Reaching Retirement Savings Goals: Bank CDs or Fixed Annuities?

As many of us know, October is the renewal month for many bank certificates of deposit. Some common selling points for bank CDs are low risk and steady earning potential. But today’s low interest rate environment throws some real curveballs for retirement savers.

In fact, CD rates have remained low for some time now. And what interest rates might be in the future still remains unclear. With the diminished prospects for wealth accumulation, many people seek an alternative to bank CDs and their low yields.

When used properly, annuities are often tapped as transfer-of-risk strategies. Many Americans rely upon them for lifelong income security, dependable asset protection, or other financial assurances. Nevertheless, annuities of the fixed variety – particularly fixed index annuities (FIAs) and multi-year guarantee annuities (MYGAs) – can also offer value as tax-efficient savings vehicles.

If you are looking for alternatives to CDs, here’s a quick look at fixed index annuities and multi-year guarantee annuities – and how they can differ from today’s low-yield bank CDs as retirement-savings solutions.

Looking to the Past

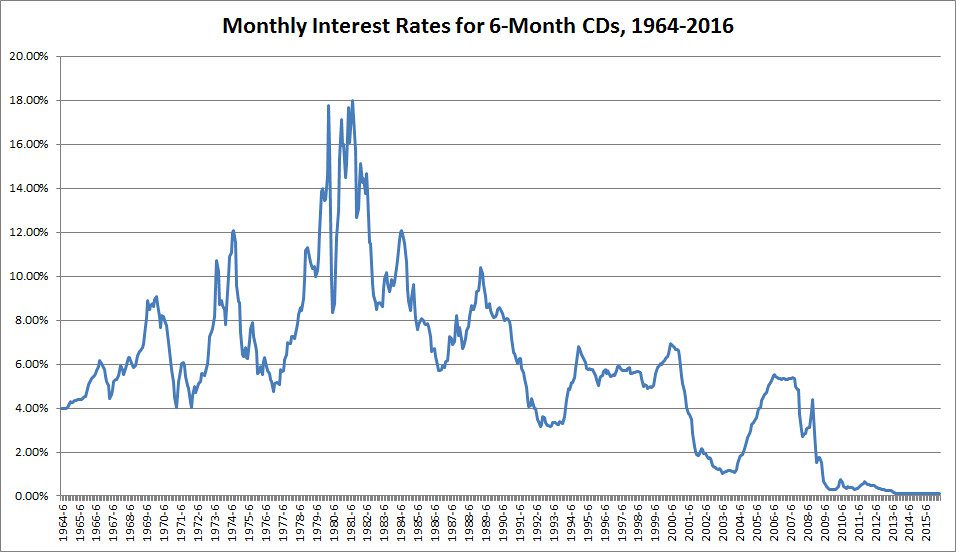

Compared to past data, CD rates have been low for a prolonged period. Statistics from the Federal Deposit Insurance Corporation (FDIC) show this difference.

This graph illustrates monthly interest rate trends for only six-month CDs. But they do offer insights into how overall rates have declined over time. In the early 2000s, interest rates on CDs hovered around 4.4-6.2% – a sharp contrast to how rates are bottoming out at 0.12-0.13% today. To show how much six-month CD rates have declined overall – compare that with when, at times, rates were at 15% or higher.

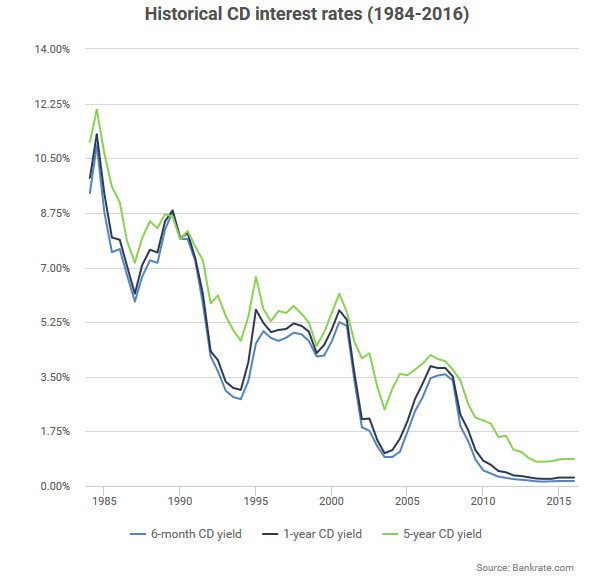

Now consider a bundle of historical trends for six-month, one-year, and five-year CD interest rates, ranging from 1984 to 2016. These data is courtesy of BankRate.com, which compiles national rate averages from banking institutions across the United States.

All of the CD interest rates have been on a downward trajectory and continue to linger below 1.75%, partially fueled by a low interest rate-setting agenda by the Fed. In the context of accumulating money for retirement, the declining interest rates make CDs a less attractive vehicle for putting away savings.

At the time of this writing, searching for a five-year CD brings low rates, with the highest rate being just 2%. In contrast, at present multi-year guarantee annuities are offering around 3% and fixed index annuities around 3-7% (which depends on the underlying index performance).

What are Some Other Ways CDs Differ from FIAs and MYGAs?

This isn’t to say that contrasting annuities with CDs is an apples-to-apples comparison. CDs are financial products which are issued by banks and, in most instances, are insured by the FDIC. On the other hand, fixed index annuities and multi-year guarantee annuities are guaranteed insurance products. They are backed by the financial strength and claims-paying ability of the insurance company issuing them.

With that said, here are a few other chief differences of bank CDs versus fixed index annuities and multi-year guarantee annuities:

- CDs tend to be better structured for short-term savings goals, while fixed index annuities and multi-year guarantee annuities are better long-term

- CD interest rates are susceptible to the effects of market conditions

- On the other hand, multi-year guarantee annuities and fixed index annuities come with minimum guaranteed rates

- CD earnings are taxable in years when interest is earned

- With annuities, interest earnings grow tax-deferred and aren’t taxable until they are withdrawn – however, it’s taxed as ordinary income

- In terms of liquidity, many insurance companies allow you to withdraw up to 10% of your annuity’s value

- Generally CDs offer less liquidity – should you access money within a CD before its maturation date, you might incur an interest penalty ranging 30 days-6 months

- In terms of distribution options, you can take a lump-sum from a CD or renew the CD for a new maturation period

- For distribution options with an annuity – you can take a lump-sum, make managed income withdrawals over time, or opt for an assured lifelong income stream

Of course, the value of these different financial products will vary, based on consumer needs, savings goals, financial objectives, consumer risk tolerance, and other variables. But these are a number of ways in which CDs differ from the discussed fixed annuity types.

Need Help with Your Retirement Planning Needs?

Retirement planning can be a complicated process. According to research from LIMRA, seniors and baby boomers who work with an advisor report higher confidence in their retirement readiness. Should you need help from a qualified, independent financial professional, SafeMoney.com can help you.

Use our Find a Licensed Advisor section to connect directly with an independent financial professional, and to request a personal strategy session to discuss your needs and goals. And should you have any questions or concerns, call 877.476.9723.