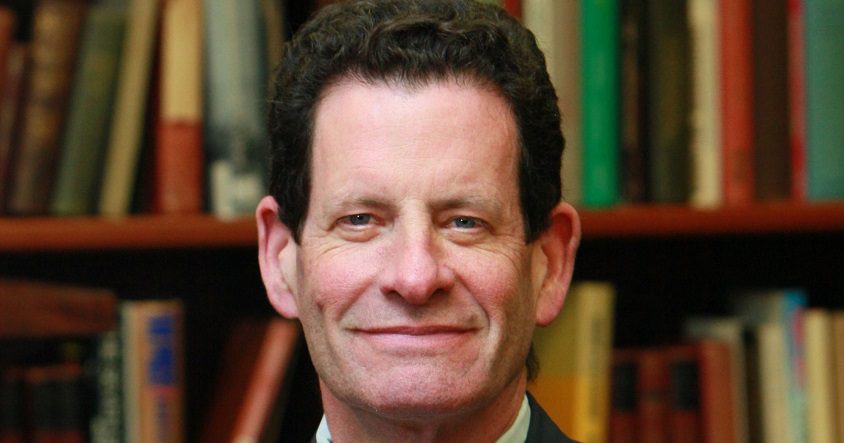

Ken Fisher and Annuities: Mogul Marketing or Saber Rattling?

Photo Credit: Fisher Investments, Featured in USA Today Special, Source Link. Photo is strictly intellectual property of its owner. All Rights Reserved.

Long-time money manager Ken Fisher says he hates annuities. And he isn’t exactly shy about it. Since 2013, the head of Fisher Investments has run many blistering anti-annuity promotions – from critical columns and print ads to aggressive TV spots and online display advertising.

Over time, those promotional spots have driven market awareness, boosting Fisher’s profile as a well-recognized annuity critic. Many campaigns still run today, with the ads building on the Fisher celebrity, retirement tips, annuity leg sweeps, or other stickler points.

But while the annuity marketing blitz has been a success, a recent article raises questions about Fisher’s strong public stand against annuities.

It may point to what some call a contradiction between the “I hate annuities” mantra of Fisher advertising campaigns and the investment holdings of Fisher’s firm.

At InvestmentNews, reporter Greg Iacurci writes that while the infamous anti-annuity ads were running, Fisher Investments itself was invested in companies with large annuity business.

What’s Fisher’s Take on Annuities?

For those who regularly visit financial news websites or watch business TV, chances are they have seen a Fisher Investments ad at some point. You may not have come across one of their annuity ads, though.

For those of us who haven’t – what are some ways that Fisher has railed against annuities and their usefulness to retirement savers?

A Roundup of Annuity Claims

While this isn’t an exhaustive list – nor is it intended to be – here are a few of the more well-known claims:

– “I HATE annuities, and you should too.” – a recurring tagline from Fisher Investment print and online ads.

– “I would rather die and go to hell before I would sell an annuity.” – Fisher speaking in a recent video ad for his money management firm.

– “You may have seen ads screaming, ‘I Hate Annuities.’ Folks ask why we run them. Simple: Because I do.” – an excerpt from the Forbes column, ‘Ken Fisher: Why I Hate Annuities.’

– “In reality, annuities are complex investment vehicles that don’t always provide the simple ‘safety’ they often promise. They typically have high fees, complex restrictions, and other risks that could offset the potential benefits.” – an excerpt from Fisher Investments report, “Annuity Insights.”

– “Sanctimoniously thin-skinned industry shills will attack me online for this column, blathering their non sequiturs like ‘I hate Ken Fisher–nonsense, drivel, spin.’ Besieging my many failings doesn’t justify these scumbag products.” – another excerpt from the Forbes column, ‘Ken Fisher: Why I Hate Annuities.’

Summing Them Up

Those excerpts are quite some strong words there! And what’s more, it’s often while lumping variable annuities together with fixed-type annuities. That is even when variable annuities and fixed annuities are very different from each other.

Ken Fisher Hates Annuities… But Invests in Annuity Companies?

Now, let’s go back to that recent InvestmentNews article. Reporter Greg Iacurci writes that, while running anti-annuity campaigns:

“Mr. Fisher’s company, among the largest financial advice firms in the country, was simultaneously investing in insurance companies with significant annuity business. And some of the stakes were quite large.”

“Specifically, Fisher Asset Management — the legal name for Fisher Investments — held several million shares of stock in American Equity Investment Life Holding Co., one of the biggest sellers of indexed annuities, and Prudential, the parent company of Jackson National Life Insurance Co., which for years has been the top seller of variable annuities.”

According to SEC filings, Fisher Asset Management maintained investment holdings in both companies from 2013 to 2015. From there, the money management firm seems to have exited both of those positions by year-end of 2016.

A Form 13F filing on EDGAR shows that in year-end of 2014, Fisher held 2.91 million shares in American Equity with a valuation of $84.9 million. Likewise, another Form 13F filing shows a peak position of 2.88 million shares valued at $129.7 million in Prudential Plc, the parent company of Jackson National, in 2015.

Not only that, the firm also had much smaller holdings in other companies offering variable annuities: Prudential Financial, American International Group, and Ameriprise Financial, Inc. Iacurci reports that Fisher Investments held stakes in these firms in 2014.

Taking a Closer Look

In 2015, the founder and chairman of American Equity Investment Life Holding Company, David Noble penned a ‘Letter from the Chairman’ to company shareholders. In his writings, Noble spoke of the powerhouse presence of American Equity within the fixed annuity marketplace:

“While we have seen companies go in and out of the fixed index annuity (FIA) market, we have been a top three company for FIA sales for 15 of the last 16 years. We believe that American Equity has capacity to continue to grow because of our financial stability, our success at enhancing our already strong independent agent network and expanding into new distribution channels.”

American Equity’s 2015 company 10-k filing with the SEC also shows strong collections of fixed-type annuity “deposits” for that year and prior ones: $4.2 billion in 2013 and a shoot-up to $7.1 billion in 2015.

American Equity’s only business is annuities, with fixed index annuities exceeding 90% of all company annuity sales in those years. The remaining percentages were made up of immediate annuities and fixed-rate annuities. American Equity manages $50 billion in assets for annuity contract holders.

What about Jackson National? As Iacurci reports, Jackson National “represents about 36% of its parent company’s [Prudential Plc] profit before tax.” Back then, Jackson had been a top variable annuity seller for years, with 94% of its 2015 individual annuity sales fueled by variable annuity purchases.

Jackson National was also the top variable annuity seller in 2016 and 2017, as Iacurci writes in another article. Its 2017 variable annuity sales were $17.5 billion while 2016 variable annuity sales hit $17.2 billion.

Industry Experts Weigh In

In Iacurci’s Fisher Investments story, a spokesperson from Fisher Investments said he didn’t believe the annuity company holdings to be an issue.

“‘Fisher Investments owned a couple of annuity stocks a couple of years ago representing a minuscule percent of our holdings — out of hundreds of stocks,’ said John Dillard. ‘You’re concerned about that? What’s the relevance? Because Ken Fisher hates annuities?'”

Likewise, Steven Saltzman of Saltzman and Associates saw no conflict, saying: “I don’t see it as a double standard. You may have people who aren’t big fans of alcohol or tobacco, but from an investment standpoint if you ignore those you might be missing out on good investment opportunities.”

Sheryl Moore with Moore Market Intelligence offered a contrasting view.

“‘Does he really hate annuities?” she said to Iacurci. “If he hates them so bad, why does he have so much money invested in companies that sell annuities?'”

Even though we don’t know specifics of different investors at the time, today Fisher Investments would be the fifth-largest shareholder in American Equity, Iacurci notes.

What’s the Takeaway?

We can be sure that folks hold no shortage of opinions on the “Fisher Investments question” in regard to annuities. But one takeaway that remains clear is this: There is more than one way to plan for retirement and to be financially secure once you are retired.

As people consider their financial futures, it’s a good idea to consider the many potential strategies available. No one-size-fits-all or cookie-cutter portfolio strategy will work for everyone’s situation.

Your income and financial needs are unique enough to the point to where they are like fingerprints. All “products” or potential solutions should be explored as to how they might help you achieve your goals. Ideally, this can be done with the guidance of a financial professional working in your best interest.

Need Help with Your Financial Future?

No matter if the income guarantees of annuities or other strategies make sense for you, you may want help with getting your financial house in order. When you are ready, financial professionals at SafeMoney.com can assist you.

Use our “Find a Financial Professional” section to connect with someone directly. Should you need a personal referral, feel free to contact us at 877.476.9723.