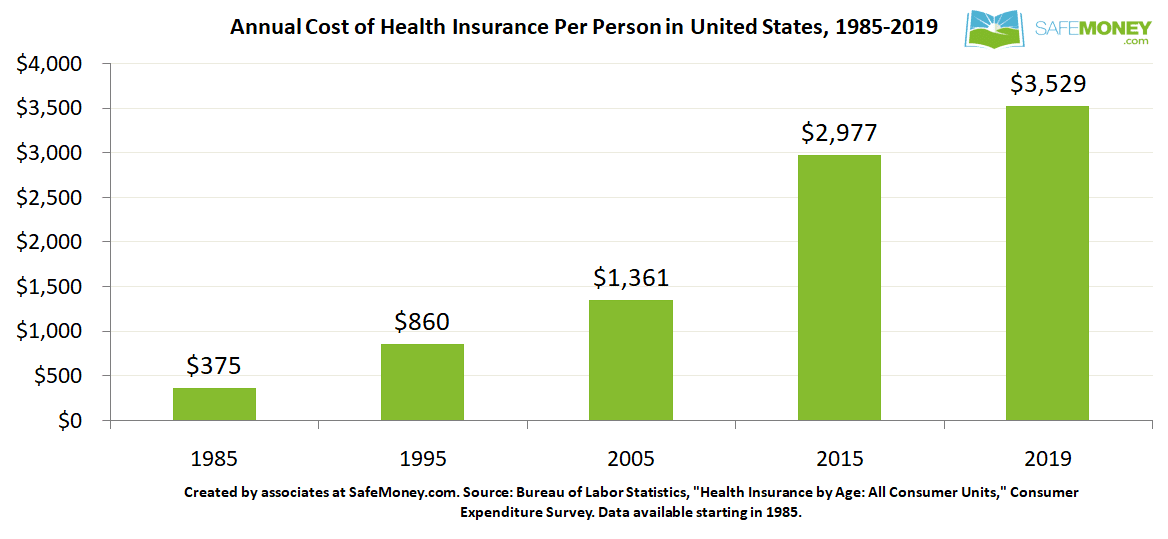

Health Insurance

Healthcare continues to be one of the fastest-growing sectors of the economy. Retirees feel the impact of this growth first-hand, as they pay for Medicare, supplemental insurance, and health and medical expenses out of pocket.

Below, we can see how the cost of health insurance has gone up over time. In just the 2000s and 2010s alone, the cost of insurance effectively more than doubled (and this was just a cost estimate across all age groups). This cost pressure continues to rise today.

As you near retirement, ask your financial professional about your options for health coverage. If you are eligible for Medicare, you may want to explore all of your options for supplemental insurance, depending on your retirement budget and willingness to pay additional premiums (so the insurer shoulders potentially more costs).

Click here to see this image in full-size render.

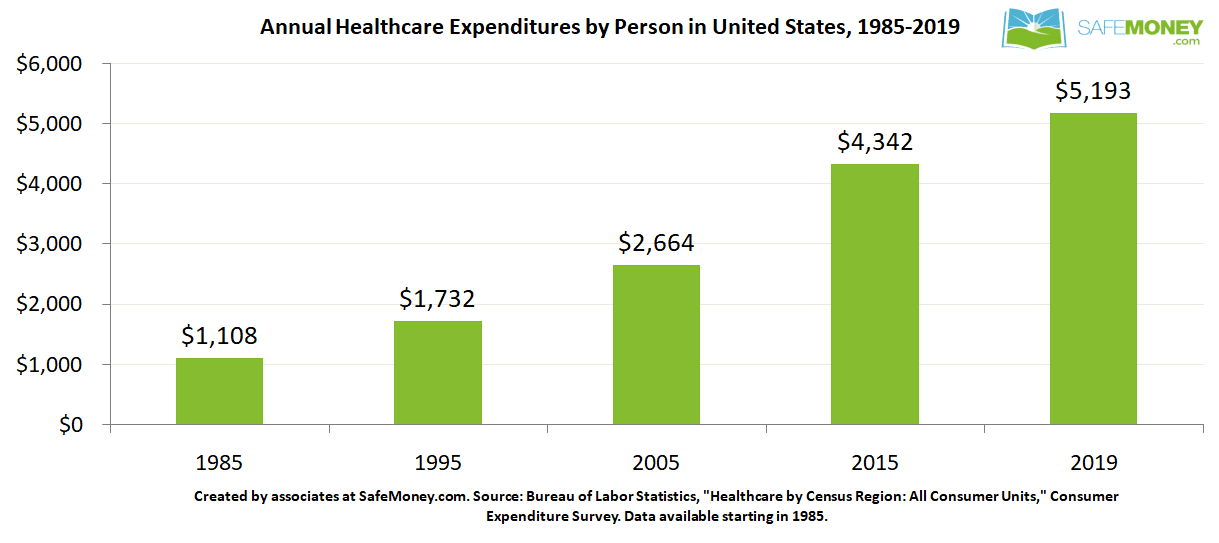

Healthcare Spending

Just as the cost of health insurance has risen, so also has healthcare spending per person. From the years of 2005 to 2019 alone, it nearly doubled.

Retirees are likely to continue to face rising health costs throughout their retirement. Since healthcare is likely to be one of the greatest areas of spending in retirement, it’s prudent to include costs of healthcare in your income planning, as well. Your financial professional can help you plan for this high-cost area in your retirement strategy.

Click here to see this image in full-size render.

Utility Costs

If you would like to “age in place” in your current home or a downsized place of living, energy costs will continue to be part of your monthly living expenses. From the 1980s until now, the average price of energy per kwh almost tripled.

The use of more expensive sources of renewable energy, such as wind and solar, has contributed to this. Federal and state regulations by different government agencies have also been a factor in rising energy costs, even as electricity use in the U.S. has remained pretty flat.

Click here to see this image in full-size render.

Cost of Gas per Gallon

Electric cars and modes of transportation are becoming more common. But gasonline continues to be the primary energy source powering our vehicles. From the 1980s until now, just the average price of unleaded regular gas went up almost 200%.

Yes, this cost declined from 2010 to 2020. But keep in mind that if you had been retired during then, you still would have paid more for gas in the 2010s.

This brings up an important point about inflation. Even if prices will be lower tomorrow than they are today, you are still shelling out money for what they cost now. They eat into your income in the present.

This can show how inflation plays a “long game” of eating into your money’s purchasing power, whether it’s in the present, years past, or some years from now. A knowledgeable financial professional can help you prepare for this cost risk in your income planning strategies.

Click here to see this image in full-size render.

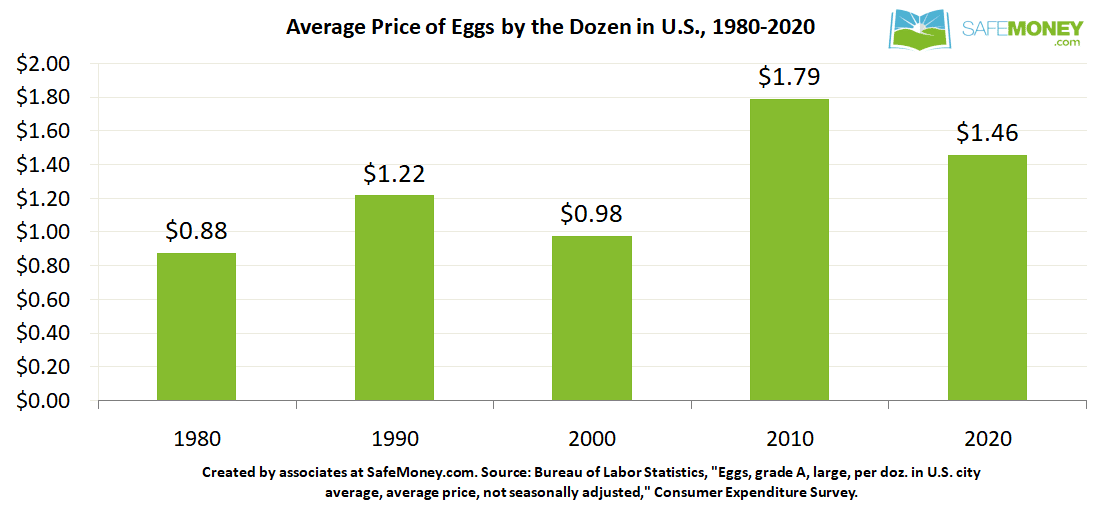

Cost of Eggs

Eggs aren’t an absolute staple for everyone, but many households use them for everyday purposes. The price of a dozen eggs over the years shows how food costs can change over time. This is particularly important for those who are living on a fixed income in retirement.

Between 1980 and 2020, the average price for a dozen eggs went up 66%. The primary takeaway here is how costs can rise across every area of retirement spending. You can see the effects of cumulative inflation even in individual food items.

Click here to see this image in full-size render.

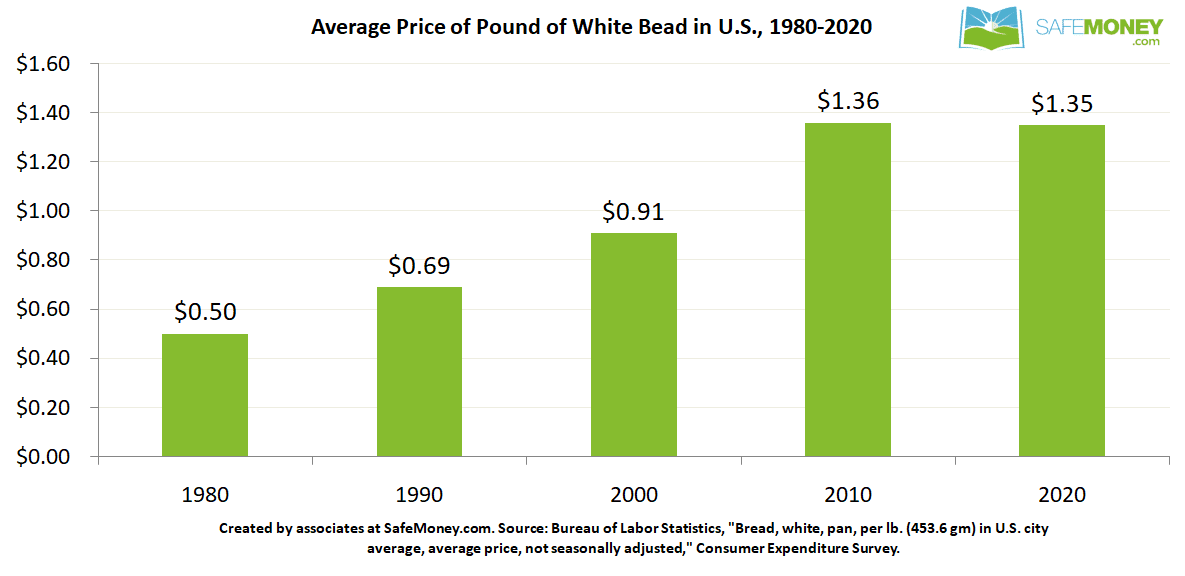

Cost of Pound of Bread

Just like with eggs, bread is another much-used food item that shows how inflation can add up over time. Over the years, the price for a pound of white bread almost tripled. This same trend with price increases can also be seen with other food and grocery items such as milk and beans.

Click here to see this image in full-size render.

The Bottom-Line

There are various reasons why the cost of these goods and others have gone up so much in the past 30 years. In some cases, the costs of some goods have been disrupted by timely events such as the coronavirus pandemic, the oil crisis of the 1970s, or the Great Recession of the 2000s.

At points, market sector events have also prompted these changes. Many factors are contributors to this in sum. In other cases it’s simply a product of supply and demand or technological improvements. For example, in 1980 you could get a microwave oven for around $240. Now you can get a nice one for about $70.

Microwaves aren’t the only things that have decreased in price over time. In 1980 a new IBM computer cost over $4,000, whereas new computers now cost about $700. But these are the exceptions and not the norm.

Planning to Make Your Money Work for You

You need a plan to have reliable retirement income for the many years that you might spend in retirement. Your plan should also have a strategy for how to keep your money’s purchasing power going strong when inflation takes its toll. This is especially important for rising costs in healthcare.

With proper planning, you don’t have to let inflation risk be a silent “retirement killer.” With your financial professional’s guidance, you can have more confidence about your ability to enjoy a comfortable lifestyle over the long haul.

Consult your financial advisor for more information on the effects of inflation and how they can impact you. What if you are looking for a financial professional to help you? Many independent financial professionals are available at SafeMoney.com to answer your questions and walk you through your retirement “what-ifs.”

Visit our “Find a Financial Professional” section to connect with someone directly. You can request an initial appointment to discuss your goals, concerns, and personal situation. Should you need a personal referral, call us at 877.476.9723.